Accident

& Health InsuranceWe’ll focus on risk, so you can take care of

Accident

& Health InsuranceWe’ll focus on risk, so you can take care of

Self-insuring your healthcare benefits can open up new possibilities for your business — affording you greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your team and assets:

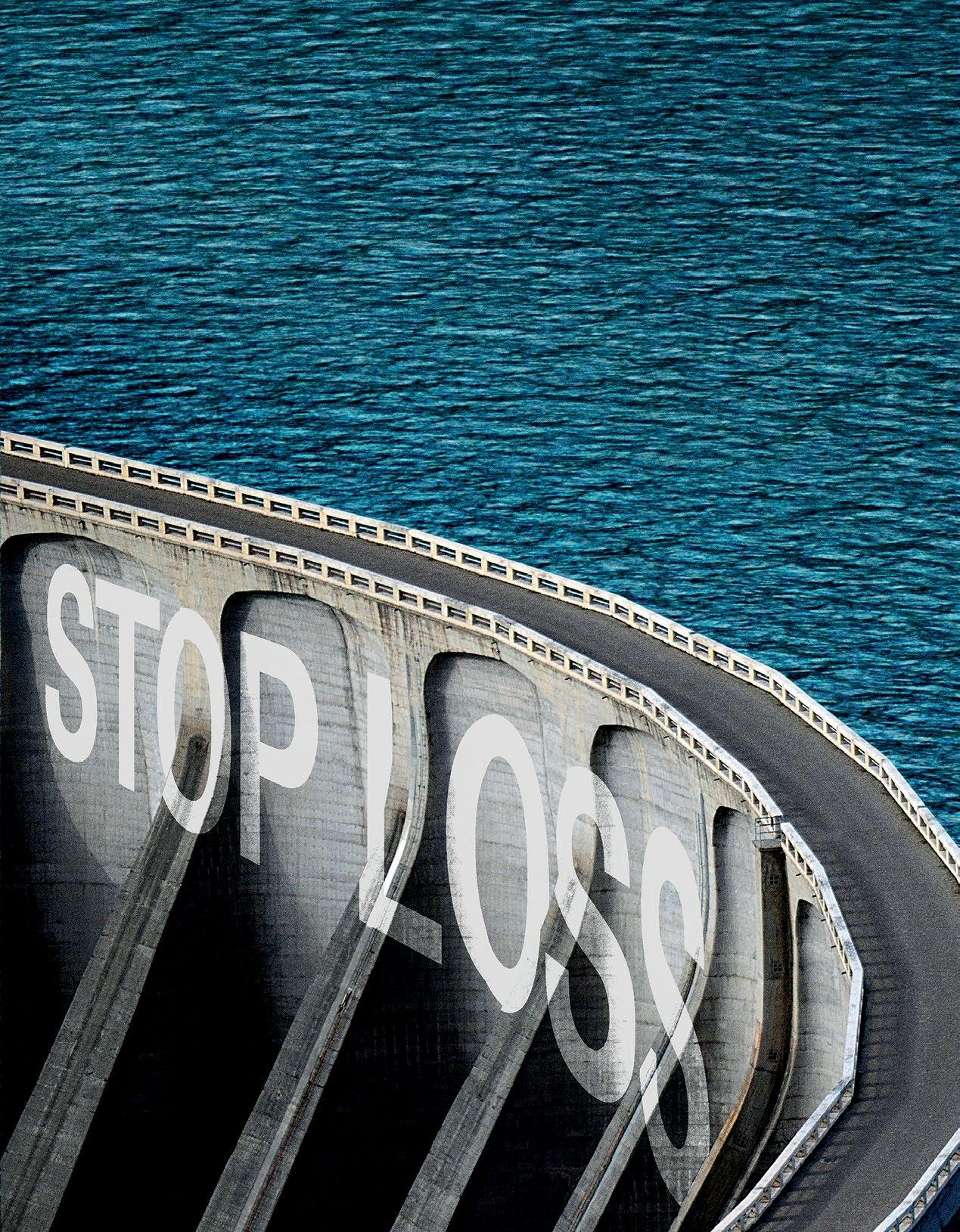

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

• Special Risk Accident

We’ll find the right answers together, so no matter what happens next, you can stay focused on your future.

FEATURES

4 EMPLOYERS PRIORITIZE BEHAVIORAL HEALTH

By Laura Carabello30 STEPPING UP CYBERSECURITY FROM TREATING EMAILS WITH CAUTION TO ENGAGING OUTSIDE EXPERTISE, ERECTING GUARDRAILS HAS BECOME NECESSARY FOR SELF-INSURED PLANS

By Bruce Shutan

By Bruce Shutan

38 INFLATION COSTS IMPACTING CAPTIVE INSURANCE

45 ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES THE AFFORDABLE CARE ACT (ACA), THE HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA) AND OTHER FEDERAL HEALTH BENEFIT MANDATES

51 GENE AND CELL THERAPY: WHERE COMPASSION AND COST COLLIDE

55 NEWS FROM SIIA MEMBERS

PUBLISHING DIRECTOR Bryan Irland, SENIOR EDITOR Gretchen Grote, CONTRIBUTING EDITORS Mike Ferguson and Ryan Work, DIRECTOR OF ADVERTISING Shane Byars, EDITORIAL ADVISOR Bruce Shutan, CEO/Chairman, Erica M. Massey, CFO, Grace Chen

With the glare of the pandemic in the rear-view mirror, employers are re-energizing their efforts to improve the state of employee mental health.

While issues associated with isolation and loneliness exacerbated by COVID-19 still persists, the significant impact of anxiety, depression, substance use disorders (SUDs), financial stress, workplace environment and other looming crises all impact well-being and productivity at work.

Peter Robinson, managing principal, EPIC Reinsurance, shares this perspective, “This is a very timely topic and in reaching out

to various insurers and health plans, I was amazed at the priority this is being given. The impact of behavioral health (BH) on overall morbidity and related health costs is clear. Nearly every health care leader I spoke with referred to BH as a health emergency.”

Indeed, BH might well be an urgent priority given this statistic from the Substance Abuse and Mental Health Services Administration (SAMHSA): one in five adults in the U.S. have a clinically significant mental health or SUD. Furthermore, the prevalence and severity of mental health conditions among children and teens has increased sharply.

“Employers are increasing their BH offerings to employees,” says Deb Adler, CEO, Navigator Healthcare Inc. “This is based upon employers recognizing the importance of their employees’ mental health for productivity, retention, cost savings, and overall health outcomes.”

She cites the factors driving this focus: 1) Mental Healthcare/SUD which are typically the number 5 medical cost for employers, and 2) Anxiety and depression which increased by 25% during the pandemic, according to the World Health Organization.

The National Institute on Alcohol Abuse and Alcoholism found that alcohol consumption increased by 39% and binge drinking increased by 30%.

“The cost of SUD, anxiety and depression and children’s needs for mental health and/or autism services rank very high as increasing the employer’s medical costs the most, year over year,” continues Adler. “Stress and anxiety from meeting either your own personal needs or your family’s needs often results in missed days from work or even being at work but not truly engaged, known as presenteeism.”

Unfortunately, many people fail to receive treatment due in part to the long-standing shortage of BH providers. One indicator of the gravity of this problem is the newest CDC report on suicide which is now ranked

as the second leading cause of death in people aged 10–34 and the fifth in people aged 35–54.

Jakki Lynch RN, CCM, CMAS CCFA. director cost containment, Sequoia Reinsurance Services, emphasizes that BH risk exposure underscores the need for risk mitigation interventions and that these issues have long been a concern of health benefits managers.

