23 NATIONAL CONFERENCE\OCT. 8-10, 2023\PHX A SIPC PUBLIC A TION SIPCONL I NE.N E T OCTOBER 2023

Get the peace of mind and support it takes to self-fund your healthcare.

Self-insuring your healthcare benefits can open up new possibilities for your business — affording you greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your team and assets:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

• Special Risk Accident

We’ll find the right answers together, so you can stay focused on your future.

New captive offerings now available!

Chat with us about how leveraging captives can help your business reduce healthcare costs.

Matthew Drakeley Vice President, Specialty Markets

Matthew Drakeley Vice President, Specialty Markets

QBE and the links logo are registered service marks of QBE Insurance Group Limited. ©2023 QBE Holdings, Inc. This literature is descriptive only. Actual coverage is subject to the terms, conditions, limitations and exclusions of the policy as issued. Crop Specialty Commercial

We’ll focus on risk, so

take

of

Accident & Health Market Report 2023 Visit qbe.com/us/ah

you can

care

your business Accident & Health Insurance

4 SIIA ENDEAVORS: ON THE RECORD WITH SIIA PRESIDENT & CEO MIKE FERGUSON

13 ELATION AND FEAR OVER AI FROM MUNDANE TO CREATIVE TASKS, ARTIFICIAL INTELLIGENCE IS REVOLUTIONIZING SELF-INSURANCE, BUT CONCERN PERSISTS ABOUT VEERING OFF COURSE, THE IMPACT ON JOBS AND CYBERSECURITY

By Bruce Shutan

By Bruce Shutan

49 ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES

THE AFFORDABLE CARE ACT (ACA), THE HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA) AND OTHER FEDERAL HEALTH BENEFIT MANDATES

66 NEWS FROM SIIA MEMBERS

The Self-Insurer (ISSN 10913815) is published monthly by Self-Insurers’ Publishing Corp. (SIPC). Postmaster: Send address changes to The Self-Insurer Editorial and Advertising Office, P.O. Box 1237, Simpsonville, SC 29681,(888) 394-5688

PUBLISHING DIRECTOR Erica Massey, SENIOR EDITOR Gretchen Grote, CONTRIBUTING EDITORS Mike Ferguson and Ryan Work, DIRECTOR OF ADVERTISING Shane Byars, EDITORIAL ADVISOR Bruce Shutan, 2023 Self-Insurers’ Publishing Corp. Officers James A. Kinder, CEO/Chairman, Erica M. Massey, President, Lynne Bolduc, Esq. Secretary

OCTOBER 2023 VOL 180 WWW.SIPCONLINE.NET OCTOBER 2023 3

TABLE OF CONTENTS

FEATURES

ARTICLES

43 NAVIGATING COVERAGE FOR WEIGHT LOSS MEDICATIONS 22

PAIN POINTS

EMPLOYERS 35 COSTLY WEATHER EVENTS FUEL CAPTIVE INTEREST

SPECIALTY PHARMACEUTICALS REMEDY

FOR SELF-INSURED

SIIA ENDEAVORS

ON THE RECORD WITH SIIA PRESIDENT & CEO

MIKE FERGUSON

TheTSelf-Insurer Editor Gretchen Grote sat down with SIIA President & CEO Mike Ferguson for a wide-ranging interview to talk about how the association continues to evolve and play an increasingly important role in helping its members be successful in the self-insurance marketplace.

ENDEAVORS

Mike Ferguson, SIIA President & CEO

4 THE SELF-INSURER

GG: Now that we are in the fourth quarter, how would you describe the year SIIA has been having so far?

MF: I am very pleased with how 2023 has been playing out from a SIIA leadership perspective. We had great participation in each of our in-person events as well as webinars for the first half the year, which is a great indicator of the vibrancy of any organization.

The association’s volunteer committees and task forces also met regularly to work on a variety of projects in support of SIIA’s mission to protect and promote the business interests of companies involved in the self-insurance/captive industry.

Of course, we always look at membership numbers as an important datapoint and I am pleased to report that the trend lines continue to be positive with new members being added every month. And these new members represent every segment of our industry.

GG: Since this is the National Conference edition of the magazine, would you like to highlight anything in particular about this event?

MF: Well first, we are excited to be back at the JW Marriott Desert Ridge, which is a favorite location with our members based on feedback received.

As we talk here today, the registration numbers look very strong so it’s possible that this year’s conference will be the biggest SIIA event ever.

But regardless of the final attendee count, our team has put together a really great program, combining top-notch educational content with multiple networking events.

We are particularly looking forward to the keynote presentation by Futurist Mike Walsh who will be talking about how we should be preparing our businesses to take advantage of the latest advancements in artificial intelligence. And of course, we have another great conference party planned to cap everything off.

GG: How has SIIA’s educational event strategy evolved and what should members expect for 2024?

MF: Over the last three years, we have identified opportunities to

develop targeted educational content and related networking environments that provide value to our members and created new events to deliver this value.

These events have included the Health Price Transparency Forum, Future Leaders Forum and Corporate Growth Forum. All had year-over-year attendance growth in 2023 and will be back on the calendar for 2024.

Our inaugural Cell & Gene Therapy Stakeholder Forum was so popular this year that it was actually sold out, so it will also be back next year with more space! Consistent with this successful approach, we have created yet another new event for 2024 focused on Artificial Intelligence, which we believe will be very well-attended. AI is coming to every other industry so we shouldn’t expect to be an exception.

Finally, we are exploring the possibility of bringing back our International Conference for later next year for those companies looking outside the United States for business development opportunities and risk management solutions.

We are planning for a very busy year so please be on the lookout for an event calendar, which will be published soon if not already.

ENDEAVORS

OCTOBER 2023 5

Is your payments solution delivering more to your bottom line? Expect more with ECHO® echohealthinc.com

GG: SIIA has had a busy and successful year on the advocacy and policy front. What should members know and how can they engage?

MF: This year has been extraordinarily busy, and SIIA continues to be at the forefront of educating, protecting, and growing our industry before policymakers and regulators.

On the federal side, we were able to pass the Self-Insurance Protection Act in the U.S. House and continue to help forge legislation to increase price transparency and bring more clarity and data sharing to the Gag Clause provision.

Bringing sunlight to these areas of healthcare costs leads to successful and affordable selfinsured plans for employers and plan participants. On the regulatory side, we have filed

comments on captive insurance regulation, in addition to engaging in current proposals related to health insurance and mental health.

On the state side, SIIA was successful in pushing back on stop-loss regulation in Rhode Island, a small group prohibition proposal in New Jersey, and engaged in Nevada as the regulators there crafted a new small group regulation.

SIIA member engagement starts with communication and education, in addition to participation in the Self-Insurance Political Action Committee. Members communicating with the SIIA team, and with policymakers and educators, about not only the role our industry plays, but the opportunities and challenges that are before us is essential. Education, relationships, and ongoing communication are the foundation of a strong advocacy platform.

GG: Let’s talk more about SIPAC. You have commented publicly on several occasions about how important it is for SIIA to become more of a major player in terms of political contributions. Can you elaborate a bit on why this should be such a priority and give any progress that has been made to move in this direction?

MF: I have been saying this for the past several years and this objective has continued to move up the list of association priorities.

There are two primary reasons for this emphasis, with the one reason being fairly obvious for most members, with the second reason less

Subrogation Management

At Davies, we provide thorough investigations and subrogation support specifically tailored to all classes and entities within the insurance sector.

Reach out for more information on how we can help your insurance business.

Marie Noble, MBA, AIC VP of Subrogation Management Marie.Noble@us.davies-group.com

Marie Noble, MBA, AIC VP of Subrogation Management Marie.Noble@us.davies-group.com

davies-group.com/us

ENDEAVORS OCTOBER 2023 7

Complete, customizable TPA solutions

From locally-focused to national-scale programs, AmeriHealth Administrators offers a full spectrum of third-party administration and business process outsourcing services. Our scalable capabilities service many unique customers, including self-funded employers, Tribal nations, international travelers, and labor organizations.

We offer innovative solutions, insight, and expertise to help you manage your health plan and capabilities, control costs, and support employees’ health.

