Inflation Impacts

We’ll focus on risk, so you can take care of your business

Get the help you need to self-fund your healthcare and grow your business.

Self-insuring your healthcare benefits can be a big step for your company — and a complicated one. But with a medical stop loss solution from QBE, our experts will help you determine the level of risk protection to meet your financial needs.

Discover a range of products to help you protect your assets:

• Medical Stop Loss

• Captive Medical Stop Loss

• Special Risk Accident

• Organ Transplant

Together, we’ll create a solution so no matter what happens next, you can stay focused on your future.

QBE Accident & Health Market Report 2022

Explore industry trends, insights and product details that can help you better manage the risks of a self-funded healthcare plan.

To learn more and read the full report, visit us at qbe.com/us/ah

Inflation Impacts Healthcare Costs and Self-Insured Benefit Plans

Written By Laura CarabelloPPointing a finger at inflation as the culprit for escalating healthcare costs, some analysts assert that while health care prices have been largely unaffected by record-high U.S. inflation, prices are likely to accelerate more rapidly in the year ahead. This will probably lead to higher insurance premiums and more costly services for both consumers and employers in 2023.

Notably, in September 2022, the Federal Reserve central bank raised rates by 0.75 percentage points for the third time this year and released new economic projections showing a significant slowdown in the economy later in 2022 and 2023.

Emotions are running high, particularly in the mid-term election year, as people express their frustration and suffering from high inflation and may be in for more difficulties if the government reneges on its commitment to pulling prices back down. Healthcare is caught in the cross-hairs of these conditions.

McKinsey insists that the impact of inflation on the broader economy has driven up input costs in healthcare significantly. They project that the likelihood of continued labor shortages in healthcare—even as demand for services continues to rise—means that higher inflation could persist.

The relatively high rate of inflation seen in overall economy, with a loss of purchasing power for everyday goods and services such as food, furniture, apparel, and transportation, may translate into higher prices for medical care. This could lead to steeper premium increases and the direct cost of care.

Mark Lawrence, president, HM Insurance Group, shares this perspective, “In a high inflation environment, all costs will rise, some more apparent than others. Inflation impacts many areas, including labor, fuel, insurance, specialty medications, medical technology and so on. In my opinion, it’s very difficult to mitigate these effects. Personally, I haven't found a way to be successful in avoiding inflation at the gas pump or in the grocery store.”

Amid this environment, there is consensus that health care costs are on the rise, with projections resulting from an Aon survey indicating that the average costs for U.S. employers that pay for their employees' healthcare will increase 6.5% -- from $13,020 per employee in 2022 to more than $13,800 per employee in 2023. They say this is largely due to economic inflation pressures, with escalating costs more than double the 3% increase to healthcare budgets that employers experienced from 2021 to 2022.

However, this is significantly below the 9.1% inflation figure reported through the Consumer Price Index, largely because medical claims were suppressed for most employers during the first year of the COVID-19 pandemic when a large slice of care, elective surgeries and preventive screening or diagnostics were postponed or skipped during quarantines.

While inflation tends to affect healthcare later than other industries, employers may have seen the medical claims experience return to more typical levels of growth but should brace for anticipated inflationary cost pressures in the coming year.

“The impact of inflation on the broader economy will likely lead to rising healthcare claim costs in an already inflated high price market. With the increasing cost of hospital inpatient services, emerging therapies and chronic illnesses treated with specialty pharmacy medications, plan sponsors are in search of affordability solutions to manage expenses, reduce waste and maintain access to care.”Mark Lawrence

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health. Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

www.BerkleyAH.com

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

She points to two key interventions for Plan Sponsors to reduce the inpatient facility exposure: insightful contracting and claim payment integrity reviews which ensure correct reimbursement and accurate payment of plan benefits.

“While reference-based pricing strategies can provide a benchmark in contract negotiations, understanding the provider cost analytics, billing and coding patterns as well as quality of care performance are critical to negotiating the most ideal economic results for a plan,” says Lynch. “With the combination of a strategic claim payment integrity program, Plan Sponsors can gain a window into the provider’s billing practices for a knowledge-based, targeted negotiation while also allowing for the right to review the claims.”

She explains that a technical high dollar claim and medical record review determines if the charges are coded accurately, appropriately documented and are free from impropriety.

Joe Dore, president, USBenefits Insurance Services, LLC, shares this guidance: “Inflation does not discriminate – it impacts all industries and segments within. HR challenges -- wages, retention, training as well as manufacturing costs, supply chain issues, rising interest rates and other considerations -- will adversely affect everyone, from employers to consumers. Make no mistake that the member/patient ultimately will need to make tough financials decisions, such as eating vs buying medications.”

Generally, Dore says the onus to mitigate falls upon the employer to address economic disturbances via their plan document and front-end negotiations with networks, vendors and others.

“This is the tipping point for all parties,” he advises, “and is inclusive of the stop-loss carrier, to be simultaneously invited to the table to align objectives and strategies in an effort to produce the best possible outcomes – not just financially, but medically as well.”

“Analyzing

dollar claims requires specialized expertise and resources, but health plan sponsors may not have the staff, time or experience to identify and construct the clinical, network and coding nuances inherent to complex claims,” she continues.

high

“With the right program, Plan Sponsors can experience savings yields of 10% to 30% of payable charges on top of the contracted rate and supported by settlement with providers. Specialty pharmacy risk mitigation can be challenging.”Joe Dore

Inflation

IS IT REALLY INFLATION?

Before attributing price increases to economic inflation, employers must remember that escalations are typically slow to appear in medical trends due to the multiyear nature of the typical provider contract.

It is also important to factor in the other contributing aspects of care that add pressure, including but not limited to emerging technologies, labor/non-labor costs, impact of catastrophic claims, high-price specialty drugs as well as new ultra-expensive gene and cell therapies with multi-million dollar price tags.

Furthermore, the Bureau of Labor Statistics data by the Kaiser Family Foundation shows that since 2000, health care costs, including medical services, insurance, medication and medical equipment, have typically increased more quickly than other costs in the overall economy.

This year, however, health care costs are increasing at a lower rate than overall inflation: 4.8% in July compared to the same time last year, while overall prices increased by 8.5%.

Increase to U.S. Health Care Plan Costs from 2021 to 2022 Plan Cost 2021 2022 Change from 2021 to 2022 Employer Cost $10,123 $10,500 +3.7 % Employee Premiums from Paychecks $2,504 $2,520 +0.6 % Total Plan Cost $12,627 $13,020 +3.1 %

Source: Aon. https://aon.mediaroom.com/2022-08-18-Aon-U-S-Employer-Health-CareCosts-Projected-to-Increase-6-5-Percent-Next-Year#:~:text=In%20terms%20of%202022%20 health,according%20to%20the%20firm's%20analysis

Typically, health care costs see a relatively stable 1% to 5% increase in costs every year, but looking ahead, high inflation rates may lead to higher medical prices and insurance premiums. According to a survey of around 2,500 Medicare beneficiaries from eHealth, 95% said they are worried about how inflation will impact health care costs, and almost 50% said their health care costs have already increased because of inflation.

Aon analysts caution that while most large, self-insured employers have a good sense of their 2023 premium costs at this time, many smaller, fully insured employers have not yet received renewal rates from their health plans which may come in higher.

Affordability is the byword in this economy, even with the prevailing high levels of insurance coverage. According to a survey released by the Commonwealth Fund, a greater number of Americans are finding it difficult to afford healthcare. Results show that insurance coverage doesn’t always provide enough financial protection against rising costs, and certain marginalized groups were chronically uninsured.

The survey also documented that more than one-quarter (29%) of continuously insured people with employer coverage and 44% of those with coverage purchased in the individual market or marketplaces are underinsured because of high out-of-pocket costs and deductibles, relative to their income. In many cases, surprise or unexpected bills caught families off-guard and unprepared to meet financial obligations for healthcare services.

