Employer Benefits on the Rise

Pregnant with

Possibilities

A SIPC PUBLIC A TION SIPCONL I NE.N E T APRIL 2023

Get the peace of mind and support it takes to self-fund your healthcare.

Self-insuring your healthcare benefits can open up new possibilities for your business — affording you greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your team and assets:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

• Special Risk Accident

We’ll find the right answers together, so no matter what happens next, you can stay focused on your future.

To learn more, visit us at qbe.com/us/ah

QBE and the links logo are registered service marks of QBE Insurance Group Limited. ©2023 QBE Holdings, Inc. This literature is descriptive only. Actual coverage is subject to the terms, conditions, limitations and exclusions of the policy as issued. Crop Specialty Commercial

We’ll focus on risk, so you can take care of your business

Accident & Health Insurance

TABLE OF CONTENTS

FEATURES

4 PREGNANT WITH POSSIBILITIES: EMPLOYER BENEFITS ON THE RISE

By Laura Carabello

20 REMOTE CONTROL: IN-HOME PATIENT CARE AND MONITORING SEEN AS MAJOR STEP FORWARD ON REAPING EFFICIENCIES FROM AN OVERWORKED SYSTEM

By Bruce Shutan

By Bruce Shutan

ARTICLES

31 ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES THE AFFORDABLE CARE ACT (ACA), THE HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA) AND OTHER FEDERAL HEALTH BENEFIT MANDATES

40 CAPTIVE FORMATIONS RISE AS INSURANCE MARKET HARDENS

48 ELI LILLY CAPS INSULIN COST

54 SIIA ENDEAVORS

59 NEWS FROM SIIA MEMBERS

The Self-Insurer (ISSN 10913815) is published monthly by Self-Insurers’ Publishing Corp. (SIPC). Postmaster: Send address changes to The Self-Insurer Editorial and Advertising Office, P.O. Box 1237, Simpsonville, SC 29681,(888) 394-5688

PUBLISHING DIRECTOR Erica Massey, SENIOR EDITOR Gretchen Grote, CONTRIBUTING EDITORS Mike Ferguson and Ryan Work, DIRECTOR OF ADVERTISING Shane Byars, EDITORIAL ADVISOR Bruce Shutan, 2023 Self-Insurers’ Publishing Corp. Officers James A. Kinder, CEO/Chairman, Erica M. Massey, President, Lynne Bolduc, Esq. Secretary

APRIL 2023 VOL 174 WWW.SIPCONLINE.NET APRIL 2023 3

PREGNANT WITH POSSIBILITIES

EMPLOYER FERTILITY BENEFITS ON THE RISE

Written By Laura Carabello

Written By Laura Carabello

Reproductive medicine has clearly entered the world of virtual care and digital health benefits. These solutions are answering employer demand for fertility benefits that help companies attract new workers and keep the ones they have satisfied with current opportunities for coverage.

Brooke Quinn, chief customer officer, Carrot Fertility says, “We’ve seen a significant shift in fertility benefits over the last five years. When Carrot was first founded, it was very rare for employers to offer fertility benefits, and if they did, they were limited to certain treatments, such as egg freezing, and not inclusive of all fertility healthcare and family-forming journeys. Now, employees are increasingly expecting their employers to invest in fertility healthcare -- similar to dental, vision, etc., and when these companies invest in their employees’ health and well-being, it builds trust and loyalty. The result is that employees are more likely to stay with their employer when offered comprehensive fertility benefits.”

FEATURE

R

4 THE SELF-INSURER

The trend has been accelerating over the past few years, evidenced by a recent Harris Poll conducted on behalf of Fortune. Respondents say that during the ongoing war for talent that is expected to continue through 2031, there is solid evidence that companies are enhancing their employee benefits programs with fertility benefits quickly gaining traction as a ‘must-have.’

A recent survey conducted by FertilityIQ, a comprehensive family planning resource that helps individuals and family members make informed fertility decisions, showed that nearly half of workers (45%) regard these types of benefits as an important component when considering a new job.

In 2021, they say the number of large companies offering or enhancing their family-building benefit grew by 8% year-over-year, including services that range from egg freezing and drug therapy to intrauterine insemination (IUI) and in vitro fertilization (IVF).

The fertility-education website expects to report even larger numbers for the year ahead based upon data it has been collecting. This is the result of increased recognition that families are built in a variety of ways, including single parents and same-gender couples.

Quinn says that for employers to truly move the needle on employee satisfaction, it’s important that they invest in benefits that are meaningful.

explains. “Most people don’t have tens of thousands of dollars at their disposal, so it makes a meaningful difference when employers offer financial support as part of their benefit.”

Pam Pure, founder & CEO, Posterity Health, sees this change in employer attitudes, “The attitude has changed from several years ago when financial savings for the employer were most important. Employers are now focused on employee satisfaction, health equity and high-quality care, while providing savings for both the employee and employer sponsored health plan.”

In a Carrot Fertility survey, 95% of members who use the Carrot benefit said they are more likely to stay at their company because they offer Carrot. Quinn attributes this result to the Company’s focus on lifelong fertility care, which means employees will leverage the benefits at different points in their lives.

Quinn observes that one of the barriers to accessing fertility care is cost. ““For example, the average cost of an IVF cycle is about $20,000, private adoption costs can start around $30,000, and gestational surrogacy typically costs more than $100,000,” she

Pure discerns that not only is there a focus on reproductive health, but there is a clear shift on treating fertility as a couple’s issue, adding, “Employers respect the fact that 50% of the time a couple is experiencing infertility issues, there is a male factor involved. At Posterity Health, we allow payers and employers to implement and utilize male fertility services to enhance their existing fertility benefit

APRIL 2023 5 Pregnant with Possibilities

“While it was not long ago that we would see companies tout office perks such as free coffee and game rooms, ultimately, these types of perks don’t have a longlasting impact on employees. Fertility benefits are a different story.”

Pam Pure

offering. While some fertility benefit programs include male benefits, most do not. To provide comprehensive, equitable fertility benefits male services must be included.”

She emphasizes that today’s employers understand that proactively evaluating the fertility status of both partners early in the process will help their employees achieve the best outcome at the lowest price point.

“Re-sequencing a couple’s infertility evaluation and working more aggressively on resolving male factor issues will reduce costs while eliminating unnecessary care,” says Pure.

“When benefits require out of pocket expense, utilization and engagement from employees will decrease.”

Infertility is on the rise as more people wait until later in life to have a child, according to Julie Campbell, vice president, Business Development, Progeny:

“According to the CDC, 1 in 5 women are impacted by infertility and, notably, one third of infertility diagnoses are due to male-factor infertility. Additionally, 63% of LGBTQIA+ individuals who are planning to build a family use assisted reproductive technology, foster care, or adoption to become parents. With the increasing need for fertility and family building services, employers are taking notice.”

She says the labor market is tight, and employers need a benefit that will help them attract and retain top talent.

APRIL 2023 7 Pregnant with Possibilities

“Today, a large portion of our workforce includes millennials, who have cited fertility treatment as a top 5 desired benefit,” explains Campbell. “Also, 46% of

Premier

Support. Less of everything that holds you back. More of everything that makes you great. Scan to request a demo. ©2023 BenefitMall. All Rights Reserved.

Julie Campbell

Broker

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health.

Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

Stop Loss | Group Captives | Managed Care | Specialty Accident ©2022 Berkley Accident and Health, Hamilton Square, NJ 08690. All rights reserved. BAH AD2017-09 2/22 www.BerkleyAH.com

Pregnant with Possibilities

Lastly, companies with comprehensive DEI initiatives are a priority for people in the workforce – nearly 80% of people want to work for a company that prioritizes DEI. When a company adopts fertility and family building benefits, it sends a strong message to employees that their company values female, BIPOC, and LGBTQIA+ individuals since these populations are the most impacted.”

There are differing opinions regarding out-of-pocket expenses for these services when they are attached to the benefit package. Campbell reports that under her organization’s benefit solution, patients are left to pay a fraction of the price of treatment – similarly to how insurance would cover any other medical need.

“Fertility treatments are regularly cited as being extraordinarily expensive, especially when a patient is being asked to pay for these services outof-pocket,” she makes clear.