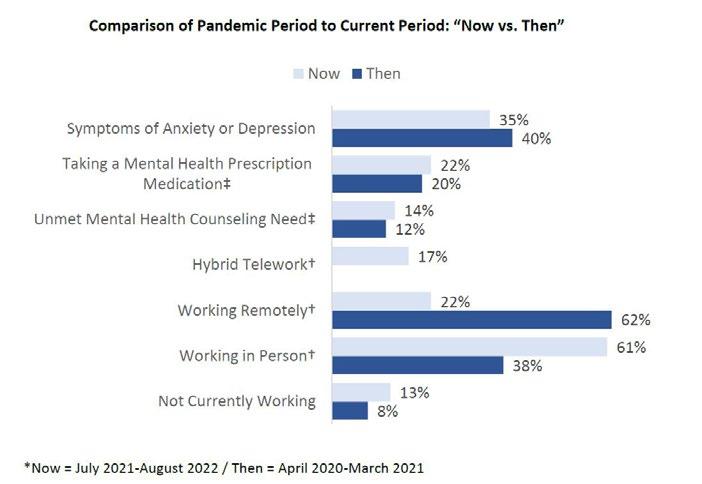

She points out that BH and substance use remain elevated three years after the onset of the COVID-19 pandemic, according to a recent Kaiser Family Foundation/CNN survey. KFF

performed an analysis of U.S. Census Bureau, Household Pulse Survey, 2020-2023 showing that more than 30% of surveyed adults reported symptoms of anxiety and depression, up from 11% in 2019.

“The key message for health plans is abundantly clear,” says Lynch. “The growing mental health crisis places an increased need for more access

In addition to claims and benefits administration, we offer pharmacy benefit management, health and wellness programs and stop-loss insurance, all backed by a dedicated in-house customer support team.

to treatment, and a proactive cost management approach to mitigate the associated BH service expenditures. With the influx in behavioral claim volume, the need for claim payment integrity is paramount for payers as experience shows that BH treatment claims are frequently not supported by the care that was rendered.”

America’s Health Rankings 2022 Annual Report shows that the prevalence of frequent mental distress increased 11% among adults between 2020 and 2021. This is alarming since employees with unresolved depression may experience a reduction in productivity, which may also affect their employers’ profitability. Conversely, a 2019 study from Oxford University found that happy workers are 13% more productive.

There is rising, widespread consensus regarding the need for behavioral health solutions since the advent of COVID. Julie Mueller, president & CEO, Custom Design Benefits reports that within their own book of business, they saw mental health claim costs increase from 3.6% in 2018 to almost 10% in 2022.

“Mental health costs have increased from about $23 PEPM to almost $39 PEPM during this same period,” says Mueller. “It’s obvious that employees and their employers need affordable and cost-effective solutions for mental

health care. However, most of the mental health claims that are coming through our clients’ plans are only treating the symptoms via medication vs. addressing the root cause of the mental health need.”

She suggests that the best solution is one that offers a variety of ways for assistance and meets the patient where they are, adding, “Crisis intervention, virtual visits with a therapist, in-person visits, text therapy, anonymous virtual group therapy sessions, videos and other digital resources can all play a role depending on what the patient needs and where they are in their journey to improve their well-being.”

Lynch cites a new JAMA study showing SUDs cost employersponsored health plans about $35.3 billion per year.

“According to a recent report from NPR, an insurance company received an inpatient rehabilitation claim for the treatment of SUD totaling $660K for 7 months of care and unfortunately, the patient ultimately expired from an overdose,” she continues.

“The three most common types of BH billing errors involve documentation, the number of units billed and plan benefit policy violations,” adds Lynch, citing a recent report from the Department of Health and Human Services’ Office of Inspector General.

“An example of incorrect billing from their report includes providers who billed for both a facility fee and a telehealth service. Two providers—a psychiatrist and psychologist—billed for both a facility fee and a telehealth service for more than 90% of their visits, amounting to nearly 4,000 visits each. The combined duplicate facility fees and telehealth services totaled approximately $1.1 million.”

She describes a recent high-dollar inpatient services claim for substance abuse treatment that was reviewed by her payment integrity team and identified $23,000 (19%) of total contract payable charges of $121,000 -- erroneously submitted from errors involving the number of units billed as the member did not receive the reported hours of treatment.

“Based on the claim payment integrity review, the treatment facility agreed these charges were not payable,” says Lynch. “Plans can successfully implement a comprehensive payment integrity program to mitigate significant risk for mental health encounters and treatment programs.”

Adler advises that the best practice for employers is to provide mental health services at no cost-share for the employees. “This ensures access and the right level of engagement with the high-quality mental health care offered, which leads to lower costs, better outcomes and higher employee satisfaction.”

Mueller explains that the behavioral health services that they administer for clients do not require a co-pay or any out-of-pocket expense.

“Our clients pay a monthly per-employee fee based on the number of

When choosing a provider network or tele-behavioral health solution, employers should be aware that the range of professionals who provide therapy may include different levels of training and capabilities, as described by the Mayo Clinic:

A psychiatrist is a physician — Doctor of Medicine (M.D.) or Doctor of Osteopathic Medicine (D.O.) — who specializes in mental health. This type of doctor may further specialize in areas such as child and adolescent, geriatric, or addiction psychiatry. This provider can identify and treat mental health conditions and A psychiatrist also can offer talk therapy, sometimes called psychotherapy. A psychologist is trained in psychology — a science that deals with thoughts, emotions and behaviors. Typically, a psychologist holds a doctoral degree, such as a Ph.D. or Psy.D. A psychologist can identify and treat many types of mental health conditions. This provider offers different types of talk therapy. In the U.S., most psychologists are not licensed to prescribe medicine. But they may work with another provider who can prescribe medicine if needed.

Less of everything that holds you back. More of everything that makes you great.

From locally-focused to national-scale programs, AmeriHealth Administrators offers a full spectrum of third-party administration and business process outsourcing services. Our scalable capabilities service many unique customers, including self-funded employers, Tribal nations, international travelers, and labor organizations.

We offer innovative solutions, insight, and expertise to help you manage your health plan and capabilities, control costs, and support employees’ health.

Visit amerihealth.com/tpa

A psychiatric mental health nurse (P.M.H.N.) is a registered nurse (R.N.) with training in mental health issues. A psychiatric mental health advanced-practice registered nurse (P.M.H.-A.P.R.N.) has at least a master’s degree in psychiatric mental health nursing. Other types of advanced-practice nurses who offer mental health services include a clinical nurse specialist (C.N.S.), a nurse practitioner (N.P.) and a nurse with a doctorate of nursing practice degree (D.N.P.). The services offered by mental health nurses depend on their education, level of training, experience, and state law. They can identify and treat mental illnesses. If state law allows, advanced-practice nurses can prescribe medicine.

A physician assistant (P.A.) practices medicine as a primary care provider or works together with a physician. Physician assistants can specialize in psychiatry and can identify and treat mental health conditions. They also can counsel on causes, treatments, and outlook.

A physician assistant can prescribe medicine.

Licensed clinical social worker

Look for a licensed clinical social worker (L.C.S.W.) with training and experience in mental health. A licensed clinical social worker must have a master’s degree in social work. Some have a doctorate in social work. Social workers offer assessment, counseling and a range of other services. What services they offer depends on their licensing and training. They are not licensed to prescribe medicines. But they may work with another provider who can prescribe medicine if needed.

Licensed professional counselor

Training required for a licensed professional counselor (L.P.C.), licensed clinical professional counselor (L.C.P.C.) or similar titles may vary by state, but most have at least a master’s degree with clinical experience. These licensed counselors identify mental health conditions and give counseling for a range of concerns. They are not licensed to prescribe medicine. But they may work with another provider who can prescribe medicine if needed.

Skyrocketing prices. Administrative challenges. Shock claims. Aging workforces. At Amwins Group Benefits, we’re here to answer the call. We provide solutions to help your clients manage costs and take care of their people. So whether you need a partner for the day-to-day or a problem solver for the complex, our goal is simple: whenever you think of group benefits, you think of us.

We help you win.

The benefits landscape is broad and complex.

A marriage and family therapist (M.F.T.) is trained in family and individual therapy. This type of therapist can help people to overcome family problems or issues in other relationships. They have at least a master’s degree. License and certificate requirements vary by state. Look for a licensed marriage and family therapist (L.M.F.T.). These therapists may work independently or in partnership with other professionals.