As employers absorb most of the health care cost increases in an effort to remain competitive in this tight job market, it will be important for decision makers to look carefully at costs associated with chronic and complex conditions that usually persist over time as well as indirect costs of absenteeism, productivity, disability and workers’ compensation.

In a survey conducted earlier this year by Mercer, 11 percent of large employer respondents -- those with 500 or more employees -- indicated that they will offer employees free coverage in at least one medical plan in 2023; another 11 percent are still considering it.

As inflation continues to stress household budgets, it appears that employers will step up to the plate and help workers keep more money from their paychecks and remove cost barriers when they require care. Attractive health benefits packages may well be the ‘carrot’ to attract workers.

Nonclinical labor, such as personal care aides which work in provider settings, may be impacted – especially where there are not enough RNs or clinicians to carry the workload. Analysts say that from a cost perspective, increased inflation in the overall economy will primarily account for incremental wage growth in the nonclinical workforce.

SKYROCKETING PAST INFLATION

Prescription Drugs

From July 2021 to July 2022, 1,216 prescription drugs saw price increases that soared past the inflation rate of 8.5% for that time period, according to a report from the U.S. Department of Health & Human Resources, published recently.

These drug prices rose by an average of 31.6%: In January, price increases from the year prior were about $150 per drug on average, a 10% increase. In July, increases were about $250 per drug on average, a 7.8% increase.

As expected, specialty drugs topped the list for high spending, contributing to 50% of total spending in 2021, and equaling $301 billion. The drugs with the highest price change in dollar amounts were Tecartus (for B-cell acute lymphoblastic leukemia and mantle cell lymphoma) and Yescarta (for lymphomas), which both increased from $399,000 to $424,000, a 6.3% increase.

The report was released shortly before a new requirement was enacted October 1 as part of the Inflation Reduction Act, making drug manufacturers pay rebates to Medicare if they increase prices for drugs in Medicare Part D past the rate of inflation.

Inpatient and Outpatient Care

Clinical / Nonclinical Labor

Witnessing the worsening clinical labor shortage is painful for everyone and McKinsey advises that this will contribute to projected increases in healthcare costs over the next five years. These shortages fuel industry estimates that healthcare labor cost growth will outpace inflation.

Nonlabor Costs

Supplies, Personal Protective Equipment, medical technologies and other items used in healthcare delivery have experienced supply chain difficulties that have spiked costs across the healthcare ecosystem. These issues are likely to persist, pushing nonlabor costs above projections.

Physicians' Services

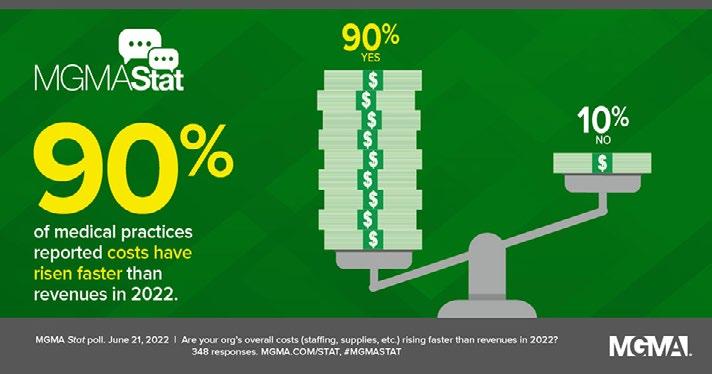

Many physician groups saw early Indications that their financial performance may be stabilizing as patient volumes and revenues improved by Q2. But the Medical Group Management Association says rising costs associated with inflation have added financial pressures for virtually all medical group practices despite the ongoing recovery from the COVID-19 pandemic.

The right solution

Self-funded health plan administration

The speed of change in the health care industry is expanding the definition of health care and redefining roles for traditional players. New and emerging technologies led by single point solution vendors, rising health care costs, regulation, and non-traditional market entrants have many payers and health systems evaluating their options.

At AmeriHealth Administrators, we have a proven history of working with employer and payer clients to address their challenges and have the vision, technology, and people to meet the needs of our customers and partners.

Inflation in certain areas is driving higher costs:

• Reimbursement cuts, especially as Medicare reimbursement fails to keep pace with the cost to deliver care

• Significant increases in lab supply and drug costs

• Increases in utility costs

• Sluggish patient visit rates inhibiting productivity and revenue

• Rising malpractice premium rates

Nursing Homes and Adult Day Services

Rising inflation and increased labor costs are multiplying the risk of closure for skilled nursing facilities across the country, according to an analysis by CliftonLarsenAllen and the American Health Care Association.

General inflation for nursing home goods and services increased 8.5% between March 2021 and March 2022 and leaped 1.3% just between February and March earlier this year. Contributing to the problem were food costs which rose 8.8% between March 2021 and March 2022.

Mary Ann Carlisle, chief revenue officer & COO, ELMCRx Solutions, says that Plan Sponsors have become acutely aware of the cost impact that specialty high-cost medications have on their plan spend.

She forecasts that specialty medications will continue as the cost driver of pharmacy benefit inflation based on three variables: (1) AWP increases for existing medications, (2) new higher cost drugs for both currently covered therapies, and (3) new drugs for diseases for which there are currently no medications available.

Strategies to Reduce Inflated Healthcare Costs

Here’s some sound advice from Mark Lawrence: “Brokers can help employers by focusing on options where health care services are provided at the lowest cost and highest quality, and combine those efforts with buying good, quality stop loss protection. And honestly, that’s a smart strategy, regardless of the economic environment.”

Carlisle advises that there are two primary opportunities for cost containment:

1) Utilization Management

“The first step is to control the cost at the point of care by taking charge of Prior Authorizations in real time rather than retrospectively,” she says. “It is difficult at best to get a

prescribing physician to change any aspect of a medication once a patient is taking it. Plans should incorporate strong dispensing quantity limits into the program. The convenience of mail order and auto-fills has created serious waste and cost issues.”

2) Cost Offloading Programs

“There are numerous programs that will 'offload’ a portion or all of the cost of Specialty and other high-cost medications,” she continues. “Some PBMs have adopted (or allow) the full suite of programs, while others only allow Member Co-pay Assistance, which offers the lowest percent of savings at less than 25% of the annual cost. Other targeted program savings solutions range from 25% to 70% of the annual medication cost net of the fees being charged by the program. These fees are typically either a percent of the savings or a per capita or per claim fee. Plan sponsors are implementing these programs at a rapid pace.”

Carving out prescription medical and/or pharmacy benefits and contracting is the sage advice of Dea Belazi, CEO and president, AscellaHealth, who says, “Increasingly, self-funded employers, Plan Sponsors and other payers will carve out prescription drugs and pharmacy benefits from their medical plan by contracting directly with a Specialty Pharmaceutical (SP) provider As costs for specialty medications continue to rise, rethinking contractual partners enables these payers to gain better controls over SP costs and greater transparency into their benefit claims, with enhanced negotiating power to get better deals and ensure that clinical and financial programs performed as promised.”

Belazi says this approach has the potential to achieve an average savings of 5-30% through plan language and benefit design. “SP service providers will also help payers implement unique Financial Assistance programs for the numerous high-cost gene/cell therapies and other expensive specialty medications that are being launched to treat rare and orphan diseases and complex conditions.”

He emphasizes that progressive SP vendors are pioneering innovative technology-based suites of unique financial solutions, includin g loanbased programs for cell/gene therapies, to help offset the high cost of curative medications.

WHAT’S AHEAD IN 2023 AND BEYOND?

McKinsey analysis estimates that the annual US national health expenditure is likely to be $370 billion higher by 2027 due to the impact of inflation compared with pre-pandemic projections.