Visit amerihealth.com/tpa

to learn more about how we can work with you.

obvious for those who are not creatures of the DC lobbying world.

The obvious reason, of course, is that it is much easier to make and keep friends on Capitol Hill if you provide financial support for their campaigns. This does not mean that if you contribute to a specific member of Congress that they are certain to vote a specific way, but it’s certainly easier to get a meeting with the member and/or their senior staff to explain your issues.

Not so obvious to those outside the beltway is that when an organization establishes itself as a political financial player, it raises your “street cred,” so to speak, with other important organizations in town that we may need to partner with on various lobbying efforts.

Our progress has been somewhat slow but steady since we established the Self-Insurance Political Action Committee (SIPAC) about eight years ago as a vehicle for SIIA members to channel political contributions to key members of Congress.

Things have accelerated over the past few years thanks to this more dedicated focus, combined with increased staffing resources, and you are now starting to see SIIA really establishing itself as a money player in DC.

Obviously, we are not the biggest name by any means, but it’s solid progress that has already directly complimented advocacy efforts and we expect even more positive results after the upcoming election.

GG: I very recently have seen that SIIA has participated in several important court victories. What do those mean and what should members know?

MF: SIIA has a long history leading and participating in larger coalition efforts on the legal front to support our members. We couldn’t do this without the association’s Legal Defense Fund (LDF), which in turn is funded by voluntary contributions from our members.

This year alone, SIIA has participated in four separate amicus filings related to surprise medical billing, seeking to ensure that the negotiation and arbitration process is fair for patients and plans. The legal fight over the No Surprises Act is ongoing, but it’s an important one in the face of legislative uncertainty.

More recently, multiple states have undertaken efforts to erode ERISA’s preemption powers through PBM legislation enacted in the wake of the U.S. Supreme Court’s Rutledge decision.

Just a few weeks ago, the 10th Circuit Court agreed with an amicus that SIIA participated in, finding that an Oklahoma PBM law restricted a selfinsured plan sponsor’s ability to develop provider networks and other value-based plan designs intended to lower costs.

SIIA continues to be active in supporting ERISA preemption legislatively, as well as through legal channels where necessary.

GG: It seems like the SIIA look has been more polished this year, can you tell us anymore about that?

MF: Yes, that is correct. We were fortunate to be able to add a senior marketing and communications professional to our team at the beginning of the year and one of his priorities has been to help polish the SIIA brand.

This work has taken place over the last several months with improvement in the quality and consistency of our external communications. A broader strategic branding campaign is also being developed for launch early next year. SIIA has a great story to tell, and we look forward to telling it more effectively in the coming months.

ENDEAVORS OCTOBER 2023 9

GG: How is the SIIA Future Leaders initiative coming along?

MF: Let me first say that this remains one of the association’s most important strategic initiatives as the generational shift continues to accelerate in our industry, so I am pleased to report that things are going great. Activities are now guided by a very active Future Leaders Committee, so we are confident that this member service offer matches the needs and interests of this targeted demographic.

Our Future Leaders Forum earlier this year was a big success with young professionals attending

from around the country. We even held a first-ever SIPAC Future Leader fund-raiser event in conjunction with the Forum that was very popular.

Many younger members also participated as part of a virtual Mentor Connect event, which matched them with senior industry executives for small group career coaching discussions.

I know more good things are in the works for our younger members and we look forward to making more announcements soon.

GG: The association continues to see an increase in its captive insurance membership constituency, so how do you view SIIA’s role in this segment of the marketplace?

MF: My view is that SIIA continues to play a unique and useful role in the captive insurance space by integrating its stakeholders into the much broader self-insurance world.

This is important because mid-market employers are becoming increasingly sophisticated in how they manage risk, understanding

® 10 THE SELF-INSURER

ENDEAVORS

that they can integrate multiple self-insurance strategies that may include the formation of a captive insurance company. SIIA brings this all together, giving captive insurance professionals more educational, networking and advocacy resources.

I am particularly pleased to see how much progress SIIA has made over the past year with political advocacy in Washington, DC to better position the captive insurance market segment with key policymakers.

Most recently, our captive insurance company developed a survey for industry stakeholders in an attempt to collect important data that has not been available previously. Second year survey results are expected to be reported soon, which I believe will be very valuable for SIIA members and others.

GG: There certainly sounds like a lot of exciting things going on at SIIA. What advice would you give industry executives who want to become more active in the organization?

MF: Well of course, become a member if you are not already. Showing up at association events - as they are available - is a big deal because SIIA is a very interactive and social organization and there is no substitute for being there.

We also recruit members to serve on our various volunteer committees and participate in periodic grassroots lobbying campaigns, which are great involvement opportunities, so watch for periodic volunteer recruitment communications. I like to say we are happy to put our members to work!

For more information visit www.siia.org.

Do you aspire to be a published author?

We would like to invite you to share your insight and submit an article to The Self-Insurer! SIIA’s official magazine is distributed in a digital and print format to reach 10,000 readers all over the world.

The Self-Insurer has been delivering information to top-level executives in the self-insurance industry since 1984. Articles or guideline inquires can be submitted to Editor Gretchen Grote at ggrote@ sipconline.net

The Self-Insurer also has advertising opportunties available. Please contact Shane Byars at sbyars@ sipconline.net for advertising information.

ENDEAVORS

OCTOBER 2023 11

Somebody has to come in second. Make sure it’s not you.

There are no insurance MVP trophies, no best PowerPoint awards, no fantasy broker leagues. You show up first with the best option for your client, or you lose. We never take this for granted. That’s why we leverage all of our people, data and relationships to reach one goal: We help you win.

We help you win.

ELATION AND FEAR OVER AI

Written By Bruce Shutan

Written By Bruce Shutan

Everyone is talking about both the promising and alarming impact of artificial intelligence – from office water coolers to kitchen tables. Those conversations – which are also on the agenda at SIIA’s 2023 national conference this month – have intensified over new “generative” AI applications such as ChatGPT that produce text, images or other media.

For self-insurance, there are a myriad of possibilities. From laborintensive to creative tasks, AI can be used in a number of areas. They include automating patient intake; scrubbing or updating patient data in electonic medical records; identifying high-quality providers; customizing population health strategies; improving triage, treatment and outcomes; bolstering predictive modeling; and suggesting actionable items.

FEATURE E

OCTOBER 2023 13

From mundane to creative tasks, artificial intelligence is revolutionizing selfinsurance, but concern persists about veering off course, the impact on jobs and cybersecurity

Those are tall orders for a technology that the industry perceives as potentially game-changing. There’s now an expectation, for instance, that pre-authorizations can be immediately turned around, according to Brian Wetter, vice president information technology, infrastructure and analytics at PacificSource Health Plans who will take part in a SIIA panel discussion in Phoenix on how AI is affecting TPAs.

Adoption of this technology is considered necessary for success, according to Matt Salerno, a software architect for VBA who also will speak about AI at SIIA’s conference. “The integration of traditional machine learning and generative AI within the health care and TPA space will become not just a value-add but a necessity,” he believes. “Those that adopt it will succeed and thrive, while those that do not will fail or be acquired for their book of business.”

PILOT TO CO-PILOT

AI’s role is that of a copilot or thought partner helping manage someone’s workload so they can focus on their core competencies and be more strategic, Wetter observes. He recently turned to AI for help crafting a presentation to the board that required a short paragraph defining self-funded administration, which he tweaked in only about 30 seconds.

Another common use involves his firm’s RFP software, which is integrated with ChatGPT and is trained to recognize historical RFP responses. “We’ll get a question, ‘can you deliver any [electronic data interchange] 834 file to a customer?’” he notes. “It’ll generate the response and it is spot on. It is exactly how we would respond to that question.”

That’s not to say every interaction will go smoothly. At a time when this nascent technology is producing strange and threatening responses to freeflowing conversations, Wetter admits that generative AI lacks enough context to confidently answer many other questions and may send responses that essentially mirror a hallucination.

Wetter believes the mundane part of administering selfinsured health plans is where AI is actually poised to deliver the most value. For instance, it recently red-flagged a client’s allergy claims involving scratch testing and injections that showed one provider in particular building in an additional code that none of the others charged.