Employers should be cognizant of these medicines since they impact the drug benefit plan. Antidepressants are common prescription medications that can help treat depression and other conditions like anxiety and obsessive-compulsive disorder.

There are several types of antidepressants, and each individual should consult with a healthcare provider to find the best one for his/her condition.

Antidepressants were invented in the 1950’s and today, a new generation of drugs for depression is stirring excitement and transforming the way scientists and clinicians diagnose, treat and think about the illness. Antidepressants are one of the most frequently prescribed medications in the United States. The Cleveland Clinic advises antidepressants are simply one type of treatment for depression. While they can treat the symptoms of depression, they don’t always address its causes. This is why healthcare providers often recommend psychotherapy therapy in addition to depression medication.

One prescription digital therapeutic (DT) that is aimed at treating alcohol use disorder (AUD) was recently granted breakthrough device designation by the FDA.

While this suggests the regulatory agency believes the therapy has the potential to provide substantial improvement in patient care compared to existing therapies, not all mental health apps may be ready for prime time.

The demise of the two leading, well-funded companies tells a different story.

One company had a clearance for software as a medical device for mental health and may have offered a pathway toward improved access, remote diagnosis and monitoring of mental health conditions –even help to cure addiction.

But neither company was able to invest the money to carry out the necessary scientific research. While DT companies may be stumbling in 2023, industry observers remain hopeful that this approach will achieve scientific reality.

The terms “behavioral health” and “mental health” are often used interchangeably, but there are subtle differences and approaches to managing problems.

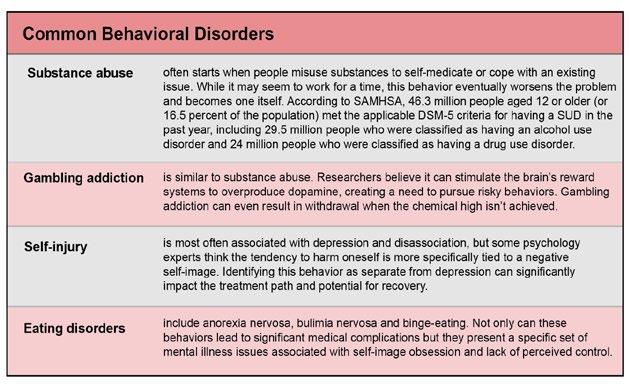

Behavioral Health as defined by the American Medical Association generally refers to SUD, life stressors and crises, and stress-related physical symptoms. The discipline examines how a person’s habits impact their overall physical and mental wellbeing and has more to do with the specific actions people take and how they respond in various scenarios.

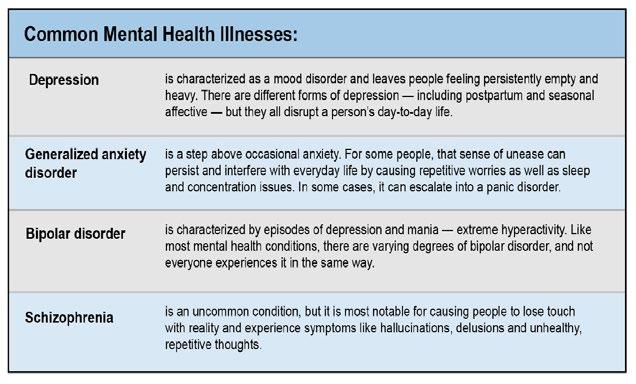

Mental health as defined by The World Health Organization is “a state of wellbeing in which every individual realizes his or her own potential, can cope with the normal stresses of life, can work productively and fruitfully and is able to make a contribution to his or her community.”

The term encompasses a number of factors, such as the individual’s biology, psychological condition and habits and has more to do with thoughts and feelings.

Negative behaviors don’t always accompany these mental health conditions. Most everyone with depression, for example, experiences sleep issues. But not everyone develops a behavioral disorder. When a distinct, regular behavior that goes beyond the scope of a typical mental illness begins to negatively affect someone, it becomes a disorder that typically requires more specific treatment.

Sources:

https://www.samhsa.gov/data/sites/default/files/cbhsq-reports/NSDUHFFR2017/ NSDUHFFR2017.pdf

https://wisqars.cdc.gov/data/lcd/home

https://www.samhsa.gov/data/report/2017-nsduh-annual-national-report

https://www.scientificamerican.com/article/how-the-brain-gets-addicted-togambling/

https://www.apa.org/monitor/2015/07-08/self-injury

https://www.mentalhealth.gov/what-to-look-for/mental-health-substance-usedisorders

https://www.nimh.nih.gov/health/publications/eating-disorders

Sources: Alvarado Parkway Institute. https://apibhs.com/2018/05/10/the-differencebetween-mental-and-behavioral-health

https://www.nimh.nih.gov/health/statistics/any-mood-disorder

https://www.nimh.nih.gov/health/topics/depression

https://www.nimh.nih.gov/health/topics/anxiety-disorders

https://www.nimh.nih.gov/health/topics/bipolar-disorder

https://www.nimh.nih.gov/health/topics/schizophrenia

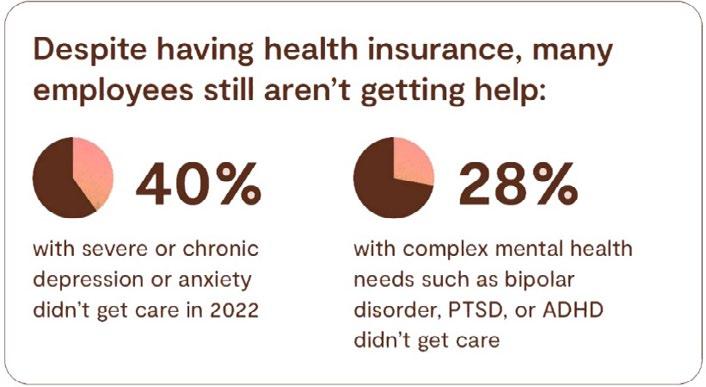

According to the 2023 State of Workforce Mental Health (Lyra) which surveyed more than 2,500 employees and more than 250 employee benefits leaders at companies in the United States with global workforces:

• Most workers face mental health struggles but, for myriad reasons, many don’t get help

• Many employees struggle to get the right care

• More people are discussing mental health at work, propelling a culture shift

• Managers lack needed mental health resources

• Employees are increasingly stressed and burned out, signaling a need for better work design.

Specifically, 86% faced at least one mental health challenge in the past year, ranging from issues like stress and relationship problems to chronic depression and anxiety, SUD and suicidal thoughts. Just 33% said they received mental health support last year, which includes seeing a therapist or psychiatrist, and using self-care resources such as stress reduction apps.

A TELUS Health survey showed that 21% of US employees are at high mental health risk and 42% are at moderate risk, but many people remain unaware of the mental health resources available to them through workplace benefit programs.

Paula Allen, global leader, Research and Total Well-being, TELUS, offers advice for plan sponsors and advisors to help employees and their families better cope with the current stressors.

She says, “Communication that workers can relate to, that includes advice on next steps and that is repeated often enough for them to remember, can help increase their use of available benefits. Members often do not know the range of resources available to them in their benefits packages and are often unaware of counseling included in the company’s employee assistance program.”

Source: 2023 State of Workforce Mental Health. Lyra Health

Adler calls out the lack of access to mental health providers through traditional channels (health plan network, EAP). “This has led employers to add multiple BH solutions to their mental health and wellbeing platforms. Adding BH navigational services to help guide employees and dependents to the right type of care quickly and seamlessly also “moves the needle” in satisfaction.”

The Society for Human Resource Management found that 78% of organizations currently offer or plan to offer mental health benefits this year, but utilization and accessibility are major hurdles for those seeking care.

Notably, six out of 10 adults who say their mental health is only fair or poor have not been able to access services, according to a 2022 survey from CNN and the Kaiser Family Foundation.

Studies confirm that the U.S. has a shortage of mental health providers and estimates are that the country will be short between 14,280 and 31,109 psychiatrists in the next few years.