“They are also introducing copay advisory services to monitor and track manufacturer copay funds,” adds Belazi.

“This also includes alternative funding programs which means access to philanthropic organizations, grants or other foundational programs that support access to highcost therapies and shift the cost away from the patient and payer.”Dea Belazi

Inflation

It appears that the IRS has already anticipated inflationary pressures around healthcare costs and significantly raised contribution limits for 2023 on Health Savings Accounts (HSAs).

While stop-loss insurance will continue to play an important role in controlling costs, additional cost-containment strategies are needed.

In a new survey conducted by consultancy WTW of 445 U.S. employers employing 8.2 million workers, over half of respondents expect their costs will be over budget this year, emphasizing that the need to manage health care costs and address employee affordability has never been greater. To mitigate higher health care costs, 52 percent will implement new programs or switch to vendors that will reduce their total costs, while 1 in 4 will shift costs to employees through higher premium contributions.

Among the actions survey respondents are using to manage costs and enhance employee affordability are the following:

Health plan budget boosts. Two in 10 employers (20 percent) added dollars to their health care plan without reallocating funds from other benefits or pay. Another 30 percent expect to do so in the next two years.

Defined contributions. Four in 10 employers (41 percent) reported using a defined contribution strategy with a fixed dollar amount provided to all employees that differs by employee tier. Another 11 percent are planning or considering doing so in the next two years.

Evaluations of employee contributions by income. The number of employers that examine employee health payroll contributions as a percent of total compensation or income as the basis for benefits design decisions is expected to more than double from 13 percent this year to 32 percent in the next two years.

Contribution banding. More than a quarter (28 percent) structured payroll contributions to reduce costs for targeted groups, such as low-wage employees, or by job class. Another 13 percent are planning or considering doing so in the next two years.

Low-deductible plan. Three out of 10 (32 percent) offered a plan with low member cost sharing (e.g., no more than a $500 deductible for a single preferred provider organization plan) this year; another 7 percent are planning or considering doing so in the next two years.

Depend on Sun Life to help you manage risk and help your members live healthier lives

Behind every claim is a person facing a health challenge. By supporting members in the moments that matter, we can improve health outcomes and help employers manage costs.

For nearly 40 years, self-funded employers have trusted Sun Life to quickly reimburse their stop-loss claims and be their second set of eyes, looking for savings opportunities. But we are ready to do more to help members in the moments that matter. We now offer care navigation and health advocacy services to help your employees and their families get the right care at the right time – and achieve better health outcomes. Let us support you with innovative health and risk solutions that benefit you and your medical plan members. It is time to rethink what you expect from your stop-loss partner.

Ask your Sun Life Stop-Loss Specialist about what is new at Sun Life or click here to learn more!

STOP-LOSS | DISABILITY | ABSENCE | DENTAL/VISION | VOLUNTARY | LIFE

The content on this page is not approved for use in New Mexico.

For current financial ratings of underwriting companies by independent rating agencies, visit our corporate website at www.sunlife.com. For more information about Sun Life products, visit www.sunlife.com/us. Stop-Loss policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states except New York, under Policy Form Series 07-SL REV 7-12. In New York, Stop-Loss policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12. Product offerings may not be available in all states and may vary depending on state laws and regulations.

© 2022 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life and the globe symbol are trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us. BRAD-6503-u SLPC 29427 01/22 (exp. 01/24)

Fraud, waste and abuse programs. A quarter of respondents (27 percent) used programs to combat fraud, waste and abuse. Another 22 percent expect to do so by 2024.

Out-of-pocket costs. Nearly a quarter (23 percent) implemented higher out-of-pocket costs for use of less efficient services or site of service, such as the use of nonpreferred labs or high-cost facilities for imaging, or respondents mandated the use of high-quality, cost-effective centers of excellence for medical care. Another 19 percent are planning or considering doing so by 2024.

Concierge navigation. Two in 10 (21 percent) offered concierge navigation even if it requires movement from a full-service health plan to a third-party administrator. Another 25 percent are planning or considering doing so by 2024.

Voluntary benefits. Over a third of respondents (35 percent) added or enhanced voluntary benefits such as supplemental health insurance (e.g., additional hospital coverage, cancer coverage, disability income replacement) in case of a catastrophic event. Another 27 percent are planning or considering doing so by 2024.

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel, and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

References

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/health-plan-changes-for-2023look-to-enhance-affordability.aspx

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/health-plan-costs-expected-to-risein-2023.aspx

https://www.washingtonpost.com/business/2022/09/21/fed-rate-hike-inflation/ https://www.mcknights.com/news/inflation-jumps-8-5-in-a-year-for-nursing-goods-and-services/ https://www.healthcarefinancenews.com/news/us-employer-healthcare-costs-projected-increase-652023#:~:text=Average%20costs%20for%20U.S.%20employers%20that%20pay%20for,budgets%20 that%20employers%20experienced%20from%202021%20to%202022

https://www.fiercehealthcare.com/providers/physician-practices-see-revenue-gains-q1-faceexpense-hikes-inflation-labor-shortages

https://www.mercer.us/our-thinking/healthcare/2023-benefit-strategies-report.html

https://www.healthedge.com/blog/first-inklingsinflation-reach-2023-health-cost-calculations

https://www.shrm.org/resourcesandtools/ hr-topics/benefits/pages/2023-irs-contributionlimits-for-hsas-and-high-deductibel-health-plans. aspx

https://www.advisory.com/dailybriefing/2022/08/30/healthcare-costs

https://medcitynews.com/2022/09/survey-67-ofemployers-to-prioritize-controlling-healthcarecosts-over-next-3-years/

https://www.healthcarefinancenews.com/ news/us-employer-healthcare-costs-projectedincrease-65-2023#:~:text=Average%20 costs%20for%20U.S.%20employers%20 that%20pay%20for,budgets%20that%20empl oyers%20experienced%20from%202021%20 to%202022

https://www.mckinsey.com/industries/ healthcare-systems-and-services/our-insights/ the-gathering-storm-the-transformative-impactof-inflation-on-the-healthcare-sector

https://www.fiercehealthcare.com/payers/ commonwealth-fund-insurance-coverage-oftennot-enough-stave-high-healthcare-costs

https://itep.org/what-tax-provisions-are-in-thesenate-passed-inflation-reduction-act/

https://www.nfp.com/newsroom/detail/in-a-tight-talent-market-most-employers-re-think-benefitsofferings-according-to-nfps-us-benefits-trend-report

https://www.fiercehealthcare.com/payers/consumers-concerned-about-rising-healthcare-costs-openenrollment-period-draws-near

https://medcitynews.com/2022/10/hhs-prescription-drug-costs-have-skyrocketed-in-recent-years/

ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES:

PRACTICAL Q & A

& A

The Affordable Care Act (ACA), the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and other federal health benefit mandates (e.g., the Mental Health Parity Act, the Newborns and Mothers Health Protection Act, and the Women’s Health and Cancer Rights Act) dramatically impact the administration of self-insured health plans. This monthly column provides practical answers to administration questions and current guidance on ACA, HIPAA and other federal benefit mandates.

Attorneys John R. Hickman, Ashley Gillihan, Carolyn Smith, Ken Johnson, Amy Heppner, and Laurie Kirkwood provide the answers in this column. Mr. Hickman is partner in charge of the Health Benefits Practice with Alston & Bird, LLP, an Atlanta, New York, Los Angeles, Charlotte, Dallas and Washington, D.C. law firm. Ashley, Carolyn, Ken, Amy, and Laurie are senior members in the Health Benefits Practice. Answers are provided as general guidance on the subjects covered in the question and are not provided as legal advice to the questioner’s situation. Any legal issues should be reviewed by your legal counsel to apply the law to the particular facts of your situation. Readers are encouraged to send questions by E-MAIL to Mr. Hickman at john.hickman@ alston.com.