But there’s a larger context to these capabilities. PacificSource Health Plans uses a proprietary algorithm that prescribes programs for members with whom they engage in active outreach. A concerted effort is made to fully understand each patient’s clinical history, local provider resources and social determinants of health.

he explains.

“That’s a prime example of how we’ll see AI come into play to help make better decisions faster.”

14 THE SELF-INSURER

“These are not traditional things that you would hear from an administrator,”

Brian Wetter

Elation and Fear Over AI

Matt Salerno

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health. Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

Stop Loss | Group Captives | Managed Care | Specialty Accident ©2022 Berkley Accident and Health, Hamilton Square, NJ 08690. All rights reserved. BAH AD2017-09 2/22 www.BerkleyAH.com

The technology is also helping identify health plan members who haven’t seen their primary care physician two weeks after an emergency room visit or prime candidates for surgery in the next 12 to 16 months, observes Michelle Bounce, president of the

J.P. Farley Corporation, another AI panelist at SIIA’s conference.

But there are limits to what AI or generative AI can do. For example, she says what’s lacking is a good weighting system for gauging quality. While clinical pathways can be built into AI and create alerts when they’re not being followed, she explains that their value depends on several factors (i.e., a nuance not being followed, wrong clinical pathway or physician not following the pathway). Making these determinations could help improve weighted quality scoring.

Like payment-integrity systems, AI also can be used to detect fraud, waste and abuse on labor-intensive, high-dollar claims, as well as review appropriateness of care, according to George Stiles, president and chief operating officer of Planned Administrators, Inc. who also will speak about AI at SIIA’s conference.

His firm is focusing on large hospital claims. In sifting through medical data, the aim is to determine if claims were correctly coded and billed. “What we’re finding is that there’s a whole lot of stuff going on in that $10,000 to $20,000 claim range that’s just been flying under the radar up until now,” he reports.

16 THE SELF-INSURER For product information, contact: marketing@amalgamatedbene ts.com Amalgamated Life Insurance Company Medical Stop Loss Insurance— The Essential, Excess Insurance Amalgamated Family of Companies Amalgamated Life ▲ Amalgamated Employee Benefits Administrators ▲ Amalgamated Medical Care Management ▲ Amalgamated Agency ▲ AliGraphics Group • Stop Loss • Voluntary Amalgamated Life Insurance Company 333 Westchester Avenue, White Plains, NY 10604 914.367.5000 • 866.975.4089 www.amalgamatedbenefits.com As a direct writer of Stop Loss Insurance, we have the Expertise, Resources and Contract Flexibility to meet your Organization’s Stop Loss needs. Amalgamated Life offers: VOLUNTARY SOLUTIONS—KEEPING PACE WITH TODAY’S NEEDS • Accident • AD&D • Critical Illness • ID Theft • Dental • Disability • Hearing • Whole Life Insurance • Specialty Rx Savings Programs and Discounts • “A” (Excellent) Rating from A.M. Best Company for 47 Consecutive Years • Licensed in all 50 States and the District of Columbia • Flexible Contract Terms • Legal • Portable Term Life • Excellent Claims Management Performance • Specific and Aggregate Stop Loss Options • Participating, Rate Cap and NNL Contract Terms Available Policy Form ALSLP-2020* *Features & form numbers may vary by state. A M BEST S A Exce en Financ a St eng h Ra ng Michelle Bounce Elation and Fear Over AI

Mindful that younger people who are coming into the workforce are more adept at using chat text vs. actually talking to someone, Planned Administrators, Inc. has embraced AI from a customer-service standpoint. One employer client is using AI to do member navigation, helping individuals find specialists based on an analysis of their claims data and quality metrics. The technology may recommend, say, the five best orthopedic surgeons in Atlanta for a 47-year-old female with certain diagnosis codes and comorbidities listed in her medical history. “It’s

A third point Salerno makes is that generative AI for technical integration will help health care organizations bridge the gap between different systems, acting as intelligent middleware. These models create interfaces that adapt in real time by understanding data structures, semantics and communication protocols. They also ensure smoother data flow and reduced system integration times, as well as a more holistic view of patient data across platforms for TPAs and other health care entities.

And where providers are concerned, the TPA realizes they want a quick and easy way to check eligibility or verify benefits, and would prefer to receive the information correctly from a chatbot than wait and talk to someone.

MOUNTING CAPABILITIES AND HIGH VALUE

Salerno predicts four major areas will emerge within the next five years that provide the most value to self-insured health plans and their partners. The first involves traditional machine learning that will take the form of enhanced adjudication. Systems will not only identify patterns and anomalies in claims submissions, but also be equipped to auto-correct potential errors. These capabilities would drastically reduce the manual labor and oversight that’s usually required in claims adjudication, resulting in reduced costs and improved efficiency.

Another noteworthy trend he sees involves smart-assistants built upon generative AI models that dynamically respond to user queries. They’re able to tap vast vector databases created from various knowledge bases such as user help systems, support tickets and customer or client resource centers. The expectation is that by offering dynamic and contextually relevant assistance, these aids will offer improved usability of claims administration software that results in enhance productivity and reduce training time for health plans and TPAs. Smart-assistants also can offer a more intuitive interface that anticipates user needs, automating various tasks from plan builds to workflow creation.

Finally, he notes that generative AI for organizational knowledge serves as a reservoir of institutional knowledge in the face of staff turnover. These models can provide insights, context and guidance to new members by training on organizational data, effectively simulating years of experience. Drastically reducing the impact of onboarding and training times will ensure that even newest team members can quickly make informed decisions. In addition, the health care industry benefits by maintaining consistent service levels and knowledge transfer across entities.

a very different list than if you just look at generic quality scores,” Stiles explains.

OCTOBER 2023 17

Elation and Fear Over AI

George Stiles

www.bhspecialty.com/msl A trusted business name. A stellar balance sheet. An executive team with 30 years of experience. Creative, tailored solutions. Berkshire Hathaway Specialty Insurance is proud to bring our exceptional strength, experience and market commitment to the medical stop loss arena. A medical stop loss grand slam. It’s a home r un for your organization. Atlanta | Boston | Chicago | Columbia | Dallas | Houston | Indianapolis | Irvine | Los Angeles | New York | Plymouth Meeting | San Francisco | San Ramon | Seattle | Stevens Point Adelaide | Auckland | Barcelona | Brisbane | Brussels | Cologne | Dubai | Dublin | Frankfurt | Hong Kong | Kuala Lumpur | London | Lyon | Macau | Madrid | Manchester | Melbourne | Munich Paris | Perth | Singapore | Sydney | Toronto | Zurich

INHUMANE TOUCHES?

Within the past year, fear is mounting that this technology will replace people and service, but Bounce says that’s a shortsighted assessment. “There are a ton of uses for AI in our industry, especially generative AI, where it involves the most risk and cost,” she says. One area that is ripe for usage is building out benefits, which can take years of experience to do.

Either way, the marketplace obviously must adapt to U.S. labor and demographic trends. People 35 and younger are only staying in a job for two or three years, which she notes “creates a significant risk to the sustainability of our industry that I think we have to acknowledge.”

The underlying problem, she explains, is that it takes time for people to become fluent in the self-insured industry. Given that fact, it’s best to redeploy workers to where they’re needed most, such as using generative AI to turn documents into plan builds or educating members to make better benefits decisions.

“I trust the technology to code better than people,” Bounce says. As for account management, which she notes is another job in this industry that takes years to learn, AI can adeptly handle the bits of analytics, price comparisons, actuarial underwriting and plan recommendation functions

that the work entails. Service providers in the self-insured space can’t keep people fast enough in the under-35 market to sustain the industry without creating depth with technology, she warns.

Bounce notes. That information should include actionable items, education, opportunities for direction or steerage. “We

While AI technology is generating tremendous excitement, it also raises serious concern about cybersecurity. Data on an opensource platform like ChatGPT may be vulnerable. In the absence of safeguards, Stiles has seen instances in which some data is easily

“If we put humans back into the equation, I think AI and AI generative are only going to make that interaction more valuable and more critical because what we’re going to end up getting is a whole lot of information coming at us at once,”

can’t forget that healthcare is a very human experience,” she adds.