APRIL 2023 9

“With benefits, these necessary treatments become affordable and comparable to treating any other common disease condition. ”

Pregnant with Possibilities

DEFINING INFERTILITY

In general, infertility is defined as not being able to get pregnant (conceive) after one year (or longer) of unprotected sex. Because fertility in women is known to decline steadily with age, some providers evaluate and treat women aged 35 years or older after 6 months of unprotected sex.

Women with infertility should consider making an appointment with a reproductive endocrinologist—a doctor who specializes in managing infertility. Reproductive endocrinologists may also be able to help women with recurrent pregnancy loss, defined as having two or more spontaneous miscarriages.

Infertility is not always a woman’s problem. Both men and women can contribute to infertility. Infertility in men can be caused by different factors and is typically evaluated by a semen analysis.

When a semen analysis is performed, the number of sperm (concentration), motility (movement), and morphology (shape) are assessed by a specialist. A slightly abnormal semen analysis does not mean that a man is necessarily infertile. Instead, a semen analysis helps determine if and how male factors are contributing to infertility.

Anderson-Bialis, co-founder of Fertility IQ says, “At some point, you are going to hit an inflection point where most major employers in every major market will decide to pay for this and the rest have to fall in line. We have hit the inflection point. I think this is the year.”

A separate survey from Mercer confirms this trend: in 2021 found 42% of large companies, with 20,000 or more employees, covered IVF in 2020, compared to 36% in 2015, and 19% covered egg freezing, up from 6% in 2015. For those who had 500 or more workers, 27% covered IVF, compared to 24% six years prior.

Campbell asserts that offering comprehensive fertility and family building benefits shows employees that their employers recognize them as individuals and prioritize their physical and mental health both professionally and personally.

“When an employee has been diagnosed with infertility, the stress they experience is overwhelming and is heightened as they begin going through treatments,” she continues. “If they do not have benefits, or have a dollar cap benefit, they find themselves making rash and cost-based decisions that greatly impact their chance to conceive and overall mental and physical well-being.”

She adds that by providing a comprehensive and inclusive benefit, employees feel supported and empowered by their employer and can prevent them from having to take on second jobs, open high-interest credit cards, and borrow against their 401(k) plans in order to support their family building dreams.

“All of this results in happier and healthier employees,” she says with a smile.

REGULATORY GUIDANCE

Employers have captured the attention of The National Infertility Association (NFA; www.resolve.org) which is increasing its reach with digital and in-person information to guide people throughout their family building journey.

Most relevant to employers, the organization is expanding the Coverage at Work program, which provides everything employees need to persuade their employers to voluntarily add family building benefits. This was prompted, in part, by employers recognizing that their employees are starting their families later in life for a variety of reasons.

10 THE SELF-INSURER

Skyrocketing prices. Administrative challenges. Shock claims. Aging workforces.

At Amwins Group Benefits, we’re here to answer the call. We provide solutions to help your clients manage costs and take care of their people. So whether you need a partner for the day-to-day or a problem solver for the complex, our goal is simple: whenever you think of group benefits, you think of us.

The benefits landscape is broad and complex.

Bring on the future – we’ll cover it. amwins.com

Pregnant with Possibilities

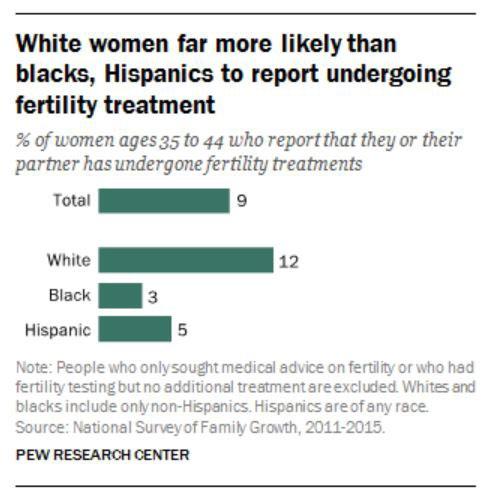

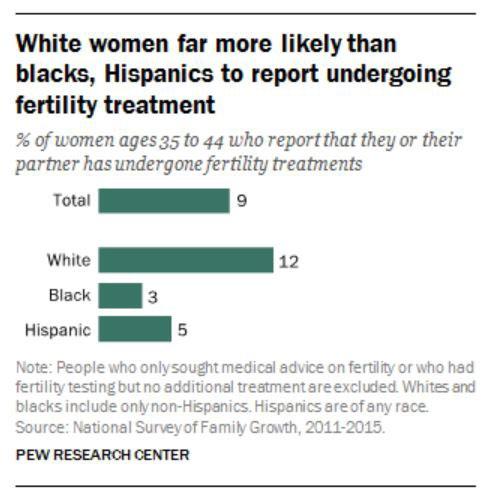

SNAPSHOT OF FERTILITY ISSUES

• 12% of women experience difficulties becoming pregnant or carrying a child to term.

• 1 in 8 couples in America encounter fertility hurdles.

• 19% of all couples are unable to conceive after a year of unprotected sex.

Source: CDC https://www.cdc.gov/reproductivehealth/infertility/index.htm#:~:text=In%20the%20 United%20States%2C%20among,to%20term%20(impaired%20fecundity

• After 1 year of having unprotected sex, 12% to 15% of couples are unable to conceive, and after 2 years, 10% of couples still have not had a live-born baby.

Source: National Institute of Health https://www.nichd.nih.gov/health/topics/infertility/conditioninfo/ common

• 33% of Americans have turned to fertility treatments or know someone who has.

Source: Pew Research Center

https://www.pewresearch.org/fact-tank/2018/07/17/a-third-of-u-s-adults-say-they-have-used-fertilitytreatments-or-know-someone-who-has/#:~:text=Four%20decades%20after%20the%20birth,new%20 Pew%20Research%20Center%20survey

12 THE SELF-INSURER

While state mandates may not be enforced with self-insured companies, it is interesting to note that at least 20 states with mandated fertility coverage have passed laws the hold private insurance responsible for either covering or offering some variation of fertility testing, diagnosis or treatment.

Each state can define the scope of coverage however they deem appropriate. Note that there is a distinction between a “mandate to cover” and a “mandate to offer.”

NFA advises that a mandate to cover requires health insurance companies to include infertility treatment in every policy while a mandate to offer only requires health insurance policies to offer a policy that includes treatment but does not require employers to subsidize.

As of June 2022, 20 states have passed fertility insurance coverage laws, 14 of those laws include IVF coverage, and 12 states have fertility preservation laws for iatrogenic (medically-induced) infertility.

FAMILY BUILDING TREATMENT OPTIONS

Advanced technology is enabling innovative treatment options that may be appropriate for one person, partners or a combination. Employers may encounter claims for medications that help with hormones and ovulation as well as for minor surgical procedures. They are often categorized as Assisted Reproductive Technology (ART):

Egg freezing: Also known as mature oocyte cryopreservation, this is a method used to save women’s ability to get pregnant in the future. Eggs harvested from the ovaries are frozen unfertilized and stored for later use. A frozen egg can be thawed, combined with sperm in a lab and implanted in the uterus – known as in vitro fertilization (IVF).

Quinn observes that one of the barriers to accessing fertility care is cost.

“For example, the average cost of an IVF cycle is about $20,000, private adoption costs can start around $30,000, and gestational surrogacy typically costs more than $100,000,” she explains. “Most people don’t have tens of thousands of dollars at their disposal, so it makes a meaningful difference when employers offer financial support as part of their benefit.”

Medications to restore fertility: Medications that regulate or stimulate ovulation are known as fertility drugs. Fertility drugs are the main treatment for women who are infertile due to ovulation disorders. Fertility drugs generally work like natural hormones — follicle-stimulating hormone (FSH) and luteinizing hormone (LH) — to trigger ovulation. They’re also used in women who ovulate to try to stimulate a better egg or an extra egg or eggs.

APRIL 2023 13 Pregnant with Possibilities

Pregnant with Possibilities

Intrauterine insemination (IUI): A type of artificial insemination for treating infertility. Sperm that have been washed and concentrated are placed directly in your uterus around the time that the ovary releases one or more eggs to be fertilized.

In vitro fertilization (IVF): This complex series of procedures used to help with fertility or prevent genetic problems and assist with the conception of a child. During IVF, mature eggs are collected (retrieved) from ovaries and fertilized by sperm in a lab. The CDC created an ‘IVF Success Estimator’ – a tool to estimate the chance of having a live birth using IVF based on the experiences of women and couples with similar characteristics.