YEAR-END HEALTH BENEFITS ROUND UP—2022

The beginning of 2022 was already shaping up to be a busy year for health plans, with several provisions from the Consolidated Appropriations Act, 2021 (“CAA”) going into effect, the expected release of the biennial Report to Congress for compliance with the Mental Health Parity and Addiction Equity Act (“MHPAEA”), and COVID-19 still at the top of the news cycle. And then came the opinion in Dobbs v. Jackson Women’s Health Organization (Dobbs). What a year it has been!

In this article we revisit some of the most pressing issues for employers, plan sponsors, plan administrators and service providers, and health insurers and provide some practice pointers heading into 2023.

CONSOLIDATED APPROPRIATIONS ACT OF 2021 (“CAA”)

The CAA established protections for consumers related to transparency in health care, comparative analyses requirements under MHPAEA, compensation disclosure requirements for indirect compensation received by brokers and consultants, prescription drug reporting, and no “gag clauses” in service agreements.

The CAA also added the No Surprises Act (“NSA”), which addresses several patient protections such as surprise billing, ID cards, provider directory requirements, maintenance of a price comparison tool, and continuity of care requirements.

Generally, except as otherwise noted, the CAA requirements are applicable to most group health plans, including grandfathered plans, but are not applicable to excepted benefits, account-based plans (e.g., HRAs, FSAs) or stand-alone retiree health plans.

CAA/TRANSPARENCY--PRESCRIPTION DRUG REPORTING

The CAA requires group health plans and health insurers to report to CMS certain information related to medical and prescription drug spending. The initial report is due December 27, 2022, with annual reporting required every June 1 thereafter (for the prior calendar year).

Fully-insured plans are able to shift the reporting burden to the insurance carrier entirely by written agreement, and the liability for failure to report shifts to the carrier. Self-insured plans are also able to relieve themselves of the reporting obligation by entering into a written agreement with TPA or pharmacy benefit manager (“PBM”) to take on some or all of the reporting responsibility, but liability for any reporting failures of the TPA or PBM remain with the plan itself.

For many plans, coordination will be required among the plan sponsor, TPA, and PBM to ensure that all the required information is submitted on time, which will be challenging for plans with multiple vendors and/or benefit package options.

Initially, the Centers for Medicare & Medicaid Services (“CMS”) was allowing just one data file per plan, but this restriction has proven to be too limiting.

CMS issued new guidance in time for the upcoming initial filing deadline on December 27, 2022, confirming that it will accept multiple data files of the same type from the same group health plan if “extenuating circumstances” prevent vendors from working with each other.

CMS will use the plan-level data files (i.e., the “P2 files”) to link a particular group health plan with the data files submitted by its various vendors.

Practice Pointers:

• Work with plan vendors to ensure that all vendors have all the required information for the P2 file, including providing each vendor’s name and EIN to the other vendors

• Confirm that each of the plan’s vendors will submit a P2 file that uses a unique plan name and number for each separate benefit package option offered by a plan.

• If the plan cannot confirm that vendors use unique plan names and numbers for each benefit package option, the plan can either:

o confirm that at least one reporting entity’s P2 file identifies all of the plan’s other vendors (by name and EIN), or

o submit its own P2 file identifying all of the plan’s vendors (by name and EIN), which would require an account to access CMS’s Health Insurance Oversight System (“HIOS”).

If applicable, document the “extenuating circumstances” preventing vendors from working together.

CAA—NO SURPRISES ACT

The NSA addresses several patient protections effective for plan years beginning on or after January 1, 2022. These protections include a prohibition against “surprise billing” from out-of-network service providers and facilities for emergency services, certain non-emergency ancillary services, and air ambulance services.

Plans and insurers are limited to applying in-network reimbursement levels for costsharing, and any cost-sharing payments from the participant related to the services must apply the in-network deductible and out-of-pocket maximums in the same manner as if the services had been provided by a participating provider.

Out-of-network providers and facilities are prohibited from billing patients for more than the applicable cost-sharing amount. To the extent that the out-of-network provider and plan cannot agree on the initial payment amount, the parties can enter into open negotiations, which can escalate to an independent dispute resolution (“IDR”) process.

As for high-deductible health plans (“HDHPs”) and health savings accounts (“HSAs”), the CAA clarifies that surprise billing protections should not interfere with HSA eligibility or the status of a plan as an HDHP.

Eligibility to contribute to an HSA will not be affected for any period merely because the person received benefits for medical care subject to and in accordance with the surprise billing protections. Nor will a plan fail to be treated as an HDHP for providing additional payments to the provider in accordance with these protections.

The NSA also establishes new rules for plan ID cards and provider directories. Effective for plan years beginning on or after January 1, 2022, plan ID cards must include information about plan deductibles, out-of-pocket maximums, telephone number, and website address. Every organization struggles to manage its Specialty Drug spend. ELMCRx Solutions understands the complexity of specialty drug management. By combining powerful clinical management with real-time oversight to control costs and prevent unnecessary payments, our unbiased program helps deliver the best outcome for the plan sponsor and the member. We partner with employers, health care coalitions, health plans, insurance captives, TPAs and Taft-Hartley Trusts. Cost Containment Solutions and superior clinical outcomes are achievable. ELMCRx Solutions is the partner to help you achieve them. CONTACT

A group health plan must maintain a regularly updated database of providers and facilities on public website, and a prompt response protocol for inquiries about provider/facility network status. Plans that fail to provide accurate information regarding network status cannot impose cost-sharing levels higher than in-network costsharing levels if a participant relies on the misinformation obtained from the database, provider directory, or response protocol about in-network status.

The provider directory requirement is currently implemented using a good faith interpretation, with more detailed rules pending.

The NSA protects some patients from having to immediately switch providers in the middle of an ongoing course of treatment in the event that their innetwork provider (or facility) ceases to be part of the provider network.

For patients that are considered continuing care patients (generally individuals undergoing a course of treatment for a serious and complex condition; scheduled for non-elective surgery; pregnant; or terminally ill), the plan must notify the patient if contractual issues result in the provider/facility no longer being in the plan’s network or no longer being able to provide the services.

Continuing care patients may be eligible for up to a maximum of 90 days of transitional care, during which time the patient can continue the treatment under the same terms and conditions as would have applied had the termination not occurred (that is, in-network rates and coverage for the same items and services).

CAA—MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT (“MHPAEA”) NQTL ANALYSES

The CAA amended MHPAEA, requiring plans to perform and document “comparative analyses of the design and application” of any nonquantitative treatment limitations (“NQTLs”) that are imposed on mental health/substance use disorder (“MH/SUD”) benefits.

In a nutshell, NQTLs are non-numerical limits on the scope or duration of the benefits, such as prior authorization requirements, step therapy/fail-first policies, and limits on access to out-of-network providers. As of early 2021, plans were required to make the NQTL comparative analysis and other specific information available upon request by a state or federal agency.

The Department of Labor (“DOL”), Department of Health and Human Services (“HHS”), and the Internal Revenue Service (“IRS”) have each been tasked with requesting and collecting a minimum of twenty (20) analyses per year.

On January 25, 2022, the tri-agencies released their biennial MHPAEA report to Congress, and the findings indicate that plans are falling far short of MHPAEA’s requirements. The MHPAEA report included a laundry list of failures:

• Failure to document comparative analysis before designing and applying the NQTL;

• Conclusory assertions lacking specific supporting evidence or detailed explanation;

• Lack of meaningful comparison or meaningful analysis;

• Non-responsive comparative analysis;

• Failure to identify the specific MH/SUD and medical/surgical benefits or MHPAEA benefit classification/s affected by an NQTL;

• Limiting scope of analysis to only a portion of the NQTL at issue;

• Failure to identify all factors;

• Lack of sufficient detail about identified factors;

• Failure to demonstrate the application of identified factors in the design of an NQTL; and

• Failure to demonstrate compliance of an NQTL as applied (DOL emphasis).