OCTOBER 2023 19 Elation and Fear Over AI

accessed for all kinds of different analyses, filters and so forth. Spear phishing attempts also are a huge concern. Wetter says generative AI can detect anomalies in, for instance, the way emails are written to uncover “digital twinning,” which enables cyber attacker to impersonate individuals.

Whatever comes of this issue, Bounce sees both a dark and light side to AI. If the focus is on the service aspect being a centerpiece of this solution, she cautions that “we just go down the road further of dehumanizing the system, increasing the cost unnecessarily and forgetting who the customer is, and that has catastrophic consequences.

“The other side of this,” she continues, “is that we use it in a smart manner that allows us to minimize not just risk for us as the administrators, but also protect those clinicians who are being pulled

around by the hospital to not do what they believe clinically is in the best interest of the patient. It can go a long way in helping us with quality scoring, patient directives and education.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 30 years.

OCTOBER 2023 21 Elation and Fear Over AI

SPECIALTY

PHARMACEUTICALS: REMEDY PAIN POINTS FOR SELF-INSURED EMPLOYERS

Written By Laura Carabello

There’s

Tno doubt that employers are still reeling with the introduction of novel, expensive and potentially lifesaving cell and gene therapies, but they must also prepare themselves for the relentless launch of specialty medications and infusion therapies that are on the horizon.

The significant impact of the drugs on budgets and benefits planning cannot be underestimated, and while new weight loss drugs are not typically classified as specialty drugs, they are already adding yet another layer of cost.

Easing the strain and impact of these specialty pharmaceuticals requires thoughtful strategies as their sheer number and scope challenge even the most astute employers to improve patient

FEATURE

22 THE SELF-INSURER

access to treatment while ensuring affordability. In the year ahead, targeted programs, financial solutions, and other initiatives to relieve these stinging issues necessitate the guidance of professionals.

Thanks to SIIA, attendees at the 2023 National Conference will get this much needed direction from three highly credible industry thought leaders, Monday, October 9, 2023, 3:15 to 4:30 PM.

• Dea Belazi, CEO, Ascella Health

• Corey Belken, Senior Employer Account Executive, Genentech, Inc.

• Dr. Brenda Motheral, CEO & Co-Founder. Archimedes.

ISSUES, TRENDS AND SOLUTIONS WORTH WATCHING IN 2023-2024

Dea Belazi says, “Emerging and continuing issues are being seen with specialty drugs in the year ahead. While specialty drugs are costly, they also can provide life-changing options to physicians and patients. A key issue is the continuing affordability of these products and employers will need to balance cost and access to ensure optimal patient outcomes. In 2022, the median annual cost for newly approved drugs was greater than $222,000 and high cost will continue to be a significant barrier to access.”

He points to reports that almost half of specialty pharmacy patients have experienced challenges in receiving specialty medications, with nearly a quarter of these patients stating high medication costs as the top challenge in gaining access.

Belazi. “Innovative financial solutions for CGT are now available amid continued increases in CGT costs that are putting pressures on employers and others. This will drive innovative approaches for absorbing these costs, which can exceed multi-million-dollar price tags for payers and individual patients. Unique financial solutions, such as loan-based programs for payers, significantly offset the cost of expensive and potentially curative CGTs.”

OCTOBER 2023 23

“A shift toward Value-Based (VB) and Outcome-Based contracts promote greater patient access to new biopharmaceutical treatments by linking reimbursement, coverage or payment to a treatment’s realworld performance and patient outcomes,”

says

Specialty Pharmaceuticals

Dea Belazi

Corey Belken

He asserts that another issue will be the evolving role of specialty pharmacies in the management of the specialty medications for the medical benefit, adding, “Payers have typically managed specialty medications on the pharmacy benefit and medical benefit separately, making it challenging to see the full effect of their specialty strategies and where there may be opportunities to improve the patient experience and health outcomes. Specialty pharmacies have the opportunity to manage these benefits seamlessly and assist both the patient and payer in enhancing the quality and cost of the specialty drug therapy regardless of the benefit.”

Belazi points out that specialty pharmacies have the additional opportunity to direct patient care and specialty drug administration sites of care.

“Hospitals typically charge more for specialty drugs and their administration than independent administration sites and physician offices, whether treatment occurs in a hospital or a hospital-owned physician practice,” he explains. “Administering drugs in physician offices and patients’ homes -- instead of hospital outpatient settings -- can significantly reduce costs and provide savings opportunities for both the payer and patient. This approach helps to eliminate hospital stays, decreases hospital utilization, hospital resources and subsequent cost.”

Finally, he emphasizes that self-funded employers, plan sponsors and other payers are contracting directly with an SP provider in designing their benefit packages.

“This enables payers to gain better control over SP costs, have greater transparency into their benefit claims and strengthen their negotiating power.”

People

Hiring the best, so our clients get the best

Partnerships

Partnerships that move us all into a brighter future

Programs

New programs and concierge services for improved outcomes and savings

Technology

A world-class experience with next-generation technology

Brand Brick & Mortar

Maintaining a fresh brand and space to reflect who we are

Better outcomes, savings and solutions for a better tomorrow.

HPI is a proud sponsor of the SIIA23 – Connect National Conference

Connect

We can’t wait to see you there.

hpiTPA.com

24 THE SELF-INSURER

with us on LinkedIn so we can connect at the conference!

At HPI, we’re investing in the future.

Specialty Pharmaceuticals

Ringmaster is dedicated to developing cloud-based software that will improve your Stop-Loss and PBM administration and the reporting capabilities for Carriers, Managing General Underwriters (MGUs), Third Party Administrators (TPAs), Brokers and PBMs.

By automating the manual processes, you will:

• Reduce processing time and complexity

• Access extensive data warehouse

• Receive real-time actionable analytics

• Minimize turn-around time

330.648.3700 • rmtsales@ringmastertech.com

www.ringmastertech.com Step Into the Ring and Start Realizing the Possibilities by Utilizing Ringmaster’s Cloud-Based Solutions to Make Your Business Thrive!

to one destination to connect partners across the entire PBM & Stop-Loss ecosystem. Start Realizing the Possibilities!

•

Come

All panelists cite the emerging role of value-based or outcomes-based contracting as a topic for discussion. Value-based contracts, sometimes called risk-sharing agreements, are innovative payment models used by payers and biopharmaceutical innovators to link reimbursement, coverage, or payment to a treatment’s real-world performance.

In an outcomes-based contract, payment is wholly or partly dependent on outcomes being achieved. Service providers are therefore directly incentivized to deliver outcomes with service users.

Additionally, they anticipate that employers will be forced to address the new, popular weight loss drugs, as many cut off or restrict access as a way to save money. These cuts and restrictions signal the financial downside of the drugs’ medical success, but people are taking them as a first step to losing significant weight.

Employers that are covering the costs may not be able to afford them. At $1350.00 or more as the monthly cost, employers are having to grapple with the expense despite the fact that their employees are anxious to take these medicines.

They also anticipate a discussion involving greater reliance on copay assistance programs and alternative funding. Copay cards are intended to reduce the total out-of-pocket expense for the patient who may be under-insured and unable to afford the expense. The benefits payer pays some of the cost and then the manufacturer pays part or all of the cost that the patient is responsible for through copay or coinsurance.

Panelists also foresee an important role for Foundations that are established to help offset these costs, including CancerCare, HealthWell Foundation, Leukemia & Lymphoma Society, National Organization For Rare Disorders (NORD) and others.

These resources are helping people to overcome financial access and treatment barriers by assisting them with co-payments for their prescribed treatments. Many offer easy-to-access, same-day approval over the phone and online.

An additional topic which is making headlines will focus on prior authorizations (PA), sometimes referred to as a “pre-authorization.” This is a requirement from the payer that the doctor obtain approval from the plan before it will cover the costs of a specific medicine, medical device or procedure. Most recently, the insurance carrier Cigna announced it would be removing close to 25% of medical services from PA requirements – although not specifically drugs.

In fact, a letter to CMS was recently issued by the American Hospital Association, the American Medical Association, the Blue Cross Blue Shield Association and America’s Health Insurance Plans which united to make the case against proposed prior authorization standards. The groups stated that the provisions of the December 2022 Notice of Proposed Rule Making would create two sets of standards that would slow implementation and add unnecessary costs. The extent to which self-insured employers follow this trend is to be determined.