ANOTHER OPTION: GESTATIONAL SURROGACY -‘BOOMING INDUSTRY’

Business analysts report that the demand for gestational carriers has never been higher.

Gestational surrogacy requires in vitro fertilization (IVF), in which an embryo is created using the eggs and sperms of the intended parents or donors, then implanted in the uterus of the gestational carrier (or surrogate).

According to the American Society for Reproductive Medicine (ASRM), a Gestational Carrier (GC) is a woman who

agrees to have a couple’s fertilized egg (embryo) implanted in her uterus. The gestational carrier carries the pregnancy for the couple, who usually has to adopt the child. The carrier does not provide the egg and is therefore not biologically (genetically) related to the child.

From 2010 to 2019, the most recent per fertility clinic data reported to the CDC, the number of embryo transfer procedures using a gestational carrier more than tripled to 9,195.

While there was no data available on the exact number of livebirth deliveries through surrogacy, the most recent CDC report found that between 1999 and 2013, gestational carriers gave birth to18,400 infants, and the number of IVF cycles using GCs more than quadrupled.

Globally, surrogacy is booming. Its market exceeded $4 billion in 2020, is valued at over $14 billion in 2022, and is projected to achieve nearly 25% compound annual growth rate in the next decade, according to Global Market Insights.

14 THE SELF-INSURER

And while it is illegal in many parts of the world, the practice has found a home in the U.S., where 47 states either permit and regulate surrogacy or do not expressly prohibit it (Louisiana, and Nebraska are the exceptions.)

The best estimates from experts are that perhaps more than 300 agencies in the U.S. actively recruit women primarily to be GCs –acting as a surrogate for intended parents and carrying a fetus to which the women bear no biological relation.

EMPLOYER AND EMPLOYEE DEMAND CONTINUES TO GROW

Employee loyalty is one of the key benefits of fertility coverage, prompting more companies to answer employer demand for services.

A Fertility IQ study showed some 61% of employees who received the coverage said they felt more loyal and committed to their employer, 73% were more grateful and 53% stayed longer. Fully 88% of women who had their IVF fully paid for by their employer in 2017 returned back to that employer after their maternity leave, according to the index.

For example, Carrot Fertility is a global fertility care platform for women, who are often at the center of fertility care decisions

APRIL 2023 15 Pregnant with Possibilities LEARN | PLAN | SAVE | PROTECT MULTIPLIED RECOVERY DOLLARS SHIFTED FIDUCIARY DUTY www.phiagroup.com | 781-535-5600 | info@phiagroup.com PERFECTED PLAN DOCUMENTS SECURED LEGAL EXPERTISE

Pregnant with Possibilities

and consequences, with services provided to people of every age, race, income, sex, sexual orientation, gender, marital status, and geography.

Carrot Fertility and others say they’ve seen incredible growth in demand for fertility benefits, both from employers and employees.

“In the last year alone, our customer base has doubled from 400 to 800+ customers, covering millions of lives globally, and that’s across all major industries beyond tech to manufacturing, automotive, food and beverage, financial and legal services, entertainment, retail, and more,” says Quinn. “We will continue to see more companies embrace fertility benefits and focus on prioritizing platforms that are inclusive of all people to best support their entire workforce.”

Pam Pure emphasizes that fertility benefits provide a significant role in employees’ overall health and wellbeing, given the significant fertility challenges that factor into a couple’s mental health.

“For our clients, these benefits allow their employees to reach parenthood in a healthier, quicker way, meaning they save healthcare dollars by avoiding unnecessary treatments and reducing costly high-risk pregnancies and NICU stays,” she explains. “In fact, the typical Progyny client will realize 25% to 30% savings compared to a traditional carrier program. With that said, there is a long runway ahead of us to ensure one day these benefits are adopted at the same rate as other necessary benefits, such as vision and dental.”

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel, and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

It is very likely that employers will increasingly offer these opportunities, with reports that companies across industries are already rapidly embracing fertility and family building benefits. Campbell says that her company continues to see exponential growth each year and now partners with over 370 employers across 40+ industries – illustrating that employers have an appetite for this benefit.

16 THE SELF-INSURER

“Knowing they have financial and emotional support throughout their fertility journey goes a long way and provides loyalty to their employer,” she advises. “Additionally, employers are thankful for the opportunity to provide accessible care and fertility benefits to the male partner. And Posterity Health promotes collaborative care working with the OBGYN and REI to make it easy for the couple to determine their best path forward.”

Medical Stop Loss from Berkshire Hathaway Specialty Insurance comes with a professional claims team committed to doing the right thing for our customers – and doing it fast. Our customers know they will be reimbursed rapidly and accurately – with the certainty you would expect from our formidable balance sheet and trusted brand. That’s a policy you can rely on.

www.bhspecialty.com/msl

Reimbursement done right.

The information contained herein is for general informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any product or service. Any description set forth herein does not include all policy terms, conditions and exclusions. Please refer to the actual policy for complete details of coverage and exclusions.

SOURCES

https://www.cnbc.com/2022/03/14/egg-freezing-ivf-surrogacy-fertility-benefitsare-the-new-work-perk.html

https://www.medicaldevice-network.com/features/fertility-tech-in-2023-athome-personalisation-and-accessibility/

https://www.monster.com/career-advice/article/companies-offer-fertilitybenefits-1117

https://fortune.com/2022/03/05/fertility-benefits-are-a-major-weapon-in-thewar-for-talent/

https://www.ypulse.com/newsfeed/2022/04/07/fertility-benefits-are-becominga-popular-work-perk-at-major-u-s-companies/

https://www.wzzm13.com/article/life/wellness/healthy-you/male-infertility-ratescontinue-to-rise/69-e1073f2d-abfd-425a-8a49-0c45a8d62436

https://www.cdc.gov/reproductivehealth/infertility/index.htm

https://resolve.org/

https://fortune.com/well/2022/11/17/business-thriving-surrogates-risksreproductive-ethics-debate-america-carolyn-barber/

https://www.asrm.org/topics/topics-index/gestational-carrier/

https://www.pewresearch.org/fact-tank/2018/07/17/a-third-of-u-s-adults-saythey-have-used-fertility-treatments-or-know-someone-who-has/

https://www.mayoclinic.org/tests-procedures/egg-freezing/about/pac-20384556

https://www.mayoclinic.org/diseases-conditions/female-infertility/diagnosistreatment/drc-20354313

https://www.cnbc.com/2022/05/27/employer-fertility-benefits-are-on-the-riseamid-the-great-resignation.html

https://news.bloomberglaw.com/employee-benefits/workers-would-pay-more-forbetter-retirement-health-benefits

https://www.surveymonkey.com/curiosity/cnbc-workforce-survey-april-2021/

Pregnant with Possibilities

https://www.google.com/ search?q=In+vitro+fertilization+%28IVF%29&rlz=1C1CHBF_enUS850US850&ei=Ix3UY9_3Jeys5NoPreuU0A0&ved=0ahUKEwiflYPNtej8AhVsFlkFHa01BdoQ4dUDCBA&uact=5&oq=In+vitro+fertilization+%28IVF%29&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQAzIFCAAQgAQyBQgAEIAEMgUIABCABDIFCAAQgAQyBQgAEIAEMgUIABCABDIFCAAQhgMyBQgAEIYDSgQIQRgASgQIRhgAUABYtBhg0iloAnABeACAAXWIAXWSAQMwLjGYAQCgAQGgAQKwAQDAAQE&sclient=gws-wiz-serp https://www.gostork.com/?utm_term=infertility%20treatment&utm_ campaign=IVF&utm_source=adwords&utm_medium=ppc&hsa_acc=6494877727&hsa_cam=17876971400&hsa_grp=141975766284&hsa_ ad=617342145758&hsa_src=g&hsa_tgt=kwd-10725740&hsa_kw=infertility%20 treatment&hsa_mt=b&hsa_net=adwords&hsa_ver=3&gclid=EAIaIQobChMIu7X6wtTZ_AIVlM3ICh2WhQsuEAMYASAAEgLVPvD_BwE

18 THE SELF-INSURER

•

•

•

•

•

•

•

•

•

•

INSURANCE SOLUTIONS DESIGNED

YOUR NEEDS Companion Life Insurance Company | 800-753-0404 | CompanionLife.com

FOR

solutions

unique needs.