In addition to listing common failures, DOL referenced several useful tools available on the DOL website, including self-compliance tools, “warning signs”, an “under the hood” look at a MHPAEA audit, and an enforcement fact sheet. Focusing on mental health issues and funding MHPAEA compliance has bipartisan support in congress, and plan sponsors would be wise to review their plan’s testing and compliance.

• Carefully review the Report to Congress and the DOL’s recommended compliance tools.

• Develop a practice of regularly checking for what is (and is not) a compliant NQTL, as this is a constantly developing area of MHPAEA compliance

• Carefully review your plan’s NQTL analysis to ensure it includes statutorily required elements.

• For self-insured plans, consult legal counsel to amend your agreement with your TPA to ensure that that a proper and comprehensive NQTL analysis is included.

THE TRANSPARENCY IN COVERAGE (“TIC”) RULES

The DOL, HHS, and IRS issued regulations in 2020 to implement the ACA’s Transparency in Coverage rules (“TiC”). TiC requires most group health plans and insurers to post machine-readable files (“MRFs”) that disclose in-network negotiated rates, allowed amounts paid to out-ofnetwork providers, and fee-for-service prescription drug costs at the pharmacylocation level on a public website.

The MRFs must be based on a rolling 90-day period, updated monthly. Selfinsured plans without public websites for posting a link to the MRFs will be in compliance if the plan’s TPA (or some other third party) posts a link to the files on a public website.

The January 1, 2022, deadline was extended to July 1, 2022 (although the deadline for posting prescription drug information has been delayed pending further guidance).

TiC also requires plans and insurers to make individual disclosures of cost-sharing information to a participant/beneficiary (or their authorized representative) through an internet self-service tool and/or on paper.

Among other things, these individual disclosures must provide an estimate of the covered person’s liability. For paper copy requests, disclosures must be provided within 2 business days of receiving the request, and plans may impose a limit of 20 providers per request.

For plan years beginning on or after January 1, 2023, disclosures can be limited to the 500 listed in the regulations, with all other services being made available for plan years beginning on or after January 1, 2024.

In a similar mandate, the CAA also requires plans to offer price comparison information both by telephone and online to allow participants/beneficiaries to compare cost-sharing for specific items or services from in-network providers.

The tri-agencies have aligned the deadlines under the ACA and CAA for these online price comparison tools to January 1, 2023. Although similar, there are some substantive differences between the TiC and CAA requirements.

For example, the CAA requirement does not have a telephonic connection requirement. Also, while the TiC requirement for a self-service tool does not apply to grandfathered plans, the nearly identical requirement in the CAA will.

These TiC requirements do not apply to grandfathered health plans, excepted benefits, HRAs, or stand-alone retiree plans. Plan sponsors can place the TiC disclosure responsibilities on the insurer or TPA by written agreement, but the liability for any failures remains with the plan sponsors of self-insured plans. Fullyinsured plans can shift liability for failures to the insurer through a written agreement between the plan and the insurer.

The TiC regulations provide for good faith compliance relief. Plans/isnsurers acting in good faith and with reasonable diligence will not fail to be in compliance solely because of an error or omission in a disclosure required, so long as the plan or issuer corrects the information as soon as practicable. Nor will the plan/issuer be out of compliance if its internet website is temporarily inaccessible, provided that it makes the information available as soon as practicable.

To the extent compliance with TiC requires a plan/issuer to obtain information from any other entity, a good faith reliance on such information will not be a compliance failure, unless the plan/issuer knows, or reasonably should have known, that the information is incomplete or inaccurate.

TiC Practice Pointers:

• Agreements with insurers and TPAs should specifically address who is obligated to post and maintain information required by TiC.

• Self-insured plans that have contracted with a TPA or third party to post MRFs must monitor the TPA(s) to ensure compliance.

• Plans without public websites should confirm that the TPA has posted a link to the required information on a public website.

• Review (and revise, if necessary) plan procedures for authorized representatives, and ensure that disclosure to the authorized representative complies with applicable security and privacy requirements.

• Stay updated for guidance regarding deadlines for prescription drug costs.

ADDITIONAL CAA 2021 REMINDERS

CAA 2021 also enabled plan sponsors to modify their FSA carryover, grace period, and election change provisions as a result of COVID. While the window for these provisions has closed, plan amendments reflecting such changes are required by December 31, 2022.

Under the CAA “gag-rule” prohibition, plans and insurers cannot enter into agreements with providers, provider networks, TPAs, or any entity that offers access to a network of providers if it would prevent the plan or insurer from disclosing or gathering information necessary to comply with CAA.

Finally, CAA 2021 requires that entities receiving $1,000 or more in total annual direct and indirect consulting and brokerage commission and fees for ERISA covered health plans (including excepted benefit health plans) disclose such fees upon

contract or renewal of the services agreement on or after December 27, 2021.

Direct compensation is compensation from the plan itself—i.e., plan assets. Amounts paid directly by the employer/ plan sponsor would not be considered plan assets, generally, but participant contributions are always plan assets. Indirect compensation generally means amounts paid to brokers/consultants by any entity other than the plan or employer/plan sponsor (e.g., from a TPA or insurer).

Although this requirement is very similar to a disclosure requirement for retirement plans that has been in place since 2012, determinations of direct compensation may be more difficult for health plans due to the careful analysis that may be needed to determine which amounts are plan assets.

Unlike some of the other CAA requirements, this disclosure requirement applies to all group health plans, including excepted benefits like standalone dental and vision, Health FSAs, certain EAPs providing medical care, wellness programs providing medical care, and HRAs.

Disclosure Practice Pointers:

• Identify all consultants and brokers with respect to any group health plan.

• Determine whether any service provider receives any direct compensation and the amount of that compensation.

• If known, determine whether the service provider receives any indirect compensation and the amount of that compensation.

• Make a demand to any covered service provider who has not provided adequate disclosure.

• Establish and document that a responsible fiduciary actually reviews the disclosures and determines that the compensation is reasonable.

DOBBS AND THE EMERGENCE OF MEDICAL TRAVEL BENEFITS

After a draft opinion in Dobbs was leaked in May 2022, many plan sponsors began exploring options for providing abortion benefits to participants who lived in states that were likely to ban or restrict the procedure.

By the time the final Dobbs opinion was posted in late June, confirming that restrictions on abortion services would be left up to each state, employer sponsored medical travel emerged as a possible way to facilitate travel to less restrictive states.

For tax purposes, amounts paid for transportation primarily for and essential to legally provided medical care can be received tax free (subject to IRS dollar limits for lodging and mileage).

There are a number of different ways employers may be able to structure medical travel benefits—health reimbursement arrangements (“HRAs”), excepted benefit health reimbursement arrangements (“EBHRAs”)—but each of these come with compliance complications.

Providing legally permitted coverage through the employer’s traditional medical plan is likely the least complicated option, with the fewest compliance risks under laws like the Affordable Care Act (“ACA”), the Health Insurance Portability and Accountability Act (“HIPAA”), and the Consolidated Omnibus Budget Reconciliation Act (“COBRA”).