Dr. Motheral foresees challenges with the emergence of biosimilars, simply defined as a biological medicine highly similar to another already approved biological medicine, referred to as the ‘reference medicine’. Biosimilars are approved according to the same standards of pharmaceutical quality, safety

26 THE SELF-INSURER

Specialty Pharmaceuticals

Dr. Brenda Motheral

and efficacy that apply to all biological medicines.

She highlights the entry of several biosimilars to the Humira brand and questions whether this preferred status of the biosimilar should extend beyond Humira to other drugs in the class. The drug suppresses the immune system by blocking the activity of TNF: a protein produced naturally by the body’s immune system. Some people with certain autoimmune diseases produce too much TNF. Humira is designed to stop tumor necrosis factor-a, or TNF, from attacking healthy cells.

She also forecasts that managing the extremely high cost of cell and gene therapies will require employers to have well defined strategies for addressing these expenses. By the end of 2022, 13 cell and gene therapies were on the US market. In 2023, expectations are that up to 12 new cell and gene therapies will be approved in the US.

OCTOBER 2023 27

“The best-selling drug Humira (adalimumab) now faces competition in the United States after a 20-year monopoly,” says Dr. Motheral. “Eight different biosimilars have launched this year with discounts as large as 85% from Humira’s list price of $6922. A few companies also offer two price points.”

Meritain Health is an independent subsidiary of Aetna and CVS, and one of the nation’s largest employee bene�ts administrators.1 We are uniquely positioned to enable our customers to combine our �exible plan administration, products and external point solutions with the right resources from parent companies Aetna and CVS. 1. Business Insurance; Largest Employee Bene�t TPAs (as ranked by 2019 bene�ts claims revenue); May 2020. Follow us: Simple. Transparent. Versatile.

Meritain Health®, our goal is simple—take a creative approach to health care and build industry-leading connections. Whether you're building an employee bene�ts program, researching your member bene�ts or o�ering support to your patients, we're ready to help you do more with your health plan.

more at www.meritain.com. Specialty Pharmaceuticals

At

Learn

“These treatments typically range from $250,000 to $3.5 million per individual,” she explains. “While these novel therapies serve only small patient populations, employers may be forced to contend with extreme and, in some cases, unsustainable drug costs. With increased pharmaceutical company investment in regenerative medicine and growing interest in rare disease, it is likely that more companies will face these expenditures for these potentially lifesaving treatments.”

Dr. Motheral also believes there will be increased focus upon the best practices for managing specialty drugs under the medical benefit, where many of the gene therapies are covered.

Specialty drugs can be covered insurance based on type of administration, and an estimated 30-50% of specialty drugs are covered under medical benefits, being administered in outpatient facilities, physician offices, or outpatient/ambulatory infusion centers.

She explains that drugs covered under pharmacy benefits are most often self-administered, such as oral medications, self-injectables, or medicines delivered via other methods that patients can manage at home. Drugs that must be administered by a health care provider, which includes many cancer medications, are typically covered by medical benefits.

“There can also be key differences in coverage, depending on whether the drugs are paid for under the medical benefits or pharmacy benefit,” she adds. “The member copays, formularies, and clinical prior authorization programs can vary significantly across the two benefits, resulting in benefit shopping and suboptimal sites of care.”

COSTS CONTINUE TO RISE

The specialty drug trend continues to be driven primarily by claim utilization, accounting for nearly three-quarters of the overall 14.1% gross trend, according to the Walmart report.

It appears that the cost per claim plays a larger role in specialty trend, with the number of members taking specialty drugs continuing to rise: 4% of members took at least one specialty drug in 2022, while the average number of claims per person remained steady. On the surface, this increase may appear minimal, but even a slight increase in the percentage of members taking specialty drugs can have substantial cost implications on a per member per year basis.

The top categories for specialty drug spend show that inflammatory, oncology and multiple sclerosis lead the way, with about 13 oncology drugs approved each year. In 2023, there are 16 oral drugs and 6

Specialty

Pharmaceuticals

On average, aequum r esolves c laims within 297 days of p lacement aequum has generated a savings of 95.5% off disputed c harges f or self-funded pl ans aequum ha s ha ndled claims in all 50 states 297 95.5% 50 No Guarantee of

–

Results

Outcomes depend upon many factors and no attorney can guarantee a particular outcome or similar positive result in any particular case.

1111 Su perior A venue E ast Suite 1360 Cleveland, OH 44114 P 2 16-539-9370 www.aequumhealth. com OCTOBER 2023 29

Protecting plans and patients across the U.S.

Partner with Nationwide® to simplify Medical Stop Loss for you and your clients. Save time and effort with easy access to experienced underwriters who offer a broad range of solutions. Our flexible plans are tailored to fit your clients’ needs and reduce future risk. Plus, claims are backed by a carrier with A+ financial ratings.* Offer coverage from a brand clients can trust. Nationwide has been in the health business for 80 years and Medical Stop Loss for nearly 20 years. To learn why top Medical Stop Loss producers and underwriters choose Nationwide, call 1-888-674-0385 or email stoploss@nationwide.com We hope to see you at the SIIA National Conference. *A+ ranking from AM Best received 10/17/02, affirmed 12/1/22, and A+ ranking from Standard & Poor’s received 12/22/08, affirmed 4/19/22. Plans are underwritten by Nationwide Life Insurance Company, Columbus, Ohio 43215. Nationwide, the Nationwide N and Eagle, and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide NSV-0113AO.1 (06/23) Strong relationships. More solutions.

drugs delivered via injection in the pipeline, with 6 drugs in the pipeline for breast cancer and 3 for non-small cell lung cancer (NSCLC).

These findings suggest that the overall increase in spend is now being driven by the introduction of new specialty utilizers rather than by increased claims among those who already take a specialty drug. Biosimilars also have a profound impact on the overall specialty spend, with biosimilar utilization increasing from 20.5% in 2021 to 26.3% in 2022.