This is problematic for employees who finally decide that they need help and may not be able to find it. Too often they get a list of doctors participating in the plan but discover that those doctors already have too many patients – or they don’t return calls in a timely manner and may not get back to them until a week later or longer.

Results of a study conducted by the Integrated Benefits Institute (IBI) on mental health concerns among employed adults ages 18-64 in the United States reveals that while employers have existing efforts to support mental health in the workforce, the pandemic greatly accelerated the progress of these efforts.

IBI researchers also report that because mental illness is often accompanied by other comorbid conditions such as diabetes and heart disease, providing options that help employees coordinate their care is important.

There is consensus regarding the importance of helping employees find mental healthcare that is culturally appropriate, that they value, and that they can identify with. All agree that adopting a prevention mindset for mental illness, as they do for physical illness, is a step forward.

Employees do care about mental health benefits. A new poll from the American Psychological Association Work and Well-being Survey reveals that 81% of employees would prefer to work for companies that provide support for mental health concerns.

The survey also reports that one-third of workers said their company’s mental health initiatives have improved since the pandemic began and 71% of respondents said they believe their employer is more concerned about employees’ mental health now than they were in the past.

In addition to mental health support, the PSA survey indicates employees would also like to see:

• more flexible work hours (41%)

• a culture that respects paid time off (34%)

• the ability to work remotely (33%)

• a 4-day work week (31%)

Increasing access to treatment is a key part of the solution. There is growing recognition of the value of BH integration (BHI), defined as the result of primary care teams (or teams in other care settings) and behavioral clinicians working together with patients to provide

Source: Integrated Benefits Institute

Driving better outcomes in partnership with:

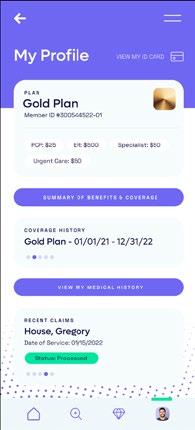

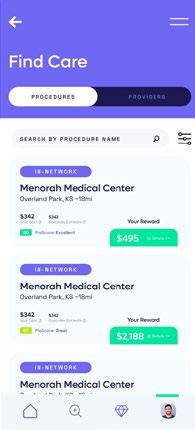

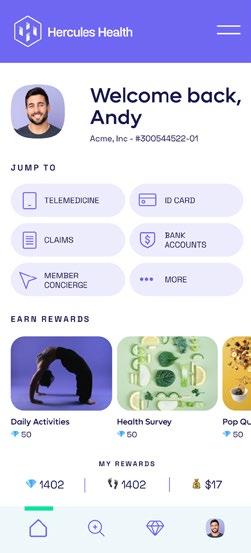

Healthcare navigation, guidance and support with live concierge and an intuitive app

Here’s how:

Healthcare Navigation

Full-service population health, clinical and risk management solutions

• Easy mobile access to benefits information and ID cards

• Provider matching, price transparency and appointment booking

• Steerage to third-party solutions—saving time and frustration

Coordinated Care Management

• Proactive member engagement

• Integrated daily claims and pre-certification for cost-saving steerage

• Targeted clinical programs including discharge planning, high-risk pregnancies, pediatrics, and oncology

Join us June 6 th to learn more about how MedWatch is disrupting the status quo! Register today for the Premier Solution webinar.

At HPI, we’re staying ahead of high-cost claims by proactively steering members to quality, cost-effective care.

patient-centered care using a systematic approach.

It’s an approach to delivering mental health care that makes it easier for primary care providers to include mental and BH screening, treatment, and specialty care into their practice.

The CDC advises that the BHI approach enables the primary care provider to receive consultations by phone about a diagnosis and treatment plan from the care provider for mental health.

For example, practicing together in a co-location model, the primary care practice has a care provider for mental health practicing onsite who is responsible for screening and referrals and may provide therapy.

To improve referrals and communication, a care coordinator manages referrals to care providers for mental health and needed social services and maintains communication between the primary care practice and care providers for mental health.

BHI can result in better outcomes for children and youth, more efficient and coordinated care, higher treatment rates, reduced stress and improved consumer satisfaction.

According to a 2020 RAND study conducted in collaboration with the AMA, while physician practices had broad motivations for BHI, they faced multiple barriers to successful integration including cultural differences, incomplete information flow between behavioral and nonbehavioral health clinicians and billing difficulties.

Overcoming these barriers to BHI adoption is now possible through the introduction and adoption of tele-behavioral health or as the NIH National Institute of Mental Health terms this “tele-mental health”: the use of telecommunications or videoconferencing technology to provide mental health services.

Sometimes referred to as telepsychiatry or telepsychology, research suggests that tele-mental health services can be effective for many people, including, but not limited to those with attention-deficit/ hyperactivity disorder (ADHD), post-traumatic stress disorder (PTSD), depression, and anxiety.

Today, forward-looking healthcare organizations are integrating primary care and behavioral care services into one seamless care model.

Michael Brombach, COO, Recuro Health, says, “There is significant value when BH services are embedded with primary care. The impact spans lower costs, improved outcomes and better member experience scores. We thoughtfully designed and implemented our behavioral health solution to be a part of our core care model, enabling members to access the right level of both behavioral health and primary care services. Our capability navigates members to their primary care doctor, a counselor or a psychiatrist based on their conditions, history, and acuity.”

Telehealth has become a key driver to increasing access to behavioral health services. With growing patient demand and greater regulatory flexibility, adoption of tele-behavioral

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health. Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

health is only rising. Recuro’s BH solution is comprehensive and includes therapy, counseling, psychiatry and medication management, all offered through secure and private online video and phone sessions.

“Now, more than ever, Americans are struggling at home and work with mental health issues that fall under the behavioral health umbrella,” Brombach continues. “Consumer demand, along with physician appetite for new behavioral health models, enables virtual care companies to innovate in this space. Recuro’s care team model, culturally

intentional care approach and inclusion of optional pharmacogenomics for medication management are a few of the recent advancements we released to the market.”

As stigmas around mental health are subsiding, Brombach says that BH is becoming more accepted and accessed as part of its virtual care model, connecting patients and providers face-to-face in real-time as part of a virtual first approach to care.

“We look forward to continuing to innovate in this space to ensure individuals have access to the BH care they need, when they need it, at an affordable cost,” he concludes.

Adler also observes an increase in the use and offering of digital program delivery, adding, “Treatment of mental health disorders has shifted from primarily in-person care delivery models to digital models of care as a result of the COVID-19 pandemic. With more options for employees and for best clinical outcomes, treatment should be matched to the employee’s need and situation.”

She says that virtual visits may be best for employees who work shifts or want to have their treatment in the evening and for others, in-person services is preferred.

“Navigator Healthcare was founded to let employees engage with a 24/7 clinical Navigator to help guide them to the right level and setting of care based on their individual situation and personal preferences (virtual or in-person), assisting individuals with an evaluation appointment within 48 hours - saving the employee time and providing a seamless concierge experience,” she adds.

Mueller points to a partnership that Custom Design Benefits has with CuraLinc HealthCare and its SupportLinc assistance program.

“We implemented it for our own employees first and then introduced it to our clients at our 2022 Annual Customer Conference,” she explains. “Over 10% of our group clients have adopted the program since we rolled it out in early 2023 and we expect more to add the service on or before their annual renewal.”

She says that one plus is that Custom Design Benefits has its own Medical/Case Management services in-house.

The company’s nurses can educate members on the various resources the CuraLinc digital solution provides and refer them to a therapist covered under their health plan if they need additional assistance beyond the sessions covered at 100% with CuraLinc.”

As background, mental health parity describes the equal treatment of mental health conditions and SUDs in insurance plans.

In 2008, Congress passed the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act (MHPAEA) to ensure equal coverage of treatment for mental illness and addiction as they do with medical and healthcare-related benefits. benefits. The Affordable Care Act (ACA) also extended parity to non-grandfathered individual insurance plans and small group health plans.

Parity applies to quantitative treatment limitations (QTLs), for example restrictions on the number of days, episodes, or treatments that are covered and financial requirements, such as copays and coinsurance.