All of the options for medical travel benefits may also be subject to scrutiny by states, depending on civil and criminal liability under state law. ERISA preemption may apply in some cases, but the likelihood of prevailing on a preemption argument would have to be analyzed on a state-by-state basis, and ERISA preemption does not typically operate against generally applicable criminal statutes. HPI—delivering

•

•

•

•

•

•

•

•

Adding to the legal challenges is the basic practicality of administering a benefit that has to take into account the state where the patient is domiciled, the situs of the plan, and the state where services are available, as several third-party administrators (“TPA”) have reported that this data is not tracked in a manner that lends itself easily to their current claim substantiation protocols. These are untested issues and the outcome for employers and plans providing these benefits remains to be seen. Any employer (or administrator) considering providing or administering such benefits should consult with legal counsel to address these compliance (and potential criminal law) concerns.

Practice Pointers:

• Structuring a benefit to provide medical travel benefit through the group health plan, available only to enrollees and their enrolled dependents, and that can be used for obtaining any legally permissible covered services that are locally unavailable could help reduce some compliance risks under the IRC, ACA, HIPAA, COBRA, and MHPAEA.

• Consider plan design issues, such as: a limit to the number of times the benefit can be used per year or an annual dollar cap; taxability for lodging and mileage that exceed IRS reimbursement limits; the substantiation requirements for reimbursement (and related HIPAA issues).

• Implement fraud and abuse protocols to ensure that travel is “primarily” for covered medical services that are legally procured.

• Consult counsel familiar with applicable state laws, as civil and criminal liability may vary and could attach based on where the employee/participant resides, where the service is rendered, or even where the reimbursement is administered.

COVID-19 AND THE PUBLIC HEALTH EMERGENCY

Although for most employers it seems as though the COVID-19 pandemic is in the rearview mirror, the National Health Emergency (“National HE”) is not set to end any earlier than March 1, 2023, and the Public Health Emergency (“Public HE”) was extended on October 13, 2022 for another 90 days.

Both of these deadlines could be extended again. This means a few things for health plans. Health plans are required to continue covering prescribed and over-the-counter COVID-19 tests, as well as COVID-19 vaccines and boosters until the end of the Public HE.

The National HE affects the tolling of certain deadlines during the “Outbreak

Period”, which continues to impact plan administration by prolonging COBRA election periods, COBRA premium payment deadlines, HIPAA Special Enrollment periods, and claims filing and appeals deadlines.

DISASTER RELIEF FILING DEADLINES

Weather-related disasters have extended several filing deadlines. Those in FEMAdesignated areas with a valid extension to file their 2021 Form 5500 due to run out on October 17, 2022, will now have until February 15, 2023:

• IR-2022-173: Hurricane Ian/South and North Carolina: Sept 25/28 (respectively), 2022-Feb 15, 2023

• IR 2022-168: Hurricane Ian/Florida: Sept 23, 2022-Feb 15, 2023

• IR 2022-164: Storms and Flooding/Alaska: Sept 15, 2022-Feb 15, 2023

• IR 2022-161: Hurricane Fiona/Puerto Rico: Sept 17, 2022-Feb 15, 2023

• MS-2022-01: Mississippi Water Crisis victims: Aug 30, 2022-Feb 15, 2023

sales@amps.com www.amps.com

The benefits landscape is broad and complex.

Skyrocketing prices. Administrative challenges. Shock claims. Aging workforces. At Amwins Group Benefits, we’re here to answer the call. We provide solutions to help your clients manage costs and take care of their people. So whether you need a partner for the day-to-day or a problem solver for the complex, our goal is simple: whenever you think of group benefits, you think of us.

Bring on the future – we’ll cover it.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Visit https://www.irs.gov/newsroom/ tax-relief-in-disaster-situations for more information.

PROPOSED SECTION 1557 REGULATIONS

Section 1557 prohibits discrimination on the basis of race, color, national origin, sex, age, or disability under any health program or activity that is receiving federal financial assistance on the grounds that such discrimination is prohibited under existing federal laws.

Final regulations have twice been issued under 1557—once in 2016, and again 2020— and a proposed rule was again published in 2022. The 2022 proposed rule would re-instate several provisions from the 2016 Final Rule that had been removed or amended by the 2020 Final Rule and made a few refinements (e.g., taglines, notices, and grievance procedures).

The 2022 proposed rules restore the 2016 application of 1557 to health insurers that receive federal funds but otherwise narrow its application to group health plans. Under the 2016 Final Rule, group health plans were included as entities that were categorically covered.

The 2022 proposed rule does not explicitly include group health plans as covered entities because many group health plans are not recipients of federal financial assistance, even if the employer, plan sponsor or TPA administering the plan are recipients. HHS proposes for complaints against group health plans to be evaluated case-by-case to determine if the plan is covered.

In a departure from its previous position, HHS is proposing to treat Medicare Part B funds as “federal financial assistance to the providers and suppliers subsidized by those funds.” As we publish this article, we are awaiting the final 1557 regulations.

MISCELLANEOUS

State PBM laws and ERISA preemption: Increasingly, since Rutledge v. Pharmaceutical Care Management Association was decided by the U.S. Supreme Court in favor of Arkansas’ regulation of PBM reimbursement levels, states are passing laws regulating PBMs that may affect group health plans. Plan sponsors— especially those with a multi-state presence—will need to stay informed of these state laws and/or address such provisions in their PBM agreements.

COBRA class actions: Employers continue to face COBRA class action lawsuits, often related to the language in the COBRA notice. One of the latest claims included an accusation that the employer discouraged employees from electing COBRA by threatening employees with fraud if any forms were filled out incorrectly.

While it may make sense to stick to the DOL model notice, even the DOL model notices are not “litigation proof.” COBRA administrators and plan sponsors that self-administer COBRA should review their COBRA notices carefully in light of this recent litigation.

Telehealth and HDHPs/HSAs: Because of the COVID-19 pandemic and during 2020 and 2021, employers with HDHPs were allowed to provide coverage for telehealth services before the minimum HSA compatible deductible was met.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, allowed this pre-deductible telehealth coverage but only through 2021. The CAA extended this relief for the months of April 2022 through December 2022.

The CAA extension presents two challenges. First, beginning in 2023 and unless Congress acts to extend this relief further, participants and beneficiaries in an HDHP should be required to pay the fair market value of any telehealth services until the minimum HSA compatible deductible is met. Telehealth services that are limited to preventive services would not be disqualifying.

Also, in Notice 2020-15, the IRS provided that coverage of medical care and items purchased for testing for and treatment of COVID-19 would not be disqualifying. The coverage for COVID-19 testing and treatment is indefinite (not geared to the Public Health Emergency) but it is unclear whether the IRS will, at some point, withdraw this exception to disqualifying coverage.

Also, based on an analogy to guidance on employee assistance, disease management and wellness programs, it may be possible to provide telehealth benefits prior to meeting the minimum HSA compatible deductible if the telehealth program does not provide significant benefits in the nature of medical care or treatment.

We Know... Risk

We study it, research it, speak on it, share insights on it and pioneer new ways to measure it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be acknowledged as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 45 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ tranpslant needs.

Unfortunately, the IRS has provided little guidance on when such benefits will be significant. The second issue is how to deal with the months of January through March of 2022. HSA eligibility is determined on a month-to-month basis so individuals enrolled in an HDHP who received pre-deductible telehealth coverage during these months may be ineligible to contribute to an HSA for those months.

Also, there is what is known as the “full contribution rule” for those who are enrolled in a HDHP with no other disqualifying coverage as of December 1 of any year.

Fixing the “Family Glitch: Under the ACA individuals are eligible for a premium tax credit for coverage obtained through the Exchange/Marketplace as long as they meet certain criteria including not being offered “affordable” employer-based coverage.

For a family member of an employee, that affordability was based on whether the employee was offered affordable employer-based self-only coverage even if the coverage was not affordable for the whole family. In fixing the family glitch the IRS now provides separate affordability determinations for employees and for family members.

Importantly, however, nothing has changed with regard to the ACA employer mandate (play or pay) under Section 4980H of the IRC. The play or pay penalty is only triggered if the offer of self-only coverage to the employee is not affordable. There is no penalty if coverage for family members is not affordable.