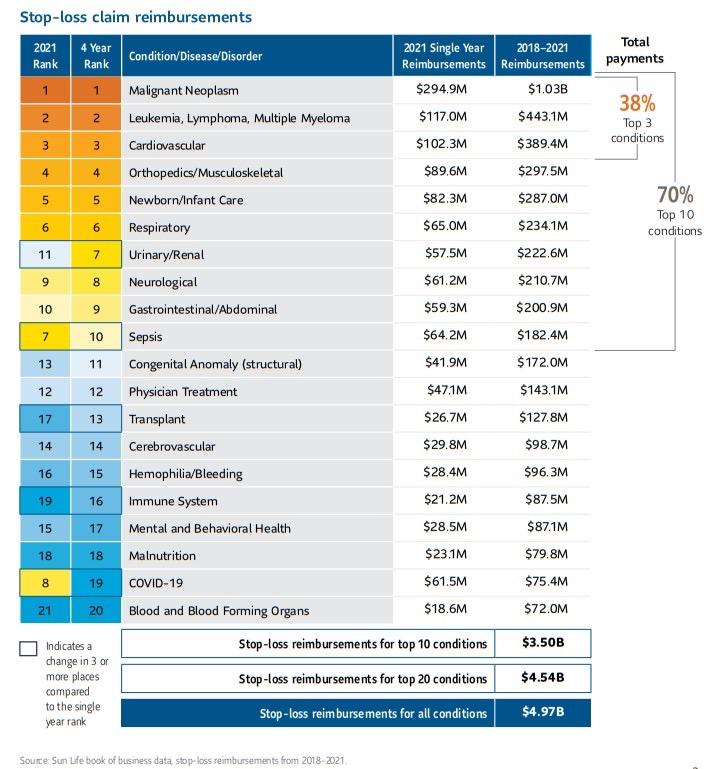

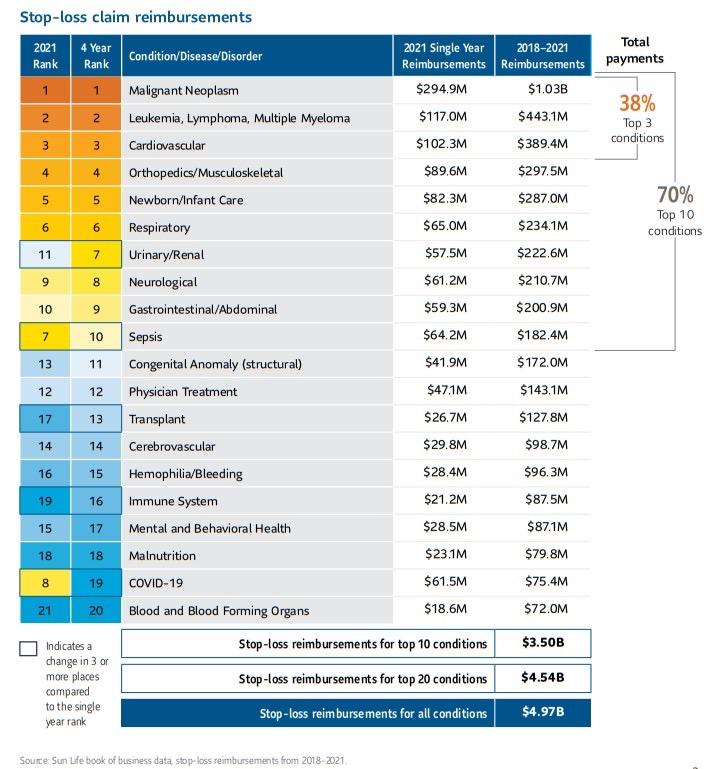

Source: 2023 SunLife

SPECIALTY DRUGS TO WATCH

The latest Sun Life Report reveals that cancer categories Malignant Neoplasm and Leukemia, Lymphoma and Multiple Myeloma continue to be top drivers of highcost claims, making up 29% of total claim reimbursements over the past four years, with cancer drugs comprising over half of the top 20 high-cost injectable drugs for 2022.

The trend report also states that some of the specific drugs have changed:

• Herceptin and Tecentriq have completely dropped out of the top 20.

• Almita, which is used to treat malignant mesothelioma and other lung cancers, moved up two rungs, at an average cost close to $67,000.

• Leukemia and lymphoma drug Rylaze, at an average cost of over $800,000, make it the most expensive drug in the top 20.

OCTOBER 2023 31 Specialty Pharmaceuticals

RISING COSTS AHEAD

The outlook for escalating costs is clear: venerable analysts at PwC’s Health Research Institute anticipate persistent double-digit pharmacy trends driven by specialty drugs and the increasing use of certain medications used to treat Type 2 Diabetes or weight loss.

In a survey they conducted with US health plans, covering 100 million employer-sponsored large and small group members and 10 million Affordable Care Act (ACA) marketplace members, they report that plans are experiencing inflationary pressure from rising median prices of new drugs as well as increasing prices of existing drugs.

Combine with the accelerated approvals of new CGTs, they don’t expect pharmacy trends to slow down in 2024 with the inflationary impact predicted to be in the high single or double digits from 20232024.

They do foresee two “deflators”:

• The adoption and potential of biosimilars to manage these rising drug costs. With the prices of biosimilars on average more than 50% lower than the reference products for which they can substitute, there is substantial opportunity to manage costs. 65% of health plans surveyed ranked biosimilars coming to market among their top cost deflator.

• Site of care is shifting from expensive hospital settings to less expensive sites, such as independent administration sites, physician offices and patients’ homes. In fact, one report said that close to two-thirds of Immune Checkpoint Inhibitors (ICI) also known as immunology treatments are administered by outpatient clinics at hospitals, where it costs $157,000 each year on average to receive care. By comparison, it costs $87,000 on average annually for a patient to receive the infusions in a doctor’s office.

Additional reports, such as one survey released from the Pharmaceutical Strategies Group, raises concerns about the lack of uptake in value-based or outcomes-based contracting for specialty drugs.

They polled more than 180 employers, insurers and labor unions and found that just 12% are using value-based models for pricey specialty therapies, with payers citing multiple hurdles to rolling out these models.

Payers are demanding to see more evidence that the models are effective and can’t seem to agree on methodologies for tracking outcomes.

32 THE SELF-INSURER

Specialty Pharmaceuticals

What is encouraging is that the survey also found that 14% of employers and 7% of health plans are deploying alternative funding models, while 14% and 33%, respectively, are exploring their use – although a majority of those polled said they don’t view these models as sustainable.

While co-pay assistance programs drew positive responses that they are necessary to assist people in affording high-cost medications, there was some respondents who said that at these programs encourage patients to take pricier brand-name drugs rather than select the lower-cost alternative medication.

It appears from this survey that the primary concern in this space is ensuring parity in costs across both the medical benefit and pharmacy benefit. Employers remain challenged on the issue of affordability and cost-sharing for members, with the majority of surveyed payers using PA for these drugs while expressing concerns about the potential for unintended related consequences, such as member dissatisfaction or care delays.

Clearly, these topics and findings reflect and complement the topics that are addressed at the SIIA panel presentation. What is so compelling is that employers will find the panelists’ guidance and recommended strategies highly valuable in the year ahead.

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel, and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Sources:

Report: Specialty drug trend, costs will continue to rise | Drug Store News

https://drugstorenews.com/report-specialty-drug-trend-costs-willcontinue-rise

https://www.benefitspro.com/2023/07/11/the-10-highest-cost-claimconditions-for-2022/

https://www.pwc.com/us/en/industries/health-industries/library/ behind-the-numbers.html

https://www.fiercehealthcare.com/payers/survey-why-value-basedcontracting-specialty-drugs-remains-rare

https://www.healthcarefinancenews.com/news/cigna-remove-25medical-services-prior-authorization#:~:text=The%20company%20 has%20now%20removed,1%2C100%20medical%20services%20 since%202020.&text=Cigna%20Healthcare%2C%20the%20health%20 benefits,requirements%2C%20the%20insurer%20said%20today.

OCTOBER 2023 33 Specialty Pharmaceuticals

We Know ... Risk

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 45 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

Visit us online at tmhcc.com/life Tokio Marine HCC - Stop Loss Group A member of the Tokio Marine HCC Group of Companies TMHCC1189 - 09/2023 HCC Life Insurance Company operating as Tokio Marine HCC - Stop Loss Group

COSTLY WEATHER EVENTS FUEL CAPTIVE INTEREST

R

Record

Written By Caroline McDonald

weather events, ranging from flooding and hurricanes to high temperatures and wildfires, have put pressure on insurance companies. These events have led to increasing numbers of claims and costs, with several insurers exiting the property and insurance market in a growing number of states.

This has also given organizations pause to look at alternatives to their property coverage and to plan accordingly.

To secure ongoing coverage, as well as have more control over pricing, organizations are increasingly looking to self-insurance and captives.

OCTOBER 2023 35

WEATHER EVENTS LEAD TO INSURER WITHDRAWALS

Recently Farmers Insurance stopped offering new auto, home and umbrella policies in Florida, citing the growing costs of natural disasters and construction.

In California, AIG, Allstate, State Farm and Farmers have all ceased writing new policies due to weather events, inflation, and reconstruction costs.

AAA has also dropped some coverage in Florida, California, and Louisiana, citing weather risks.

According to McKinsey & Company’s report, “Climate Change and P&C Insurance and Opportunity”:

“The projected escalation of climate risk, such as the occurrence of more floods and wildfires, may lead to underinsurance—or to no insurance at all. The result, substantial market dislocation will include premium loss, higher rates of self-insurance, and an increased demand for disaster relief from the public sector.”

Dale Porfilio, chief Insurance Officer with the Insurance Information Institute, and president of the Insurance Research Council notes

that the nature of insurance is “the balance of availability and affordability. Based on the information they have, if insurers don’t perceive they can achieve a reasonable return on a particular type of risk, they either need to increase the price, or to write less of it,” he said. “With what’s happening now with climate risk, there is a need to be taking prices up.”

In the property market, “From the beginning of the pandemic to the end of 2022, replacement cost prices on losses went up a cumulative 55 percent for homeowners’ writers,” Porfilio said. This means higher costs to repair or replace damaged homes and business.