Companion Life for insurance that works for you:

You deserve more than one-size-fits-all insurance. At Companion Life Insurance Company, we provide personalized service and take the time to really listen. Our relationship with you matters, and we offer custom

designed for your

Choose

Stop Loss Insurance

Limited-Benefit Health Insurance

Term Medical Insurance

Short

Insurance

Group Medical Supplemental

Life Insurance

Dental Insurance

Short Term Disability Insurance

Long Term Disability Insurance

Vision Insurance

Critical Illness Insurance

REMOTE CONTROL

IN-HOME PATIENT CARE AND MONITORING SEEN AS MAJOR STEP FORWARD ON REAPING EFFICIENCIES FROM AN OVERWORKED SYSTEM

GGreater acceptance and use of telehealth will continue to lighten the load of brick-and-mortar office visits and seed deeper operational efficiencies into a system that’s rife with fraud, waste and abuse. However, there are built-in limitations, which are giving way to more of a hybrid approach post-pandemic. The next wave in virtual visits is expected in the form of remote patient care and monitoring.

Written By Bruce Shutan

A need for more meaningful house calls comes amid the convergence of what one industry analyst described as “a growing senior population, explosive Medicare spending and the sickest generation in the history of the U.S.” Fawad Butt, executive in residence at Canvas Ventures who advises startups in the healthcare, data and analytics space, believes the use of technology represents a profound change in that it can address more complex and costly conditions than basic telemedicine appointments.

FEATURE

20 THE SELF-INSURER

But that model is just one aspect of a changing health care ecosystem that also includes remote patient treatment options. As technology continue to advance, opportunities to deliver care efficiencies and improve clinical outcomes will swell for self-insured health plans.

The chief motivator in pursuing more meaningful virtual visits is securing cost-effective solutions built around high-quality care, observes Lois Irwin, president of EZaccessMD. This emerging model allows patients to be seen and treated at their preferred location, which she says is increasingly in the home.

Remote patient care and monitoring has evolved in recent years from addressing simple or minor medical problems for relatively healthy people to a second phase that the pandemic pushed to a peak, according to Keith Algozzine, co-founder and CEO of UCM Digital Health. COVID-19, of course, turned telehealth into the default option for most nonemergency care because hospitals and doctor’s offices were overrun with infected patients.

But it also triggered a mental health and substance abuse crisis that necessitated its expansion into the psychotherapy arena where he saw a disconnect between mind-body treatment. Algozzine notes that siloed mental health providers will treat anxiety indefinitely even when it could be traced to, say, thyroid disease that went undetected and undiagnosed.

U.S. workers who now look to employers to provide a broad suite of virtual care services. Employers have responded in turn and dramatically expanded the scope and scale of services to support employees with chronic condition management, mental health and whole-person primary care.”

As many as 96% of employers surveyed by the Employee Benefit Research Institute adopted predeductible coverage for telehealth services under the CARES Act, while 76% would like to make this provision permanent.

Another strong consideration in the evolution of virtual care is recent government policies supported by SIIA that allow health savings accounts to be used for telehealth, making it easier for patients to access treatment and monitoring remotely.

“It has made a measurable difference,” says Hunter Sinclair, VP of solution strategy at Teladoc Health, “expanding access and enabling better health outcomes. COVID-19 has shifted the expectations for

One development that could slow growth, however, is movement toward payment parity that matches telehealth rates to inperson care. Sinclair is aware of specialized telehealth groups that actually charge more than standard in-person fee schedules and believes that trend will continue. Still, there’s no denying that technology will continue to buttress in-home options.

“Until you’ve actually treated their medical problem, you’re never going to solve it,” he cautions.

APRIL 2023 21 Remote Control

Hunter Sinclair

Keith Algozzine

EARLY ADOPTERS

While remote patient care and monitoring has gained traction in recent years, the concept took root more than a century ago. Irwin says legislation allowing Medicare to reimburse homebound patients for portable X-ray services performed in the home dates back to 1969.

Kim Darling, president of sales for Recuro Health, recalls attending a telemedicine meeting 20 years ago that featured a demo of Costa Rican clinic using TytoCare technology that projected data and imaging to the provider.

The emphasis today is on smartphones, tablets and wearables that can perform a plethora of health measurements, she observes, adding that virtual care automation and artificial intelligence will become more dominant in the face of continued shortages of doctors, nurses and pharmacy staffers.

Kaiser Permanente and the U.S. Department of Veterans Affairs were among the early adopters of remote patient monitoring, Sinclair notes. A significant drop in the cost of cellular technology means more Americans increasingly are going to be using more wearable solutions.

® 22 THE SELF-INSURER Remote Control

“We moved all of our solutions from Bluetooth to cellular so that as soon as someone wants to join remote patient monitoring, they raise their hand and then a device gets shipped to their house,” he says.

PAYMENTS DONE RIGHT Saving our customers over $1B a year. An end-to-end solution tailored to your needs: Contact us to learn more. echohealthinc.com | 440.835.3511 CONNECTION to over 1M+ vendors COMPLIANCE across HIPAA, PCI, OFAC, and IRS 1099 reporting EFFICIENCY that streamlines and reconciles through one system EASE OF USE with quick deployment and training for your team

CRITICAL INSIGHT

The ability to take critical patient information and turn it into insight has scaled dramatically, Sinclair says. If somebody has a stubbornly high A1C or blood pressure, Teladoc suggests they speak with a physician to help understand what’s going on and improve those numbers. Steps may include sending a lab test to the patient’s home or using a continuous glucose monitor and examine the data to see what’s happening in between glucose checks.

Diabetes is fertile ground for remote patient monitoring. The trouble with treating this condition based on a reading at the point of care is that it’s hard to know what triggered blood sugar spikes or drops if, say, the patient’s medication hadn’t worked over several months and needs to be adjusted, explains Lauren Roberson, head of nurse advocacy for Connect Healthcare Collaboration. She says it’s also difficult to secure commitments to keeping a daily food journal.

But remote monitoring devices not only alert providers to what’s going on, she says they also let patients monitor their blood sugar in real time to help better associate their levels with what they just ate.

The onus is no longer on patients who then become more a part of a process wherein they can actually objectively review the decisions that they’re making and the impact on their blood-sugar levels, Roberson notes.

The use of technology has evolved in meaningful ways. “We would go to the patient’s bedside, bring the film back to the office and develop that into an X-ray,” Irwin recalls. “We would drive those films over to the hospital where the radiologist would read them and issue a report. Now all of that is done digitally.”

Irwin and her husband were inspired to start their company after providing mobile X-rays to the University of Rochester Medical Center, which received a Centers for Medicare & Medicaid Services grant in 2009 to study the impact of telemedicine on elderly populations.

As part of that effort, trained technologists were dispatched to a patient’s bedside with a suitcase full of equipment to perform physical exams, lab tests, and order bedside X-rays and ultrasounds as needed. The experience stuck with them.

At the end of five years, there was a 34% reduction in ER transfers from facilities when intensive telemedicine plus a bedside exam was made available to patients. They later realized this model also could greatly benefit 180 million Americans under age 65 who receive employer-provided health insurance coverage.

“As they use the blood pressure cuff the first time or step on the scale, all of that information directly go to us. And then we’re able to use our data science to give real-time feedback to members.”

24 THE SELF-INSURER Remote Control

Lauren Roberson

Lois Irwin

Digital technology is empowering the industry to better drive patient engagement, says Mary O’Connor, M.D., co-founder the chief medical officer of Vori Health. She cites motiontracking home exercise with the camera on a smartphone, laptop or desktop computer replacing the need for strap-on sensors as one such example for treating musculoskeletal conditions.

“Our physical therapists perform a virtual visit with the patient and prescribe a home exercise program on our platform,” she explains. “They receive verbal feedback on whether they are doing the exercises properly

because the camera can track and compute their movement, and the program captures the number of repetitions performed by the patient.”

IMPORTANCE OF ACCESS AND CARE

Remote patient monitoring, while no doubt a powerful tool, has its limitations. “Other than installing the equipment, nobody’s coming to the home to deliver care,” Irwin explains. The key is early intervention, whose savings she says you don’t necessarily see on the ledger.