The IRS subsequently allowed an election change event for employees with family members seeking to enroll in exchange coverage.

Medicare Creditable Coverage: Medicare Part D notices (either creditable or noncreditable coverage) were due prior to October 15. Online disclosure to CMS is due no later than 60 days after the beginning date of the plan year (contract year, renewal year, etc.) and upon change of the plan’s creditable coverage status.

Prescription drug cost reductions for Medicare enrollees in the Inflation Reduction Act may impact the analysis of whether employer sponsored prescription drug coverage is creditable. Plan sponsors need to be mindful of this possibility when making this calculation.

Telephone Consumer Protection Act of 1991 (TCPA): The TCPA generally restricts certain unauthorized automated calls and texts to residential and cellular phones, including some restrictions potentially applicable to health care messages.

A recent federal district court opinion, Fiorarancio v. Wellcare Health Plans, Inc., serves as an important reminder that even if a plan is in compliance with all other applicable laws, including HIPAA privacy requirements, the plan must still be cognizant of the TCPA when reaching out to plan participants via texts and pre-recorded messages, absent express consent.

Plan sponsors should evaluate the administrative practices of their TPAs and vendors and have clear language in service agreements with regard to which party has the responsibility to obtain proper consent (and the liability for such failures).

Medicare Secondary Payer (“MSP”): In Marietta Memorial Hospital Employee Health Benefit Plan v. Davita, the U.S. Supreme Court decided the very narrow question of whether an employer-provided benefit plan violates the MSP rules when the plan treated all dialysis providers as “out-of-network,” reimbursing them at the lowest rate.

In DaVita, the plan offered an outpatient dialysis benefit to everyone enrolled, regardless of whether the person had end stage renal disease (“ESRD”).

Even though the vast majority of people who require dialysis are living with ESRD, the Court ruled that it is not a “disparate treatment” violation of MSP rules if all dialysis providers are out-of-network because all individuals enrolled in the plan had access to the same benefits, regardless of any health condition. This outcome, which some believe is not consistent with the intent of MSP rules, may be resolved by federal legislation.

Gender Identity: How gender issues can be appropriately addressed through healthcare continues to be an evolving area for health plans. Litigation against plan sponsors has centered around discrimination claims under Title VII and Section 1557.

Counsel should be consulted before limiting or excluding treatment for gender issues since this area remains a highly-debated subject among health professionals, both in the United States and worldwide.

2023 HEALTH BENEFIT ADJUSTMENTS

Included in the Table below are 2023 indexed amounts for some of the health benefit related limits and caps:

BENEFIT

A HISTORIC OPIOID SETTLEMENT COULD PRESENT OPPORTUNITIES FOR INSURERS TO SEEK REIMBURSEMENT

Written By Brady Bizarro, Esq.

Written By Brady Bizarro, Esq.

In early November, it was announced that the nation’s three largest retail pharmacies – CVS, Walgreens, and Walmart – had agreed ‘in principle’ to pay $13.8 billion in damages in a settlement to resolve thousands of claims related to the opioid epidemic.

Due to the uniquely insidious nature of opioid addiction and the truly devastating scale of the crisis, hundreds of thousands of Americans have lost their lives, families have been shattered, and governments and health insurers alike have spent tens of billions of dollars on rehabilitation and increased claim costs.

If this settlement proceeds, as appears very likely as of this writing, insurers, including self-funded plan sponsors, could have new opportunities to recover funds on behalf of their plan participants.

A medical stop loss grand slam.

A trusted business name.

A stellar balance sheet. An executive team with 30 years of experience. Creative, tailored solutions. Berkshire Hathaway Specialty Insurance is proud to bring our exceptional strength, experience and market commitment to the medical stop loss arena.

It’s a home r un for your organization.

www.bhspecialty.com/msl

Earlier settlements related to the opioid crisis, totaling tens of billions of dollars, were reached between many state attorneys general and drug manufacturers, including Purdue Pharma. This settlement is notable not only for its size but also because it would be the first nationwide deal reached with retail pharmacies. The claims at issue were brought by states, localities, and tribal entities. Why would these pharmacy chains agree to settle such claims? This is mostly because evidence emerged in various trials, during the discovery process, that executives at these companies ignored repeated warnings from their own pharmacists that their dispensing actions were fueling the opioid crisis.

The economic toll of the opioid crisis cannot be overstated. In late September, the Joint Economic Committee of the U.S. Congress release a detailed report revealing that the opioid crisis has cost the country nearly $1.5 trillion in economic losses in 2020 alone.

For health insurers, the cost has skyrocketed over the past few years, reaching well into the tens of billions of dollars. The scope and size of opioid-related claims may not be entirely obvious, even to seasoned industry veterans, and so they are worth reviewing here.

A 2018 report from BioMed Central (BMC) concluded

According to the Centers for Disease Control and Prevention, prescription opioids can be up to 50 times more powerful and addictive than heroin. In 2021, as many as 100,000 Americans died from drug overdoses. Not all of these deaths were caused by prescription painkillers, but the vast majority of them were caused by opioids, both synthetic opioids and prescription opioids. The recent COVID-19 pandemic and the burgeoning nationwide mental health crisis have caused overdose deaths to spike in recent months; a trend which the data suggests will continue into next year.

This study’s findings are in line with numerous other studies conducted by esteemed medical research institutions, including the Johns Hopkins Bloomberg School of Public Health.

that “[i]ndividuals with high-risk prescription opioid use have significantly higher healthcare costs and utilization than their counterparts, especially those with chronic high-dose opioid use.”

Flatten the trajectory of rising health plan costs with Vālenz® Health.

We’re driving a fundamental shift in how self-insured employers look at stop loss insurance – not as a commodity, but as the foundation of lowering year-over-year plan costs. Leveraging the cost reduction value of our fully integrated Healthcare Ecosystem Optimization Platform, we engage early to assess financial risk and capture more optimal stop loss ratings.

To further mitigate risk and meet fiduciary responsibilities, ask us how our new V-Rated Solution takes smarter, better, faster healthcare to the next level.

MARKET AVERAGE VALENZ HEALTH CLIENTS

The BMC report demonstrated that the average claim cost for an employee who is prescribed a single opioid increased by a factor of four to eight. The specific claim costs the authors focused on were addiction treatment, rehabilitation, emergency room visits, death, and obviously, increased prescription drug costs.

The most recent data available from Peterson-Kaiser Family Foundation, going back to 2016, reveals that the cost to large employers has jumped significantly, to $2.6 billion in 2016, up from $300 million in 2004, a more than nine-fold increase.

One obvious way to do this is for insurers to become part of nationwide opioid litigation, joining these cases (or initiating them) as plaintiffs. Another, perhaps less obvious way, is on the back end, in the form of subrogation.

Many, if not most, of the thousands of lawsuits related to the opioid crisis will eventually end in settlements. For health insurers, this result, depending on the terms of the settlement, and any applicable law, may actually be more beneficial as it relates to recovering claim costs than relying on a judgment imposed by a court.

For one thing, health insurers, especially smaller self-funded plans with limited resources, are not likely to be able to join most lawsuits on the front end. Even if a self-funded plan was able to track down and join a particular lawsuit in any given state, it is exceedingly unclear to what extent a health insurer’s claims will be prioritized in any given judgment, especially since the families of victims are almost certain to receive the lion’s share of any financial compensation, followed closely by federal, state, local, and tribal governments.

Put another way, FAIR Health, which owns and continuously updates a database of more than 21 billion claims from privately insured individuals, concluded back in 2015 that “on average, private insurers and employers providing self-funded plans paid nearly $16,000 more per patient for those with diagnoses of opioid abuse or dependence than for those with any diagnosis.”