36 THE SELF-INSURER

The Insurance Regulator State of Climate Risks Survey, conducted by the Deloitte Center for Financial Services, found that:

• A majority of U.S. state insurance regulators expect all types of insurance companies’ climate change risks to increase over the medium to long term—including physical risks, liability risks, and transition risks.

• More than half of the regulators surveyed also indicated that climate change was likely to have a high impact or an extremely high impact on coverage availability and underwriting assumptions.

Shared Values

Hurricanes in Florida and wildfires in California have meant that insurers are having to file for rates as they are able, Porfilio said. Those that are not able to get the rate they need, “are

The extra layer, he said, is that most companies writing property insurance also purchase reinsurance for their book of business. “In part because of Hurricane Ian coming through and the perception of increased climate risk, reinsurance pricing also went up,” Porfilio said.

Higher reinsurance costs means that insurers ultimately have to pass that cost onto consumers, “and that is where it is affecting both personal lines and commercial,” he said.

Customer Service, Cost Controls, Quality Performance

We deliver value other TPAs can’t match. Our three-year medical trend is beating the industry at 1.3% and our claims reviews are finding an extra 15%in savings before network discounts. Our people are working hard to deliver incredible value for our customers. They can do it for you too.

scaling back the amount of business they can write—whether it’s scaling back new business, opening the door for new business or deciding to leave the market—and different companies are making different choices.”

37 OCTOBER 2023 R450-2880

400 Field Drive • Lake Forest, IL 60045 | 800.832.3332 • TrustmarkHB.com ©2023 Trustmark Health Benefits® Scan the QR code with your smart phone to learn more

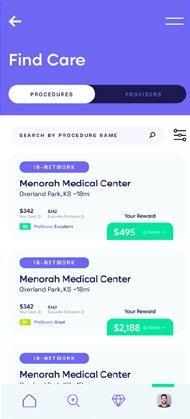

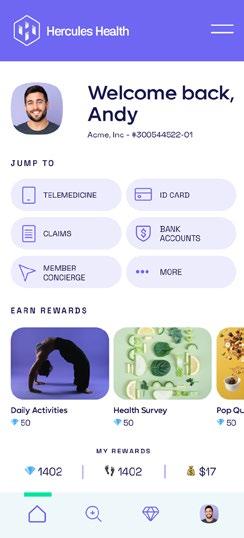

Bringing the Power of Consumerism to Healthcare

A first-of-its-kind healthcare SuperApp for self-funded plan sponsors that helps members make better decisions around quality medical care delivery, so everyone wins.

The only self-funded healthcare engagement platform of its kind.

Hercules Health rewards habitual app utilization by giving cash incentives earned through intelligent healthcare shopping tied to quality and cost. More app use equals more savings for members and plan sponsors alike.

Comprehensive Compliance

Hercules Health delivers best-in-class price transparency that is fully compliant with the Transparency in Coverage (TiC) and the No Surprises Act (NSA) rules and regulations.

Contact us today.

herculeshealth.com

info@herculeshealth.com

IMPACT ON COMMERCIAL PROPERTY

While historically there has been greater regulation of personal products than commercial, “Looking at departments of insurance data every quarter, we are seeing commercial property insurance premiums going up more than personal property,” Porfilio said. “This speaks to the fact that if an insurer feels it needs additional premium, they file for it and in general, commercial insurers are able to get higher rate increases than personal property insurers.”

In the commercial property market, “I would say it is all business owners who are affected,” he said. “If you own your own plant, you are the one who has to maintain insurance for that facility. You will have to maintain your own property insurance, and whoever the insurer is, odds are they have purchased reinsurance behind that.” He added, “If you are a renter of an office space or the place where you run your business, your landlord is probably passing that increase to you in the form of higher rent.”

Robert P. Hartwig, clinical associate professor, finance department and director for the Center for Risk and Uncertainty Management at the Darla Moore School of Business, University of South Carolina noted, “Historically, the commercial property insurance markets have been less affected by the factors that are today leading personal

property insurers to freeze, shrink or withdraw from markets such as Florida and California.”

While commercial property insurance rates are not subject to the same degree of rate regulation as the homeowners market, commercial property insurers in Florida, California, and Louisiana, are still vulnerable to the pressures, “associated with the issues driving claim severity: higher inflation, supply chain issues, high labor costs, high catastrophe losses and high reinsurance costs,” he said.

Commercial property insurance markets, “are hard and likely to remain that way for some period of time,” Hartwig said. “Demand for commercial property cover remains strong.”

This demand, in addition to the impetus from the drivers of claim costs, “does give insurers some leverage in terms of pricing,” he said. “Even risks with good loss experience may be seeing doubledigit increases and narrowed terms and conditions upon renewal.”

For these reasons, Hartwig added, commercial property risks could potentially benefit from captive arrangements, “which could allow them to more directly benefit from their own commitment to loss control and risk management.”

While there are potential advantages for commercial property risks using a captive arrangement, captives are “especially attractive for entities

Learn More 8 88-248-8952 selffunding@benefitmall.com ©2023 BenefitMall. All Rights Reserved. Stop-Loss Management Services Claim Risk Solutions Premier Broker Support Expect More FROM YOUR STOP-LOSS PARTNERS 39 OCTOBER 2023

with better-than-average loss performance,” he said.

COVERAGE OPTIONS

If coverage is not available in the private market with standard carriers, “There are three relief valves,” Porfilio said.

1. In some states “you have the Fair Plans—fair access to insurance. This is mostly for personal insurance, but they usually have a commercial insurance component as well. So, you could go to a state run organization like that, and they exist in most states.”

2. Another option is the excess and surplus markets. “Those are outside of the standard regulators. Excess and

surplus means they are operating outside of that and therefore have more latitude on pricing. They generally have more latitude on coverage restrictions, too. So, they may have stripped down some features to make it more affordable, but there is an entire excess and surplus market that operates, on top of the private market,” he said.

3. The third is captives or self-insurance, which “I am hearing is happening more,” he said.

Of these options, he said, “we

Organizations can set up a captive for their property insurance or exclusions. “I met with one of our members that covers personal lines for the high net-worth market,” Porfilio explained. “The finding is that some companies don’t want to write high-valued homes, so companies are placing the liability coverage with standard carriers and are doing combinations of self-insurance or a captive to cover the property risk.”

know the state funds are growing, but we also see that excess and surplus and the captive markets are coming in to fill that void to the extent that they are able.”

40 THE SELF-INSURER

DOMICILES WEIGH IN

Christine Brown, director of captive insurance with the Vermont Department of Financial Regulation noted, “We are definitively seeing growth due to increased rates, unaffordability and unavailability of certain types of coverage and lines of business.”

This has been happening, she said, “in the property space, with interest from large, well established real estate investors and property owners and managers.”

John Huth chairperson of the Montana Captive Insurance Association and an independent captive director, said, “It’s a fairly new phenomenon that companies are pulling out of these states, so I’m sure people are scrambling trying to figure out what to do.”

In the commercial market, he said, captives would be more likely for owners of office buildings and apartment complexes.

A captive, “could be an option for hotel chains with locations in different geographic regions. Or possibly hospitals,” Huth said. “Feasibility studies would have to be considered. You definitely would need a good premium base to even consider a captive.”

Group captives might be more viable for commercial captives with varied types of businesses and locations, he noted. “A group captive is something they could look at, but you would want to diversify your locations. Because if you have a natural disaster that takes out everybody, you’re not going to survive that,” Huth said.

41 OCTOBER 2023

Caroline McDonald is an award-winning journalist who has reported on a wide variety of insurance topics. Her beat has included in-depth coverage of risk management and captives.

“Fatima

“I've

Learn more at Claim-doc.com or call (888) 330-7295 With ClaimDOC you’re in the driver’s seat to create a rich and sustainable healthcare plan using RBP principles. Our approach to elevate the member experience, while diligently managing risk is what sets us apart. Nobody delivers like we do. ClaimDOC’s reference based pricing program is unlike any other. Experience savings and a caring team who is always there to go above and beyond for members.

can’t tell you enough how pleased we are with getting all of our physicians on board.”

“I

was knowledgeable, quickly calmed me down, and put my fears to rest.”

never had such a good customer service experience in my lifetime!”