GPW offers a unique combination of captive and reinsurance management, accounting, tax compliance, and actuarial services all under one roof, providing clients with efficient and comprehensive service. GPW’s team of experts includes credentialed Actuaries, Certified Public Accountants, and Associates of Captive Insurance.

Learn more at www.gpwa.com

GPW and Associates, Inc. 3101 North Central Ave., Suite 400 Phoenix, Arizona 85012 Ph 602.200.6900 Fx 602.200.6901

“The sooner any patient is able to talk with a physician and be diagnosed and get on a treatment plan,” she adds, “the better it is for that course of illness.”

in serving the risk management needs of over 3,600 clients. APRIL 2023 25 Remote Control

Specializing

Before embracing any technological advances with unbridled enthusiasm, some industry observers caution that a deeper perspective is needed to understand where improvements need to be made.

Algozzine says. “They don’t want to feel any tech. They just want it to be convenient. They want it to be as inexpensive as possible. They want it to be as high-quality and personal as possible.” In a nutshell: expanded and affordable access.

An overarching goal with remote patient care and monitoring is to help recast a system that Algozzine describes as “singular point solution driven” and mired in siloed care. Before attempting to remotely measure blood pressure, glucose levels and any other key metrics, he says patients need to know they can connect 24/7 with a team of health care professionals, ask questions and determine whether or not they’re having a medical emergency.

Opening patient homes to care and monitoring could have a significant impact on specialty care. “I have the best coverage any American could have,” Darling admits, “but it takes me five months to see a cardiologist and six months to see a dermatologist where I live in Orange County California. So if it’s happening here you can only imagine what it’s like in more remote places to find pathways for people to get their care.”

RETURN ON INVESTMENT

Darling says there are a plethora of studies suggesting in-home care is better in many instances, noting how hospitals are not only

“Patients don’t need technology, they need care,”

26 THE SELF-INSURER Remote Control

costly but also a dangerous environment prone to infections and medical errors with inadequate levels of personnel.

Citing a 2022 Commonwealth Fund study, she notes that the U.S. has some of the poorest outcomes relative to other nations. They include the lowest rate of practicing physicians and hospital beds per 1,000 population, highest maternal and infant mortality, highest death rates for avoidable or treatable conditions, lowest life expectancy at birth and highest rate of people with multiple chronic conditions in the world. All of these alarming statistics suggest a need to vastly improve clinical outcomes.

Technology obviously can help reduce the amount of care delivered in costly settings by funneling it to the home.

which often results in overutilization and much higher medical bills.

The return on investment for remote patient care and monitoring can be substantial. Using in-person urgent care as an example, Irwin notes how the collateral damage quickly adds up when an employee typically would miss four hours of work, depending on wait times.

With the average hourly wage just north of $30 in the U.S., according to the Bureau of Labor Statistics, any missed work time will hit those households hard. But she says there’s also a steep cost to organizations that might have to pay another employee overtime to fill in for someone who’s absent or hire a temp, plus supervisory time.

If a virtual care visit averages $45 relative to a brick-andmortar doctor visit that ranges from $80 to $125, depending on an individual’s Zip code, Darling says those savings will add up over time. “The math is the same for urgent care and the ER,” she adds.

“When you go to the ER, you are automatically charged a facility fee of $500 to $1,000 or more before you’re even seen by a doctor,” Irwin notes.

“And then you’re charged for a consult with the doctor and testing that’s needed,”

On average, aequum r esolves c laims within 297 days of p lacement aequum has generated a savings of 95.5% off disputed c harges f or s elf-funded pl ans aequum ha s ha ndled claims in all 50 states 297 95.5% 50 No Guarantee of Results – Outcomes depend upon many factors and no attorney can guarantee a particular outcome or similar positive result in any particular case. Protecting plans and patients across the U.S. 1111 Su perior A venue E ast Suite 1360 Cleveland, OH 44114 P 2 16-539-9370 www.aequumhealth. com 28 THE SELF-INSURER Remote Control

One caveat associated with remote patient monitoring is information overload. “If I’m watching my blood pressure 24/7, am I constantly anxious as a patient because now I’m worried?” Algozzine wonders. “That could make me run to the ER more often, potentially because I’m panicked over my blood pressure.”

Noting there’s no one-size-fitsall to offering home care and monitoring, he says the needs of a healthy 20-year-old needs will be wildly different from a 78-year-old female on 10 medications with diabetes, COPD, congestive heart failure and early-onset dementia.

he says. “The person treating the anxiety also knows about the thyroid and will check that. And the person who is monitoring blood pressure and glucose is also able to solve your problem in an instant if you have an emergency, then hold the patient’s hand when that one singular group can’t solve every problem through care coordination and navigation.”

“There’s a reason why ERs, hospitals, long-term care and acute-care facilities are so expensive,” he says. “It’s because they’re designed to save lives. So, when you come to them with something that doesn’t need lifesaving care, you end up essentially paying for the price of readiness and stressing the system.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 30 years.

he explains. While all patients just need their smartphone and access to care, for example, he says only people with hypertension and high blood pressure will need blood pressure cuffs and heart rate monitors. Offering that technology beyond this segment “would be a tremendous waste of resources, money and a valuable clinician’s time,” he adds.

The future of medicine needs to be whole-person care, Algozzine opines.

“You have to start looking at data and breaking it down based on segments,”

“You have to be able to triage them, then you’d be able to actually provide both the acute care and longitudinal care in a team-based approach,”

APRIL 2023 29 Remote Control

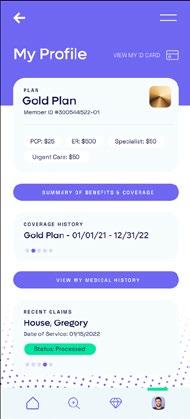

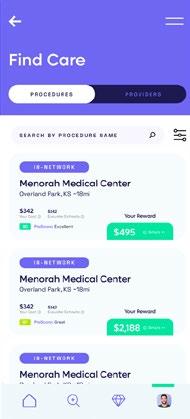

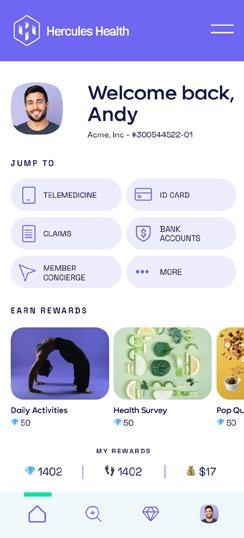

Bringing the Power of Consumerism to Healthcare

A first-of-its-kind healthcare SuperApp for self-funded plan sponsors that helps members make better decisions around quality medical care delivery, so everyone wins.

The only self-funded healthcare engagement platform of its kind.

Hercules Health rewards habitual app utilization by giving cash incentives earned through intelligent healthcare shopping tied to quality and cost. More app use equals more savings for members and plan sponsors alike.

Comprehensive Compliance

Hercules Health delivers best-in-class price transparency that is fully compliant with the Transparency in Coverage (TiC) and the No Surprises Act (NSA) rules and regulations.

Contact us today.

info@herculeshealth.com herculeshealth.com

ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES: PRACTICAL Q & A

Q & A

TheAffordable Care Act (ACA), the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and other federal health benefit mandates (e.g., the Mental Health Parity Act, the Newborns and Mothers Health Protection Act, and the Women’s Health and Cancer Rights Act) dramatically impact the administration of self-insured health plans. This monthly column provides practical answers to administration questions and current guidance on ACA, HIPAA and other federal benefit mandates.

Attorneys John R. Hickman, Ashley Gillihan, Carolyn Smith, Ken Johnson, Amy Heppner, and Laurie Kirkwood provide the answers in this column. Mr. Hickman is partner in charge of the Health Benefits Practice with Alston & Bird, LLP, an Atlanta, New York, Los Angeles, Charlotte, Dallas and Washington, D.C. law firm. Ashley, Carolyn, Ken, Amy, and Laurie are senior members in the Health Benefits Practice. Answers are provided as general guidance on the subjects covered in the question and are not provided as legal advice to the questioner’s situation. Any legal issues should be reviewed by your legal counsel to apply the law to the particular facts of your situation. Readers are encouraged to send questions by E-MAIL to Mr. Hickman at john.hickman@alston.com.