As the human and economic tolls have come increasingly into focus, it should be no surprise that thousands of lawsuits have been filed against drug manufacturers, physicians, and pharmacies. Litigation related to the opioid crisis is likely to continue for many years in suits brought by individuals, government entities, and insurers of all stripes. Indeed, there are numerous law firms working together to assemble litigation teams to help insurers recoup opioid-related costs.

Digital

A large share of the money received in most opioid-related settlements is paid out to government entities and designated to be invested in drug rehabilitation programs and efforts to respond to the ongoing opioid epidemic.

Another, often equally substantial share, is reserved to establish victim restitution funds. True, victim restitution funds can be set up as a result of court judgments, but those set up pursuant to settlement agreements are often less restrictive. In most cases, when a victim restitution fund is established, whether by judgment or settlement, self-funded health plans have legitimate opportunities for recovery against amounts received by victims.

Arguably, plan sponsors have a duty to pursue recovery opportunities against victim restitution funds, when practical. Even within the context of opioid-related litigation and settlements, plan sponsors have a fiduciary duty to act prudently with plan assets. This means that plan sponsors should be looking to employ legal, practical means of recovery for the billions of dollars they have collectively spent on opioid-related claim costs.

They may feel that the public perception of this practice in cases involving the tragic results of opioid addiction is unacceptable. That said, it is very important to remember that the recovery of plan funds in this context has a trickle down, positive impact on all employees and members of the plan, because they all rely on plan funds being used prudently to help lower premium costs for everyone and to ensure that plan funds are available to pay future claims, including in tragic cases like these.

In many cases, notwithstanding the fiduciary duties described above, it may not be practical, appropriate, or fair for plans to pursue recovery opportunities against funds received by a victim or a victim’s family, and many plans may choose not to do this.

There have already been examples of recoveries obtained by victims of the opioid crisis from trusts established after bankruptcy proceedings for opioid manufacturers, and there will undoubtedly be many more examples going forward as a result of settlement agreements.

One such example involves Mallinckrodt Plc, an opioid manufacturer that filed a Chapter 11 bankruptcy proceeding in 2020, in the U.S. Bankruptcy Court for the District of Delaware. Mallinckrodt’s Chapter 11 Plan of Reorganization took effect on June 16, 2022.

As part of that Plan, the Court approved the establishment of the Mallinckrodt Opioid Personal Injury Trust. The Court also drafted procedures by which funds from the Trust could be dispersed, accounting for subrogation and reimbursement claims.

In this, what would be the first-of-its-kind settlement with nationwide pharmacy chains related to the opioid epidemic, it is likely that a victim restitution fund will be established. If it is, it would present a new opportunity for plan sponsors to recover some of the claim costs they have incurred throughout the opioid epidemic. It will also likely serve as a blueprint for future settlements with pharmacy chains as long, arduous legal battles continue to play out.

Brady Bizarro joined The Phia Group as a healthcare attorney in early 2016. As the Senior Director of Legal Compliance & Regulatory Affairs, he specializes in regulatory, transactional, and compliance matters related to healthcare and employee benefits law. He provides general consulting services to clients, including employers, third-party administrators, brokers, and vendors associated with health benefit plans on matters related to the health insurance industry, including ERISA, ACA, and HIPAA compliance. He also performs contract review and due diligence on healthcare transactions and assists with dispute resolution efforts between the various players in the healthcare industry in an effort to protect plan members and plan sponsors.

During law school, Brady participated in the Edward C. Stone Moot Court Competition and completed a legal internship in the U.S. House of Representatives. He also worked as a summer associate at Greene LLP, a complex civil litigation firm in Boston that specializes in healthcare fraud cases, and as a Rule 3:03 attorney with Greater Boston Legal Services, where he represented indigent defendants in employment and discrimination cases in state court. Prior to law school, he worked as a mediator for the Massachusetts Attorney General’s Office and for the National Defense University in Washington, D.C.

We would like to invite you to share your insight and submit an article to The Self-Insurer! SIIA’s official magazine is distributed in a digital and print format to reach 10,000 readers all over the world.

The Self-Insurer has been delivering information to top-level executives in the self-insurance industry since 1984.

Articles or guideline inquires can be submitted to Editor Gretchen Grote at ggrote@ sipconline.net

The Self-Insurer also has advertising opportunties available. Please contact Shane Byars at sbyars@ sipconline.net for advertising information.

Do you aspire to be a published author?

The

Specifically,

The Reports are part of a larger effort to collect information on the amount of money health plans spend on medical services and prescription drugs through annual reports, which Congress has mandated for all group health plans, including self-insured plans. A more detailed summary of the reporting requirements and upcoming deadlines can be found here

prescription drugs covered under the plan, the top 50 most frequently dispensed brand name drugs, and the top 50 prescription drugs with the greatest spending increase from year-to-year. As part of this, plans must also report the total amount of drugs covered under the plan, total rebates by class, and the top 25 greatest rebate amounts.

Along with the above information, plans must also include a “narrative file” explaining the size of the self-insured plan sponsor, the prescription drugs covered as medical benefits, the type and amount of drug rebates, the allocation methods for drug rebates, and how the drug rebates impact spending under the plan.

MULTIPLE REPORTING ENTITIES

Importantly for self-insured plans, the plan sponsor and TPA will have access to the plan-related information, while the plan sponsor’s PBM(s) will have access to the prescription drug-related information. Thus, multiple entities will be completing and submitting these Reports on behalf of a single self-insured plan.

This complexity means that coordination between the TPA(s), PBM(s), and/or thirdparty reporting entities will be critical in compiling, reporting, and submitting all of the plan-related and prescription drug-related information.

It will be imperative for self-insured plans, and their reporting entities, to prepare and coordinate ahead of the December 27, 2022 deadline.

In short, the Prescription Drug Reports must include information on the total spending on health claims related to a variety of medical services, as well as the total premiums paid under the plan, the total number of covered lives, and the cost-sharing paid by plan participants during the calendar year.

SIIA will continue to provide you with any updates relating to the Prescription Drug Reports. For more information, or with additional questions, please contact Chris Condeluci at ccondeluci@siia.org or Ryan Work at rwork@siia.org

In addition to this plan-related information, the Prescription Drug Reports must include information on, among other things, the costliest

NEWS FROM SIIA MEMBERS

2022 DECEMBER MEMBER NEWS

SIIA Diamond, Gold, and Silver member companies are leaders in the self-insurance/ captive insurance marketplace. Provided below are news highlights from these upgraded members. News items should be submitted to membernews@siia.org.

All submissions are subject to editing for brevity. Information about upgraded memberships can be accessed online at www.siia.org.

If you would like to learn more about the benefits of SIIA’s premium memberships, please contact Jennifer Ivy and jivy@siia.org.

DIAMOND MEMBERS

BERKLEY ACCIDENT AND HEALTH RELEASES 2022 HEALTH CARE PRESSURES FACING U.S. EMPLOYEES

HAMILTON SQUARE, NJ -- U.S. employees are feeling the pressure of health care costs, with 8 in 10 concerned about the cost of care and more than half reporting that they have skipped medical tests, office visits, or prescriptions.

These findings come from the 2022 Health Care Pressures Facing U.S. Employees report, released by Berkley Accident and Health, a Berkley Company.

"Cost-sharing is a major problem for U.S. employees, who are struggling with increased out-of-pocket costs due to high deductibles and coinsurance," said Brad N. Nieland, President and CEO of Berkley Accident and Health. "These costs can place the largest burden on those who are least able to pay, forcing patients to skip care, self-pay, and take on medical debt."

• 38 percent report having medical debt, with the majority owing between $1,000 and $10,000. The top reason cited for medical debt was an unmet deductible or coinsurance.