NAVIGATING COVERAGE FOR WEIGHT LOSS MEDICATIONS

Written By Kevin Brady, Esq., Director, Plan Document Compliance of The Phia Group

Written By Kevin Brady, Esq., Director, Plan Document Compliance of The Phia Group

I In October of 2022, Elon Musk (one of the world’s wealthiest individuals) ignited headlines when he revealed that he used Wegovy as a primary method for losing weight.

Wegovy, and other drugs such as Ozempic and Mounjaro, instantly became national news and an intriguing weight loss option for people across the country.

By all accounts, these drugs seem to show effectiveness in addressing weight loss concerns; however, it’s important to note that they come with a significant cost.

Specifically, Wegovy, Ozempic, and Mounjaro boast per-treatment list prices of $1,349, $936, and $1,023, respectively.

43 OCTOBER 2023

This scenario often presents a familiar challenge for self-funded group health plans. Employees may express a desire for specific treatments or services to be covered, but the plan may have an understandable reluctance due to the substantial expenses associated with the treatment. Given this situation, group health plans should take a systematic approach:

1. Assess Whether Coverage is Right for Your Plan: Initially, plan sponsors should thoroughly evaluate whether coverage of weight loss drugs aligns with their overall goals. This entails considering the plan’s overall strategy against the preferences and potential health needs of their members.

2. Cost Containment Strategies: If the decision is made to cover weight loss drugs, plans should explore effective strategies to manage the costs linked to these medications. This might involve proactive conversations with their Pharmacy Benefit Managers (PBM), medical management techniques, or exploring potential alternatives to reduce expenses.

3. Update Plan Documents: To ensure clarity and alignment with revised coverage decisions, plan sponsors should review and update their plan documents accordingly. This includes coverage details and communication to members about the inclusion of weight loss drugs as a covered benefit and any associated medical management techniques.

By methodically addressing these issues, plan sponsors can better navigate the complexities of covering weight loss drugs. This approach promotes informed decision-making, effective cost management, and transparent communication with plan participants.

With a comprehensive understanding of the considerations surrounding the coverage of weight loss drugs such as Wegovy, Ozempic and Mounjaro, let’s now delve into each of the three key aspects in greater detail.

1. ASSESS WHETHER COVERAGE IS RIGHT FOR YOUR PLAN

PROS:

The primary argument in favor of covering weight loss drugs is the potential to improve employees’ overall health. Obesity is closely linked to a range of health problems, including diabetes, heart disease, and joint issues.

By providing access to medications like Ozempic and Wegovy, which are approved by the FDA and have demonstrated effectiveness in aiding weight loss, employers could contribute to reducing these health risks among their workforce. (Wegovy is FDA approved for weight loss while Ozempic is currently only approved for diabetes treatment).

Coverage may also impact employee productivity and morale. Employees may ask about coverage. While this may not be the most important factor in recruiting new employees or retaining current employees, it may give a leg up to employers who offer coverage.

44 THE SELF-INSURER

Furthermore, employees who are healthier are often more productive. By promoting weight loss through covered medications (and other means), employers may see reduced absenteeism due to health-related issues and increased employee engagement. Finally, while these drugs are expensive and require upfront costs, it could lead to longterm savings for employers. Health problems associated with obesity can be expensive to treat, including hospital stays, ongoing medical appointments, and more serious chronic conditions. By investing in weight loss drugs, employers might ultimately mitigate some of these future expenses.

CONS:

The high cost associated with weight loss drugs is the primary argument against coverage. Plan sponsors must evaluate whether the cost of covering these medications aligns with their budget constraints and overall benefits package.

Striking a balance between providing valuable benefits and managing costs is always crucial. As these drugs become more popular, related claim expenses on a group health plan may be significant.

This concern becomes even more significant when considering the necessity for ongoing treatment. To achieve desired results, consistent injections are required. Consequently, discontinuing the drug often leads to weight regain for individuals.

Weight loss drugs, while effective for some individuals, do not guarantee long-term success for everyone. Weight loss is a complex process influenced by various factors including genetics, lifestyle, and mental health.

45 OCTOBER 2023

Granular Insurance is a risk platform to help employers, health care providers, and other stakeholders manage risks, costs, and achieve better outcomes.

Many companies today are looking for ways to combat the increasing volatility of their

Precision Risk approach, Granular Insurance is able to segment risk, reduce variability and deliver a more accurate assessment of a client’s exposure.

What Make’s Granular Unique?

• Precision Risk segments a population into as many as 22 unique cohorts

• with the opportunity for three to ��e�year r�te protection

• Granular clients have access to inno�ati�e tools and ser�ices from Alphabet’s Life Sciences company Verily

A Better Way to Assess Risk

Precision Risk delivers value through more consistent and predictable risk transfer.

75%

10,000 test cases

Shifting Risk from the Employer to Granular

Restructuring Risk

Granular segments a population into as many as 22 unique cohorts, and as a result, can more accurately assess risk, monitor and impact the group’s performance, shift risk from the employer to the carrier and better manage costs.

Underwriting Predictability

Granular deli�ers better estimators and tighter clusters of expected claims costs across the employers’ population, allowing attracti�e rates and multi�year rate and bene�t protection.

Financial Predictability

�ith multi�year rate and bene�t protection, Granular puts ameaningful cap on annual premium increases with moderate and predictable changes to an employers’ spec.

Mind the Gap

Granular offers protection from higher frequency and higher �olatility claims through a mix of speci�c employer stop�loss deductibles, lowering employer risk both at the member le�el and o�erall le�el.

������� � ������������� �� ��������� ���� ������ �or �ore in�or��tion� cont�ct ���e���r�n���rin��r�nce�co�

the employer received more value from Granular’s Precision Risk approach INOF

There is a risk that employees might not experience the desired results, aside from the emotional impact on the individual, this would essentially result in claim expense that does not effectively treat the underlying condition.

Finally, relying solely on medication for weight loss may discourage employees from adopting healthier lifestyle changes. Sustainable weight management often requires a combination of dietary adjustments, regular physical activity, and behavioral modifications. If an individual relies on the weight loss drug to achieve these results, it may have a net-negative effect on their overall health.

2. COST CONTAINMENT STRATEGIES

First, it is imperative to discuss potential options with your PBM. This approach is important to understand the treatment options currently available and whether any generic or lower cost options may be out there.

Next, imposing medical management techniques such as treatment limitations, established medical necessity criteria, and/or prior authorization requirements will limit coverage and the potential claim exposure to the plan.

3. UPDATE PLAN DOCUMENTS

Once the decision to cover weight loss drugs is reached, plan sponsors should update their plan documents to clearly outline the details of this coverage. This includes specifying eligible drugs, criteria for coverage, and any associated costsharing responsibilities for plan participants.

Furthermore, the plan should review the plan document in its entirety to ensure that other language within the plan document does not contradict or otherwise limit coverage on the drugs unintentionally. For example, a general exclusion for “services related to obesity”

PBM Services that Bridge the Gap Between Experience & Technology

Prescription spending is rising with no end in sight, but ELMCRx Solutions is the PBM services company that gets the full picture. Discover how much our cutting-edge tech platform and expert team of pharmacists can save plan sponsors.

For more information, contact Mary Ann Carlisle: 484.433.1412 | mcarlisle@elmcgroup.com elmcrx.com Specialty and High-Cost Drug Management Clinical Case Management Non-Specialty Drug Management Prior Authorization Review Clinically Grounded. Technology Focused. Supported by superior technology and analytics. 47 OCTOBER 2023

should be removed from the document entirely or modified to specify that the exclusion does not apply to these drugs.

Transparent communication with plan participants is essential. Health plans should effectively communicate that coverage is available and provide details on any medical management criteria or techniques that may be relevant for participants. This ensures that members are wellinformed and understand their coverage options.

CONCLUSION

The decision to cover weight loss drugs is a multi-faceted one that is likely unique for each employer.

This decision point will likely be relevant for the foreseeable future. As weight loss drugs continue to make headlines across the country, drug coverage, cost containment strategies, and proper plan language will be essential to ensuring that the plan is protected from increasing claim expense and put into the best possible position to provide meaningful benefits to its participants.