APRIL 2023 31

BREAKING UP IS HARD TO DO: THE END OF THE COVID MANDATES AND OUTBREAK PERIOD EXTENSIONS

On January 30, 2023, the White House announced that both the national emergency and the public health emergency would officially be over as of May 11, 2023. For group health plans, this means an end to several temporary changes that plan sponsors and group health plans were required to make in response to the COVID pandemic, and the beginning of a transition back to pre-pandemic benefits and administration.

Generally, there are two sets of issues that plan sponsors and TPAs need to address in preparation for the transition.

The first issue involves certain benefits, including mandatory benefits like COVID testing and vaccines, and optional benefits like telehealth and EAPs.

The second issue involves the tolling period, known as the “Outbreak Period,” for certain deadlines under all ERISA plans (not just group health plans). We look at each in turn, with added practice pointers to assist with planning.

MANDATES AND OTHER RELIEF THAT END AS OF MAY 11, 2023

As of May 11, 2023, group health plans are no longer required to cover certain benefits that were mandated in response to the pandemic. COVID tests, both prescribed and over-the-counter, and out-of-network COVID vaccines no longer have to be covered without cost-sharing after May 11, 2023.

Plan sponsors can continue to cover some or all of these benefits with cost-sharing, prior authorization, or some other medical management requirement.

HPI delivers:

Helping our members seek what matters—care that’s high-quality and cost-effective

• Healthcare navigation tools

• Full-service concierge

• Clinical management

• Scalable, custom plan designs and network options

• Pharmacy benefit integration

• Ancillary benefit administration

Partnering with leading healthcare navigation solutions:

• Preferred A-rated reinsurance carrier relationships

See what sets us apart from other third-party administrators.

hpiTPA.com

32 THE SELF-INSURER

In the case of OTC COVID tests, if plan sponsors wish to continue coverage, the direct coverage safe harbor no longer needs to be satisfied in order to apply a cost-sharing cap for OTC COVID test purchased at non-preferred providers, and the $12 reimbursement limit can be adjusted.

Also, the 8 tests per person/per month limit can be adjusted for OTC COVID tests from network and non-preferred providers. Note that coverage for innetwork COVID vaccines must continue without cost-sharing for non-grandfathered plans under Affordable Care Act (ACA) preventive services requirements.

Also, the IRS will continue to recognize personal protective equipment, or PPE, as a qualified medical expense, so health FSAs and HRAs that allow reimbursement for all qualifying §213(d) medical expenses will continue to reimburse claims for PPE.

Other benefits that were permitted but not required during the emergency periods include stand-alone telehealth for employees who are not eligible for the major medical group health plan of their large employer.

The relief for these stand-alone plans from most ACA mandates continues until the end of any plan year that begins on or before May 11, 2023, unless extended by future legislation or guidance. Other relief includes allowing COVID diagnosing, testing, and vaccines though an EAP while permitting the EAP to maintain status as an “excepted benefit.”

Currently, there is no clear guidance on whether EAPs can continue to provide these benefits and still maintain status as an excepted benefit after May 11, 2023. In the absence of further guidance, plan sponsors will need to weigh the risk of noncompliance with continuing to provide this benefit through the EAP until the end of the plan year.

APRIL 2023 33

PRACTICE POINTER:

For plan sponsors that wish to end coverage for some or all of these benefits, consider the projected cost to the plan for continuing these benefits through the end of the plan year and whether continuing the benefits would be preferable to making a mid-year change. If continuing coverage until the end of the plan year is preferable, plan sponsors of self-insured plans should discuss this decision with their stop-loss carriers. If making a mid-year change is preferable, plan sponsors need to ensure that notice is properly provided to participants. Additional relief regarding notice of reversal was announced by the agencies (see below). Plan sponsors may also need to amend their plan documents.

RELIEF FOR ADVANCE NOTICE OF COVERAGE REVERSAL

With the emergencies ending May 11, 2023, plan sponsors that choose to cease covering benefits that are no longer mandatory after that date may not have time to provide the advance notice required for material changes.

The agencies provided relief in 2020 and 2021 through FAQs Part 42 and Part 44 that initially allowed plan sponsors to provide notice of added or increased benefits for COVID diagnosis, treatment, or preventive services as soon as administratively feasible rather than 60 days in advance.

FAQs Part 43 states that once the federal emergencies end, plan sponsors (and issuers) that choose to reverse these changes will be considered to have satisfied the advance notice obligation for material modifications if the plan sponsor (or issuer) either (i) previously notified participants of the general duration of the additional benefits

Simple. Transparent. Versatile.

At Meritain Health®, our goal is simple—take a creative approach to health care and build industry-leading connections. Whether you're building an employee bene�ts program, researching your member bene�ts or o�ering support to your patients, we're ready to help you do more with your health plan.

Learn more at www.meritain.com.

Follow us:

34 THE SELF-INSURER

Meritain Health is an independent subsidiary of Aetna and CVS, and one of the nation’s largest employee bene�ts administrators.1 We are uniquely positioned to enable our customers to combine our �exible plan administration, products and external point solutions with the right resources from parent companies Aetna and CVS. 1. Business Insurance; Largest Employee Bene�t TPAs (as ranked by 2019 bene�ts claims revenue); May 2020.

coverage or reduced cost-sharing, or (ii) notified participants within a reasonable time in advance of the reversal of the changes. Note that plan sponsors that choose to continue providing these benefits must comply with applicable requirements to update plan documents or terms of coverage.

PRACTICE POINTER:

Plan sponsors and their TPAs should review all plan communication related to announcements about coverage for COVID diagnosis, treatment, and preventive services to confirm whether the duration of the expanded benefit (i.e., until the end of the emergency) was clearly communicated. If it was not, then then participants need to be notified within a “reasonable time” in advance of the reversal. These plan sponsors will need to evaluate the reasonableness of providing a notice that is less than 60 days in advance of a reversal. Even if adequate notice of the duration was provided in prior notices, a best practice would be to provide a reminder of the upcoming end date.

SPECIAL ISSUES FOR HDHPS AND HSAS

Health Savings Accounts

(HSAs) will also encounter transition issues, although these issues are not as closely tied to the expiration of the national emergency or public health emergency.

Generally, pre-deductible coverage can disqualify a person from being eligible to participant in an HSA, but guidance and legislation announced in response to the pandemic provided some relief. IRS Notice 2020-15 allows HDHPs to cover COVID testing before the deductible without disqualifying HSA eligibility, and this remains in effect until the IRS modifies or updates this guidance, regardless of the date that the emergency periods end.

Also, the Coronavirus Aid, Relief, and Economic Security (CARES) Act permitted HDHPs to cover pre-deductible telehealth and other remote services offered through the HDHP without disqualifying a person from HSA participation.

This original relief expired December 31, 2022, regardless of plan year. Although the relief was most recently extended in December 2022 by the Consolidated Appropriations Act, 2023, this extension applies only to plan years starting on or after January 1, 2023 and before January 1, 2025.

Relief for non-calendar year plans expired on December 31, 2022, and no relief is available in 2023 for non-calendar year plans until the beginning of the 2023 plan year. For example, this relief for a plan year that began on July 1, 2022 expired on December 1, 2022, and will not apply to this plan until its 2023 plan year begins on July 1, 2023.

SPECIAL ISSUES FOR MHPAEA QTLS

In light of the mandates on group health plans to cover COVID diagnostic testing, the agencies announced enforcement relief for the quantitative treatment limitation requirements under the Mental Health Parity and Addiction Equity Act (MHPAEA).

For purposes of compliance with the “substantially all” and “predominant” tests for financial requirements and quantitative treatment limitations, no enforcement action will be taken against any plan or insurer that disregards benefits for the items and services that are covered without cost-sharing as required by the Families First Coronavirus Response Act (FFCRA).

The relief was intended to be temporary and applies to the COVID diagnostic testing mandated by FFCRA, which is tied to the public health emergency.

Presumably this non-enforcement protection also ends on May 11, 2023, and while (depending on QTL testing results) plan changes may not be required in all cases, any non-mandated COVID coverage must be taken into account for QTL testing.

APRIL 2023 35

OUTBREAK PERIOD TRANSITION OF TOLLING PERIODS

During the national emergency, certain deadlines for ERISA plans were extended by disregarding the “Outbreak Period.”