More recently, Congress expanded mental health parity law to also

include a parity analysis related to non-quantitative treatment limitations (NQTLs). This sixpart test creates documentation standards to ensure that the use of utilization review or prior authorization requirements are not more restrictive for BH benefits coverage than for other medical and surgical coverage.

A plan following the federal mental health parity law must cover equally the six classifications of benefits defined in MHPAEA final rules: (1) inpatient, in-network; (2) inpatient, out-of-network; (3) outpatient, in-network; (4) outpatient, out-of-network; (5) emergency care; and (6) prescription drugs.

Federal parity also applies to clinical criteria used by health insurers to approve or deny mental health or substance use treatment.

The standard for medical necessity determinations— whether the treatment or supplies are considered by the health plan to be reasonable, necessary, and/or appropriate—must be made available to any current or potential health plan member upon request. The reason for denials of coverage must also be made available upon request.

Here’s the challenge:

There are Issues surrounding NQTLs: the processes, strategies,

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 45 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

evidentiary standards, or other criteria that limit the scope or duration of benefits for services provided under the plan. In support of its members, SIIA has been involved in coalition and congressional discussions between mental health providers and employer groups.

Ryan Work, senior vice president, Government Relations, explains, “The entire NQTL requirement is vague, and SIIA is working hard to push the DOL to issue clarifying durance or model NQTL language to support and help with MHPAEA compliance. As noted above, MHPEA is a federal law that generally prevents group health plans and health insurance issuers that provide mental health or substance use disorder (MH/ SUD) benefits from imposing less favorable benefit limitations on those benefits than on medical/ surgical benefits.”

Work continues, “My understanding is that the DOL has yet to see an acceptable NQTL report at first pass. Not a single one. As the Report to Congress outlines, the Employee Benefits Security Administration (EBSA) has conducted nearly 90 investigations thus far, and issued hundreds of letters for comparative NQTL analysis.”

However, while the DOL has not seen an acceptable report, it has also not provided an example of what an acceptable one may look like. Hopefully, they will soon be updating the self-compliance tool.

In the meantime, the DOL has outlined a number of common NQTL shortfalls, including:

• Conclusory assertions lacking specific supporting evidence or detailed explanation

• Non-responsive comparative analysis

• Documents provided without adequate explanation

• Failure to identify the specific MH/SUD and medical/surgical benefits or MHPAEA benefit classification(s) affected by an NQTL

• Limiting scope of analysis to only a portion of the NQTL at issue

• Failure to demonstrate the application of identified factors in the design of an NQTL

By loosening limitations on telehealth during the pandemic and extending those flexibilities in Medicare in the FY 2023 omnibus bill, Congress has significantly elevated the successes of telehealth.

Legislative developments also continue to boost the use and expansion of telehealth as a critical component of rendering behavioral healthcare, including extended flexibilities in providing such care, removal of geographic restrictions, loosening of certain healthcare supervision requirements and extension of greater flexibility for prescribing controlled substances in connection with medication assisted treatment (MAT).

The MH/SUD stakeholder community applauds these moves and is now calling on Congress to make those flexibilities permanent.

Employees that request a leave to address their or their family member’s mental illness are protected under the US Department of Labor Family Medical Leave Act (FMLA) which is available to:

• Eligible employees: Employees are eligible if they work for a covered employer for at least 12 months, have at least 1,250 hours of service for the employer during the 12 months before the leave, and work at a location where the employer has at least 50 employees within 75 miles.

• Covered Employers: Private employers are covered employers under the FMLA if they employed 50 or more employees in 20 or more workweeks in the current or preceding calendar year, including joint employers or successors in interest to another covered employer. Public agencies, including a local, state, or Federal government agency, and public and private elementary and secondary schools are FMLA covered employers regardless of the

Medical Stop Loss from Berkshire Hathaway Specialty Insurance comes with a professional claims team committed to doing the right thing for our customers – and doing it fast. Our customers know they will be reimbursed rapidly and accurately – with the certainty you would expect from our formidable balance sheet and trusted brand. That’s a policy you can rely on. Reimbursement

right. www.bhspecialty.com/msl

number of employees they employ.

FMLA requires employers to:

• provide 12 work weeks of FMLA leave each year;

• continue an employee’s group health benefits under the same conditions as if the employee had not taken leave; and

• restore the employee to the same or virtually identical position at the end of the leave period.

• FMLA may be unpaid or may be used at the same time as employer provided paid leave.

FMLA also designates specific mental and physical health conditions for eligibility, including

if the employee requires inpatient care or ongoing treatment from a medical provider — severe conditions might include a hospital stay or seeking help at a treatment facility.

Often, employers require the medical provider — such as a psychologist or psychiatrist familiar with the person’s mental health history — to furnish a letter explaining the condition’s ability to encumber the employee.

The letter may also indicate whether a chronic mental health condition necessitates immediate, ongoing treatment.

In a turbulent domestic and world environment, improving mental health in the workplace is becoming a priority. Employers are beginning to emphasize employee well-being -- not simply as an obligation -- but as an opportunity to enhance productivity and retain top talent.

Going forward, mental health benefits are expected to become the norm with further regulations in place.

The escalating cost of providing prescription drug coverage is at the forefront of employers’ minds. Work with an experienced trusted partner who can help navigate this complex world. ELMCRx Solutions is that partner – Results Oriented, Accurate and Clinically Based.

“While there may be some generational differences in behavioral health stigma, it has declined significantly over the past decade across all demographics,” says Adler. “With the advent of ‘mental health days’, employers increasingly offering access to behavioral health tools and services beyond EAP and the media coverage of mental health issues/trends during the pandemic will continue to reduce stigma. Employers are able to directly reduce stigma in BH by offering access to more mental health solutions and discussing the importance of behavioral healthcare.”

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel, and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

h ttps://www.benefitspro.com/2023/01/16/health-care-2023-what-doesthe-new-year-hold/ https://www.uhc.com/broker-consultant/news-strategies/resources/healthcare-trends-impacting-employers-2023

https://www.cms.gov/cms-behavioral-health-strategy

https://blog.telehealth.org/2023-preview-of-telemental-health-laws-

behavioral-telehealth-regulations/ https://www.polsinelli.com/ publications/polsinelli-top-issuesin-behavioral-health-2023newsletter

https://polsinelli.gjassets.com/ content/uploads/2023/02/ March_23_Behavioral_Health_ Newsletter.pdf

https://www.ama-assn.org/ delivering-care/public-health/whatbehavioral-health

https://www.ama-assn.org/ delivering-care/public-health/ compendium-behavioral-healthintegration-resources-bhi-basics

https://apibhs.com/2018/05/10/thedifference-between-mental-andbehavioral-health

https://www.uhc.com/brokerconsultant/news-strategies/ resources/health-care-trendsimpacting-employers-2023

https://www.healthline.com/health-news/over-80-of-us-workers-seek-employers-who-care-about-their-mentalhealth#What-the-APA-survey-shows

https://apibhs.com/2018/05/10/the-difference-between-mental-and-behavioral-health

https://www.ama-assn.org/delivering-care/public-health/behavioral-health-integration-physician-practices-randstudy

https://www.umassglobal.edu/news-and-events/blog/comparing-behavioral-health-vs-mental-health

https://www.nimh.nih.gov/health/publications/what-is-telemental-health#:~:text=Telemental%20health%20 is%20the%20use,to%20provide%20mental%20health%20services.