The Outbreak Period began on March 1, 2020 and will end 60 days after the end of the national emergency. For purposes of determining certain periods and dates related to events that occur during the Outbreak Period, ERISA plans must disregard a portion of the Outbreak Period that is the lesser of (i) one year after the otherwise applicable triggering event date (the “one-year rule”) or (ii) 60 days after the end of the national emergency (i.e., May 11, 2023), which is July 10, 2023.

The following periods and dates are affected by the Outbreak Period extensions:

• Furnishing COBRA election notice

• COBRA election period

• COBRA premium payment (initial payments and monthly payments)

• COBRA notice period for second qualifying events and determinations of disability

• Claims and appeals (for all ERISA plans), including for health FSAs and HRAs (note that dependent care FSAs and HSAs are not ERISA plans)

• External review requests and filing a perfection of a request

• HIPAA special enrollment request

Prior to the announcement of the end of the national emergency, the one-year rule was the only rule that plan sponsors and TPAs needed to apply. Now that the end of the national emergency is fixed at May 11, 2023, the portion of the Outbreak Period that is to be disregarded will be cut off at July 10, 2023.

Example: Mary is a participant in a group health plan. On March 1, 2023, Mary received medical treatment for a condition covered under the plan, but a claim relating to the medical treatment was not submitted until April 1, 2024. Under the plan, claims must be submitted within 365 days of the participant’s receipt of the medical treatment. Was Mary’s claim timely?

Conclusion: Yes. For purposes of determining the 365-day period applicable to Mary’s claim, the Outbreak Period is disregarded. Under these facts, the disregarded period is March 1, 2023 through July 10, 2023. Therefore, Mary’s last day to submit a claim is 365 days after July 10, 2023, which is July 10, 2024, so Mary’s claim was timely.

A general rule of thumb here is that events occurring on or before July 10, 2022 will be subject to the one-year rule, while events that occur on or after July 11, 2022 and before July 11, 2023 will generally use July 11, 2023 as “day 1” for purposes of determining an applicable time period.

For plan sponsors that did not provide the COBRA election notice to qualified beneficiaries within the usual, non-Outbreak Period timeframe, calculating deadlines for COBRA elections will be more complicated.

Also, there is some uncertainty regarding the special COBRA premium rule involving COBRA elections that are made outside the initial 60-day election period but within the Outbreak Period extension, as well as the deadline for COBRA monthly premiums.

36 THE SELF-INSURER

Less is more.

We need only one word to describe how our culture of innovation leads us to handle the complexities of healthcare. Through a single platform, we deliver transformative models of care that de-clutter the member health journey while maximizing savings for the plan sponsor.

Driven by data, we provide clarity into the right decisions to simplify the complex. That’s why our customers choose Valenz and why they stay with us. It’s our culture that makes us different, which is why we wear it on our sleeves.

Simplify

how Valenz delivers smarter, better, faster healthcare by keeping it simple

valenzhealth.com or call (866) 762-4455.

Diamond Member

See

in a complex world: visit

Proud to be a

PRACTICE POINTER:

As a best practice, plan sponsors and TPAs should prepare reminder communications to explain deadlines to prevent participants and enrollees from missing crucial deadlines. This includes reminders about the tolling of the Outbreak Period for qualified beneficiaries, including those who have not yet elected COBRA but who will still have an opportunity to elect COBRA after July 10, 2023 as a result of the Outbreak Period extension.

ACTION ITEMS

Plan sponsors and TPAs should begin planning for transition by:

• Determining whether to continue providing benefits that are no longer mandatory after May 11, 2023

• Review COVID communications to determine whether duration of increased benefit was clearly stated

• Prepare reminders for end dates of certain benefits (if applicable)

• Communicate upcoming deadlines related to the end of the Outbreak Period to participants/enrollees

• Update SPDs and amend plan documents (if applicable)

38 THE SELF-INSURER

CAPTIVE FORMATIONS RISE AS INSURANCE MARKET HARDENS

Written By Caroline McDonald

TThe current economy’s rise and fall has meant accelerated risks for businesses., including supply chain disruption, workplace staffing issues and cyber hacks; and massive property and infrastructure damage caused by storms, floods and wildfires.

As a result, the insurance market is hardening across a diverse and increasing set of risk areas.

This market, as well as a variety of emerging risk, has meant accelerated growth of captives, as well as a normalization of the concept of captive insurance in general. This evolution has increased the need for captives as an economical way to fill coverage gaps and add control and flexibility to the management of difficult risks.

40 THE SELF-INSURER

We Know... Risk

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 45 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

Visit us online at tmhcc.com/life Tokio Marine HCC - Stop Loss Group A member of the Tokio Marine HCC Group of Companies TMHCC1185 - 04/2023

HCC Life Insurance Company operating as Tokio Marine HCC - Stop Loss Group

said Jason Tyson, communications director of the North Carolina Department of Insurance.

He added, “All indications signify that 2023 will be another year of growth for North Carolina’s captive insurance industry, as companies of all sizes seek increased flexibility and lower costs while managing their risk profiles in the hardening market.”

Vermont, the largest domicile in the U.S., said in a statement, “The growth in captive formations in 2022 is Vermont’s 6th highest year of growth in its over 40-year history since passing captive-enabling legislation in 1981.”

Joe Holahan, partner at Morris, Manning & Martin, LLP, and president of the Captive Insurance Council of the District of Columbia noted that D.C. licensed 25 captives in 2022, “Which was a fairly big year for D.C.” He added, “We’ve formed five captives, so we’re looking good for 2023.”

CELL CAPTIVES TAKING OFF

Cell captives top the list of new formations across a number of domiciles, which have increased in popularity for several reasons.

“There are a few things going on with them,” Holahan said. “One is with new formations. Owners see joining an existing cell facility as being the convenient way to get the captive up-and-running.”

“The continued hardening market and investment volatility has helped propel an interest from businesses of all sizes in leveraging captives to insure many types of coverages, as a solution to risk management needs for controlling costs and providing customization of coverages,”

42 THE SELF-INSURER

He is also seeing clients opting to form a cell captive, “even when they don’t have an immediate need for a cell, with the idea that they may have some plans in the future to form cells for different purposes. It allows a level of versatility that is attractive to them,” Holahan said.

Being with a sponsored facility, he explained, “is a turnkey solution for services. You have an auditor lined up for your annual audit, and actuarial support to prepare an annual actuarial opinion. Everything is wrapped into a convenient package.”

Tennessee is seeing is a big interest in cell structures as well.

“This structure can be used as a cost savings method and to fill gaps in coverage, while creating value for businesses that maintain strong loss-prevention programs.”

Looking ahead, Tyson said,

Mark Wiedeman, director of the Tennessee Department of Commerce and Insurance’s captive insurance sector.

Similarly, Vermont said its 59 sponsored cell captives currently host more than 500 cells and separate accounts, in addition to the licensed captive companies.

In North Carolina, the Department of Insurance approved more than 100 cell captives in 2022, “and we anticipate the trend of new cell formations to carry through 2023,” Tyson noted.

GROWING USES FOR CAPTIVES

One risk that is increasing the formation of captives is cyber insurance. “There is interest in using a captive because that market has turned very hard,” Holahan explained. “Insureds are keeping larger and larger retentions, so that is driving a lot of interest in using a captive to finance that self-insured risk.”

Another reason, he said, is “a shakeout in the market in the last few years, when ransomware attacks exploded, which put a lot of pressure on capacity and rates in the cyber insurance market.”

As of January 2022, Vermont stated new captives were licensed in 17 different industries, the top three being healthcare (7), construction (5), and real estate (4).

In North Carolina, “We have recently seen an uptick in captives writing medical stop loss, tenant liability, and various cyber security coverages,” Tyson said.

FEDERAL OVERSIGHT

In Montana, “We’re still seeing some 831(b) captives, but we’ve also seen a lot of 831(b) captives dissolve, which I believe is from increased scrutiny of the Internal Revenue Service.” The IRS keeps a watchful eye on 831(b) captives, “because of a few captives in the past that were formed for purposes other than insurance, such as trusts,” said John Huth, chairperson of the Montana Captive Insurance Association and an independent captive director.