https://get.lyrahealth.com/whitepaper-2023-state-of-workforce-mental-health-report.html?utm_

source=google&utm_medium=paidsearch&utm_campaign=pa-2023-q1-search-google-2023-workforce-mentalhealth&utm_content=mental-health-state-2023&utm_term=mental%20health%20and%20work&campaignid= 14807085567&adgroupid=127227439345&adid=649605853108&gclid=CjwKCAjwitShBhA6EiwAq3RqA7ua1p5aM3iJR4i4axtW0cJLYtkNBJ1iKNmwSWwgg8XvlngdSQzJhoCtHsQAvD_BwE

https://www.benefitspro.com/2023/04/11/21-of-workers-at-high-mental-health-risk-and-unaware-of-availablecounseling/ https://lifeworks.com/en/media/1640/download?inline

https://www.dol.gov/agencies/whd/fact-sheets/28o-mental-health#:~:text=The%20Family%20and%20 Medical%20Leave,to%20address%20mental%20health%20conditions

https://www.benefits.gov/benefit/5895

https://www.dol.gov/sites/dolgov/files/EBSA/laws-and-regulations/laws/mental-health-parity/report-tocongress-2022-realizing-parity-reducing-stigma-and-raising-awareness.pdf

https://www.dol.gov/sites/dolgov/files/EBSA/laws-and-regulations/laws/mental-health-parity/mhpaeaenforcement-2021.pdf

https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/aca-part-39-final.pdf

https://blog.nisbenefits.com/resources-finalized-for-mental-health-parity-compliance

https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/mental-health-and-substance-use-disorder-parity

https://www.benefitnews.com/news/how-to-design-mental-health-benefits-employees-will-use

https://pubmed.ncbi.nlm.nih.gov/29540118/

https://www.dol.gov/agencies/whd/fact-sheets/28o-mental-health

https://my.clevelandclinic.org/health/treatments/9301-antidepressants-depression-medication https://www.socialworkers.org/practice/clinical-social-work

https://www.mayoclinic.org/diseases-conditions/mental-illness/in-depth/mental-health-providers/art-20045530

https://www.benefitnews.com/advisers/opinion/fmla-to-support-employee-mental-health?position=ed itorial_1&campaignname=V2_EBN_Daily_Views_20210421-02152023&utm_source=newsletter&utm_ medium=email&utm_campaign=V2_EBN_Daily_Views_20210421%2B%27-%27%2B02152023&bt_

ee=AzzLSdLf5k4I%2BkMW93l%2BTm1eA1XbFkLuNu9Zr5yHDuUXoZbX80NmPm8xhkQMPYRL&bt_ ts=1676494857901

https://www.cms.gov/cms-behavioral-health-strategy

https://www.managedhealthcareexecutive.com/view/aud-therapy-wins-fda-s-breakthrough-device-designation https://www.benefitnews.com/news/reminding-employees-about-their-mental-health-benefits-reduces-stigmaand-improves-engagement

https://healthpayerintelligence.com/news/top-5-common-conditions-driving-employer-healthcare-spending)

Staying healthy depends on being proactive. So does spend management. At Vālenz® Health, we believe lowering healthcare costs is driven by the ability to engage early and often in the member’s healthcare journey.

Before a claim even begins, we use data to identify cost, network and plan design opportunities to drive cost containment and improved health outcomes for members. We ensure everyone is aligned. There are no surprises – just reduced costs, better outcomes, and an improved member experience from start to finish.

That’s our promise to you. This is precisely why our customers stay with Valenz, because no one else does what we do.

See how Valenz engages early and often to deliver smarter, better, faster healthcare: visit valenzhealth.com or call (866) 762-4455.

Proud to be a Diamond Member

Proud to be a Diamond Member

FROM TREATING EMAILS WITH CAUTION TO ENGAGING OUTSIDE EXPERTISE, ERECTING GUARDRAILS HAS BECOME NECESSARY FOR SELFINSURED PLANS

Written By Bruce ShutanAAs the workplace deepens its digital footprint and electronic medical records become the norm, efforts to shore up cybersecurity protection have become a necessary cost of doing business across the selfinsurance community.

Cybercriminals are increasingly mining health care data by making payers, providers and plans their top targets last year, according to a recently released report from Fortified Health Security. The number of medical record breaches increased to 51.4 million, which was up from 49.4 million the previous year, with more than 78% attributed to hacking and IT incidents. In addition, health care providers remain the overwhelming source of breaches, accounting for 70% of 2022 incidents.

Industry observers often say that these thieves are more sophisticated with their attacks, which is why cybersecurity protection is an area where expertise cannot be understated.

“My biggest recommendation would be to look for a very look for a good outside vendor who can support your company and meet with that entity once a month just to review their protocols,” says Mary Ann Carlisle, chief operating officer of ELMCRx Solutions, LLC, which assists selfinsured employers in managing their prescription drug benefits. “It’s an investment in your company and a lot less expensive than trying to build all of that inside your own organization.”

In keeping with ERISA’s fiduciary standard to act in the best interest of plan participants, PlanTools, LLC CEO David Witz explains that advisers must obtain on behalf of the plan sponsors they serve an annual due diligence report on cybersecurity for two reasons. One is that documentation demonstrates a fiduciary process. Also, it helps the commercial insurance carrier supplement its policy with the appropriate terms and coverage to protect employers from cybersecurity claims.

Like all benefit plan sponsors and administrators, self-insured health plan administrators are obliged to monitor and ensure that the recordkeeper has state-of-the-art cybersecurity protections in place, says Susan Rees, an attorney with extensive ERISA experience with the Wagner Law Group. But plans and plan fiduciaries also must be prepared to have their own cyber insurance policy to help mitigate these risks, she adds.

Liability for cybersecurity breaches may include civil or criminal penalties under the Health Insurance Portability and Accountability

Act, as well as litigation expenses related to participant claims for ERISA fiduciary breach or state privacy and security violations, notes Sarah Bassler Millar, a partner at Faegre Drinker.

Given how technology has evolved since HIPAA took effect in 1996 and in light of remote work’s increasing popularity, she advises plan sponsors to review their privacy and security policies and procedures. With so many working Americans logging into their laptops at home, local coffee shops or on the road, more personal data is now at risk for hacking than ever before.

There also are state and federal regulatory challenges to consider. “One of the problems is that the recordkeepers are subject to state law, and state privacy laws will give participants a cause of action against the recordkeeper where that same cause of action against the plan sponsor or plan fiduciaries is most likely preempted by ERISA,” Rees explains. “So recordkeepers are on the line for sure.”

Another obstacle is that there’s limited case law and the most noteworthy litigation involves retirement plan assets rather than health plans. All lawsuits involving cybersecurity breaches of employee benefits plan participant data or assets have been settled at the district court level, she notes. “So we don’t have any strong legal guidance on some of the issues,” she explains.

This void has been partially filled by the Department of Labor (DOL), which in April 2021 issued a dozen best practices that plan sponsors, fiduciaries, recordkeepers and participants can follow to reduce the risk of sensitive employee medical information falling into the wrong hands.

Although, it seems like the courts, and DOL are inclined to take the position that “when a recordkeeper’s computer system gets hacked, it’s the responsibility of that service provider to have provided an adequate service to the plan to protect the plan assets and plan data,” Rees says, describing the DOL guidance as good advice.

Among the noteworthy court cases, three involve lawsuits against Alight Solutions LLC, a cloud-based human capital and technology services provider. One of the first publicized cases of a cybersecurity breach in the employee benefits arena was

filed in April 2020. A U.S. district court judge presiding over Bartnett v. Abbott Laboratories dismissed claims against the plan fiduciaries involving the theft of $245,000 from the plaintiff’s retirement plan account, but allowed both ERISA and state law claims to proceed against Alight Solutions. The vendor was named as a defendant in a separate suit filed by a participant in Estee Lauder’s 401(k) plan over $99,000 in missing assets, which was settled in March 2020, and also subject to a DOL successful subpoena enforcement action in the Seventh Circuit.

Another case filed in July 2022 involving Alight that Rees says serves as a cautionary tale is Disberry v. Employee Relations Committee of the Colgate-Palmolive Co. et al. The plaintiff, a retired Colgate-Palmolive marketing executive named Paula Disberry, alleged a breach of fiduciary duty under ERISA after a cyberthief emptied more than $750,000 from her 401(k) plan.

With regard to this ruling, she says the judge seemed to suggest that the parties needed to figure out a way to pay the plan participant her money and greenlit the case for trial. “It’s almost like the judge was helping the participant to make her case, which is really not the job of a district judge,” according to Rees, who assumes this case will be settled.

While cyber thieves continue to crack complicated codes, they also know all too well the value of simple schemes of deception. One of the most underrated areas of cybersecurity breaches involves email, observes Michael Carrara, CEO of Hi-Tech Health, whose claims management platform is used by third-party administrators, carriers and provider-sponsored plans.

“People don’t understand an email is not secure by nature,” he says. “All it takes is a name associated with an address, date of birth and the first three of a Social Security number, and people can take out car loans, mortgages and credit cards. It’s really scary.”

“Fatima

“I've

The explosion of artificial intelligence is expected to further complicate cybersecurity protection. Carrara has little doubt that AI is becoming involved with “phishing” attacks that send fake emails or other messages that look like they’re from reputable companies. The purpose of this fraudulent activity is to induce individuals to reveal personal information such as passwords and credit card numbers. “I get bills from FedEx with the company’s logo and everything,” he reveals. “Sometimes the attacks are hard to decipher whether they’re real.”

One of the most recent hacking attempts Carrara has noticed involves what he describes as “brute force threats from these bad actors who are constantly trying to infiltrate through different holes in your firewall.”

Apart from having a dedicated department whose sole concern is cybersecurity, Hi-Tech Health relies heavily on its partners and tries to stay at the forefront of this topic through seminars and blogs. Other steps include moving all systems to a tier-one data center’s managed hardware platform whose firewalls are safely maintained and the company is constantly apprised of threats. Different layers of protection also allow Hi-Tech Health to take advantage of everything from Center for Internet Security protocols to expertise from in-house network engineers.

Carrara’s employees also undergo monthly online training with different scenarios and an annual penetration test from different third-party companies that supplements weekly penetration tests from Carson & Saint, a security and management consulting firm. In addition, Soc 1 and Soc 2 audits, which stand for service organizational control, are done to protect financial controls as well as security, processing integrity, confidentiality and privacy.

Cybersecurity compliance is difficult enough in the U.S., but those efforts expand even further when it involves overseas business. Since Hi-Tech Health’s client base is worldwide, for example, the company is subject to general data protection regulation rules in Europe, as well as HIPAA in the U.S.

Another protective layer that has become a table stake for self-insured employers and their partners is cybersecurity insurance, which Carrara says is mandatory in this climate, noting that his firm has $2 million in coverage for each incident. “It’s not only government that’s being attacked,” he explains. “It’s health insurance. It’s banking. It’s retail. Attacks are doubling.”

While perfect protection against cybersecurity breaches is always the goal, and the vast number of attacks are thwarted, the reality that some health plan sponsors and participants face can be harsh. Adds Rees: “Some of the human errors that have enabled hacking up to this point are fairly low level. There are hundreds, if not thousands, of attempts to hack into plans and service providers, and 99% of them are unsuccessful. All it takes is that 1%.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 30 years.

Markel has developed a strategic collaboration with Nevaeh to provide new product solutions for employer accident and health coverage.

Nevaeh products have distinct advantages, but working together provides a leveraging effect that’s called the Nevaeh advantage which includes:

• Employer stop loss insurance

• Supplemental medical and accident insurance

• Outpatient, PBM carve-out plans

For more information, visit nevaehinsurance.com

Self-insured health plans and their vendor partners should be following these five steps to stay ahead of cyber thieves and protect highly sensitive personal information, suggests Mary Ann Carlisle, chief operating officer of ELMCRx Solutions, LLC. They include:

1. TFA or MFA: Two factor authentication, or TFA for short, will send a code to one’s smartphone whenever a password is changed, which must be entered in order to access an online account. When two or more steps are required every time someone logs into a system, it’s called multi factor authentication, MFA for short.

2. VPN or VDI: Securing work conducted in a virtual personal network known as a VPN or virtual desktop interface known as VDI will keep information private and secure. Working through a cloud or server-based system that requires entering an email address and password that generates an authentication code is safer than logging into a computer’s local drive, which creates a risk if the computer is lost or misplaced.

3. Public facing: Information that is stored on a company website is considered “public facing” content made available to the general public. It can be easily obtained by cyber thieves who break into the back end of a website. Medical information stored in the VDI is more safely contained in that ecosystem and is not public facing.

4. Scanned attachments: One of the most basic cybersecurity efforts involves scanning attachments for malware and viruses before making them available to recipients to be safely opened. Advanced threat protection scans attachments for these threats and ensures that any Word, Excel, PowerPoint, etc. documents are legitimate.

5. Phishing tests: Monthly phishing tests, along with mandatory training on this issue, will help walk users opening attachments or clicking on embedded links and how to spot red flags. One such example is when the sender’s email address doesn’t match up with the organization that is being impersonated to poach personal information. Any cyber threats should be documented and included in a monthly report to the cybersecurity carrier.

At

•

•

•

•

•

•

•

•

•

•

Written By Caroline McDonald

Written By Caroline McDonald

TThe rising prices of goods and services, healthcare, wages, increasing litigation and the lingering effects of pandemic supply chain issues, are impacting companies across the nation, contributing to inflation.

According to U.S. Labor Department data published February 14th, the inflation rate for the United States for a range of goods and services rose by 6.4 percent for the previous 12 months, down slightly from a rate of 6.5 percent in 2022.

Rising wage costs and higher prices could impact key metrics used for measuring performance of captive insurance programs, including loss rates and claim frequency, explained Amy Angell, Principal & Consulting Actuary at Milliman in Chicago.

“Higher claim costs, particularly in property and some liability lines of business, have resulted in the need for higher captive funding levels,” she said. “And the effect of inflation is still making its way through open liability cases.” She added that captives writing liability coverages need to monitor their experience and assess reserve levels on an ongoing basis.

Because captives are part of a larger risk management program that includes commercial excess insurance partners,

and repairs as well as greater involvement of plaintiff attorneys.

“Social inflation and attorney advertising is affecting a broad array of coverages,” she said. Those include employment practices liability, professional liability, construction liability, and premises liability for high-traffic retail operations.

Maryellen Vargas, consulting actuary at Milliman in Chicago notes that employers using captives may have greater incentive, “to implement programs that can help manage claim costs and therefore combat inflation.”

She noted that no industry is immune from the effects of inflation. The impact on an individual organization depends on “the mix of operations insured, and the coverages offered through the captive,” she said. “Certain operations, such as commercial trucking and property exposures, have seen cost increases across industries.” Organizations that have experienced labor shortages and high employee turn-over may be seeing a greater inflation impact, Angell said.

One line of coverage seeing heavy impact from inflation is automobile.

“The auto line of coverage is a standout,” said Sandra Springer, senior vice president, director of marketing for Captive Resources, in greater Chicago. “Inflation rates applicable to new vehicles, and parts and equipment, since Jan. 1, 2020, were up 14-15 percent. In the fourth quarter of 2022, they were significantly outpacing overall inflation rates,” she said.

Angell noted that the climb of commercial auto liability, auto physical damage, and property coverages is due to higher costs of materials

Angell added that captives are a valuable part of an overall risk management strategy, as using a captive to its maximum, “means continually reviewing the coverages and coverage limits being offered through the captive.”

Tracking and understanding the impact of inflation on exposure bases is important, she said.

For example, “payroll may be increasing due to higher average hourly wages, sales may be increasing due to inflation, and total insured value may be increasing with higher property valuations.” Increases in the exposure bases, “may not correlate one-to-one with expected increases in insured costs,” Angell said.

“Many single-parent captives have increased their policy limits to accommodate higher retentions and to help make the overall insurance program more cost effective,” Angell said.

The captive also should evaluate its own premium rates to ensure that they are reflective of the current average inflation level of the exposure bases. “And if the commercial market has increased premium rates ahead of loss trends, or not adjusted for the anticipated effect of the inflationadjusted exposure bases, this may represent an opportunity for the captive to offer higher coverage limits,” Angell said.

Medical inflation on average is higher than general inflation. Milliman reports in its white paper, “Medical Inflation: Drivers and Patterns,” that two trends emerge:

• Medical inflation patterns often, but not always, follow a similar but lagged pattern to general inflation.

• Annual medical inflation tends to be higher than its general counterpart (1.7 percentage points higher, on average).