“We are coming close to our 1,000th captive, and a good number of those are cell entities,”

observed

“All indications signify that 2023 will be another year of growth for North Carolina’s captive insurance industry, as companies of all sizes seek increased flexibility and lower costs while managing their risk profiles in the hardening market.”

APRIL 2023 43

Wiedeman said that on the federal level, Tennessee keeps track of IRS guidance and rulings that could impact captives. From a state perspective, he added, a captive’s tax status is not regulated.

In D.C., “We’re always talking with the insurance department here about ways to improve the authorizing legislation for captives, but it’s extremely flexible now,” Holahan said. He added that if there are allowances in other jurisdictions, “the department has the discretion to allow those things in D.C. It gives regulators a lot of flexibility.”

TRENDS

As for trends, “One that I have seen is more and more insuretech industries interested in forming a captive, particularly an agency captive,” Holahan said. The driver there is, “if it’s a managing general agent, it helps attract the capacity if they take the risk in their own captive program.” Taking the risk shows that,

“They believe in their underwriting model and they’re willing to take on risk for the program, which is attractive to insurers, reinsurers and investors.”

Insurtech can mean a number of things, but in this context, he explained, it refers to a group that has automated or may be using various technologies to improve their underwriting process. It can be used to process claims, evaluate risk, process contracts, or underwrite policies.

“I’ve seen more and more insuretechs form captives because it allows them to capture some of the underwriting profit that they’re writing, and it makes for a compelling case when they are pitching new partners,” Holahan said.

All in all, if 2022 is any indicator, 2023 will be a continuance of the upward trend of captive formations.

RBP MVP Standout savings, support and quality. imagine360.com Your health plan can do better. We promise.

THE

44 THE SELF-INSURER

In addition to claims and benefits administration, we offer pharmacy benefit management, health and wellness programs and stop-loss insurance, all backed by a dedicated in-house customer support team.

We simplify health benefits administration. Contact us today! 866.930.PCMI quotes@pinnacletpa.com www.pinnacletpa.com Pinnacle Claims Management understands the importance of providing affordable and comprehensive benefit solutions for employers, employees and their families. As a leading third-party administrator for self-funded employers, we’re committed to maximizing your health plan savings with innovative, customizable and cost-saving solutions that will

for your

make the biggest impact

employees.

DOMICILES SEEING CONTINUED GROWTH IN 2022

Captive growth over the past year has been reported in a number of domiciles, including the following:

• Vermont had 620 captives in 2021 and licensed 41 new captive insurance companies in 2022.

• North Carolina’s total was 257 captives in 2021 and that number reached 294 by the end of 2022.

• In Montana, growth has been steady, with 261 captives in 2021 and 268 by the end of 2022.

• The District of Columbia had a total of 175 active captives at year-end 2021. It licensed 25 new captives in 2022 and terminated 9, for a net increase of 16 active captives totaling 191 in 2022.

• In Tennessee the 2021 total was 148 captives. In 2022 there were 13 new captives and 11 surrendered licenses, for a year-end total of 150.

• Utah had 384 formations in 2021 and 419 in 2022.

• Hawaii saw 251 total formations in 2021 and 255 in 2022.

• South Carolina totaled 181 formations in 2021 and 208 in 2022.

46 THE SELF-INSURER

Ringmaster Technologies’ pharmacy consulting platform presented by its wholly owned subsidiary, “Ringmaster Rx”, is a huge win for Brokers, TPAs, and PBMs (pharmacy benefits managers). Its cloudbased data warehouse integrated with a RFP workflow process gives clients the ability to:

• Solicit, Compare and Award PBM Contracts and Programs

• Perform contract reconciliations & audits on contract performance

• Deliver sophisticated analytics and generate value added reports

• Customize their own panel of preferred PBM’s

• Efficiently manage cost for their employer groups

330.648.3700 • rmtsales@ringmastertech.com • www.ringmastertech.com So, Step Into the Ring and Start Utilizing the Ringmaster Rx Pharmacy Consulting Platform to Realize the Possibilities. INTRODUCING the first pharmacy consulting platform for self-funded experts. Interpreting and comparing PBM responses just got faster, easier, and more dynamic!

ELI LILLY CAPS INSULIN COST

Written By David Ostrowsky

DDuring his State of the Union speech last month, President Joe Biden called for the out-of-pocket cost for insulin to be capped at $35.

It turns out that at least one drugmaker was listening.

On March 1, Eli Lilly, a pharmaceutical company with vast global reach, announced that it was indeed capping the out-of-pocket cost of its insulin at $35 a month—in addition to slashing the price of its two highest-selling insulin products, Humalog and Humulin, by 70%—and thus falling in line with a provision in the recently passed Inflation Reduction Act, which ensured that seniors enrolled in Medicare pay no more than $35 per month for insulin.

Eli Lilly’s announcement made for above the fold news because now some individuals with private insurance—and not just Medicare recipients—would reap the considerable benefits of a $35 cap. For those without insurance, they too can pay just $35 per month by downloading Eli Lilly’s Insulin Value Program savings card.

48 THE SELF-INSURER

The costs of insulin, a lifesaving drug for millions of Americans (the American Diabetes Association estimates that 8.4 million Americans who are diabetic rely on insulin), remain exorbitantly high, at least compared to the medication’s price tag in other countries where their respective governments negotiate prices directly with drug manufacturers.

Case in point: a 2020 Rand study revealed that the average price per vial of insulin in the US was over $98 in 2018; in Australia, Canada, and the UK, the prices for a vial of insulin were approximately $7, $12, and $8, respectively.

Hopefully, Eli Lilly taking the initiative to help rectify this systemic problem will motivate America’s two other primary insulin manufacturers, Novo Nordisk and Sanofi, to follow a similar course of action.

“While the current healthcare system provides access to insulin for most people with diabetes, it still does not provide affordable insulin for everyone and that needs to change,”remarked Eli Lilly’s Chair and CEO David A. Ricks in a company-issued press release. “The aggressive price cuts we’re announcing today should make a

real difference for Americans with diabetes…for the past century, Lilly has focused on inventing new and improved insulins and other medicines that address the impact of diabetes and improve patient outcomes. Our work to discover new and better treatments is far from over. We won't stop until all people with diabetes are in control of their disease and can get the insulin they need.”

Tragically, for decades now, millions haven’t been able to get the requisite amounts of insulin they need because of the runaway prices charged for the medication that in its absence can lead to death or, at the very

APRIL 2023 49 Trust 16+ Years of Cost Containment Experience sales@amps.com www.amps.com

least, severe health consequences including kidney failure and amputation.

In fact, for many Americans living with diabetes, the annual cost to obtain life-saving insulin can well exceed $1,000. As such, it comes as little surprise that, per a report released earlier this month by “PBS News Hour,” among the millions of diabetic Americans, approximately 1.3 million are either uninsured or have subpar insurance and are thus forced to ration their insulin in order to pay other bills … ultimately to jeopardize their ability to survive.

Undoubtedly, Eli Lilly has been a chief culprit behind such escalating prices, as evidenced by

the fact that for the past nearly 30 years, the publicly traded company has increased the list price of its most popular insulin product, Humalog, by more than tenfold.

And while the announcement that Eli Lilly will not only enact the $35 price cap but also plans to lower the list prices of Humalog and Humulin by 70 percent in the last quarter of 2023 and reduce its generic lispro’s list price from $126 to $25 per vial appears promising, diabetic Americans and lobbyists clamoring for price regulation still face significant headwinds in their campaign to reduce costs for an injection that millions take to stabilize their blood sugar levels.

For one, the reduced list prices, which will take effect over the course of 2023, are only applicable to Lilly’s older insulin products. (One of the company’s newer Humalog products, a prefilled insulin pen, will still cost $530 while its long-acting insulin product, Basaglar, first approved in 2015, will not become more affordable.)

Meanwhile, Lilly’s new list price for a vial of Humalog ($66) still exceeds triple the amount which the company charged for the product when it was brought to market in 1996. And perhaps most significantly, Lilly’s list-price cuts won’t necessarily translate to all

50 THE SELF-INSURER

diabetic patients enjoying a corresponding reduction in their out-ofpocket costs for insulin as many insured people pay fixed monthly copays that will continue to be static.

As Elizabeth Pfiester, who has diabetes and is the executive director of T1International, a group that has been advocating for a federal ceiling on insulin list prices, told the New York Times, Lilly’s announcement