Inflation, Vargas said, is impacting most parties involved in the U.S. healthcare system – from providers to health plans and employer plan sponsors.

Healthcare inflation is driven largely by rising costs on the provider side, “that flow through the rest of the healthcare system,” Vargas said. The causes are similar to those in other sectors, including increasing labor costs, supply costs, and other operational costs. An added component is the high costs often attached to emerging healthcare treatments and technologies, she said.

“We primarily see the impact of inflation on healthcare unit cost trend,” she said.

Vargas added that while the impact of healthcare inflation on those employers that purchase healthcare may not differ significantly by industry, “One key differentiator will be the provider reimbursement structure inherent in the provider network being accessed,” she said.

Networks that have reimbursements based on Medicare’s payment structure or on negotiated fixed fee amounts, such as per diems or per admission payments for hospitals, “will be less impacted by healthcare inflation than networks whose reimbursement is calculated as a percentage of billed charges,” Vargas said.

“The best claim remains the claim that does not happen,” Angell said. “Investment in safety and risk management programs that address the root causes of claims can help to lower both the frequency and severity of claims.”

Another strategy is to align the captives with the incentives of the insureds. “For example, increasing member deductibles in a group captive program or adjusting the internal charge-back program for a single-parent captive,” can help in achieving better adoption

of important safety and risk management initiatives, she said.

Also helpful is more frequent monitoring of loss experience, which can help alert captive management to changing trends in the data, “and to avoid surprises at year-end,” Angell explained.

Because captives may have experienced declines in invested asset values in 2022, reviewing capital adequacy levels is an important step in the financial management of the captive, “particularly in light of the greater volatility that may have been introduced with the addition of new coverages or higher policy limits,” she added.

The Insurance Information Institute reports in its study, Group Captives: An Opportunity to Lower Cost of Risk:

Participation in a group captive can help companies save on insurance costs and provide access to extensive risk management resources, including industry-specific expertise. These attributes are a source of value in the best of times, and today’s inflationary conditions may increase their appeal for certain types of companies.

Attention to risk management and safety is important for member companies with a goal of keeping their losses lower within the captive retention, said Sandra Springer, senior vice president, director of marketing for Captive Resources in greater Chicago. This can “help to lower their individual premiums since those are based on the member company’s own loss experience,” she said.

Springer noted that an industry hit hard by inflation is construction. “Worker shortages, higher materials costs, supply chain interruptions and housing shortages are among the issues impacting the industry and contributing to rising prices,” she said.

Construction is also, “the largest industry segment among the group captives we support – there are over 2,000 construction companies across the U.S. in our client captives,” she said, adding that demand for group captive insurance remains high in this sector, “as a long-term cost management solution.”

Inherent features of the group captive model help member company insureds to continually drive down costs, she explained. “The model focuses companies on risk management and safety and provides them with numerous services and resources to support their efforts,” Springer said.

The typical result is lower losses, “which results in lower costs over time from lower premiums and dividends received for better-than-expected loss performance,” she said.

Some of the group captives have also increased their primary limits. “This all helps to control the captive’s excess insurance cost – at a time when excess insurance costs have been increasing exponentially in the marketplace,” Springer said.

Caroline McDonald is an award-winning journalist who has reported on a wide variety of insurance topics. Her beat has included in-depth coverage of risk management and captives.

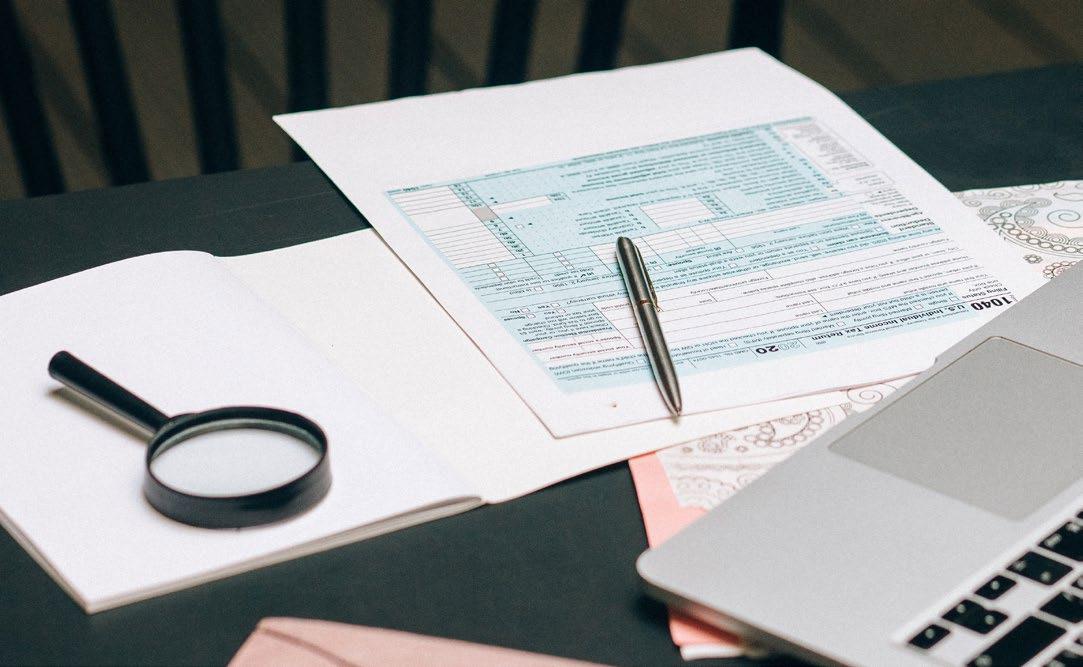

TheAffordable Care Act (ACA), the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and other federal health benefit mandates (e.g., the Mental Health Parity Act, the Newborns and Mothers Health Protection Act, and the Women’s Health and Cancer Rights Act) dramatically impact the administration of self-insured health plans. This monthly column provides practical answers to administration questions and current guidance on ACA, HIPAA and other federal benefit mandates.

Attorneys John R. Hickman, Ashley Gillihan, Steven Mindy, Carolyn Smith, Ken Johnson, Amy Heppner, and Laurie Kirkwood provide the answers in this column. John is partner in charge of the Health Benefits Practice with Alston & Bird, LLP, an Atlanta, New York, Los Angeles, Charlotte, Dallas and Washington, D.C. law firm. Ashley and Steven are partners in the practice, and Carolyn, Ken, Amy, and Laurie are senior members in the Health Benefits Practice. Answers are provided as general guidance on the subjects covered in the question and are not provided as legal advice to the questioner’s situation. Any legal issues should be reviewed by your legal counsel to apply the law to the particular facts of your situation. Readers are encouraged to send questions by E-MAIL to John at john.hickman@alston.com.

The IRS recently released internal guidance from its Office of Chief Counsel to the head of its employment tax policy division that reiterates and emphasizes the potentially severe consequences of taking shortcuts when substantiating flexible spending account claims (IRS Chief Counsel Advice 202317020, March 29, 2023, released April 28, 2023.

Employers, TPAs, and card processors must ensure that they follow the IRS substantiation rules as written without administrative shortcuts like sampling, de minimis thresholds, or other methods that do not satisfy the IRS substantiation guidelines set forth in the IRS Notices and proposed regulations. Otherwise, FSA plans risk disqualification of the entire cafeteria plan.

As the IRS memo makes clear, if the cafeteria plan is disqualified then all non-taxable benefits any employee receives through the employer’s cafeteria plan must be included in gross income and are wages subject to withholding for Federal Insurance Contributions Act (FICA) and Federal Unemployment Tax Act (FUTA) purposes.

In other words, the consequences of failing to adhere to the IRS guidelines extend to defeat all tax advantages employers and employees receive via a cafeteria plan and are not limited to the improperly adjudicated claims.

The IRS memo does not break new ground or add any new rules. The IRS’ Office of the Chief Counsel prepared it for the IRS’ head of employment tax policy.

It’s unlikely the IRS will make an official statement about what prompted the memo, but the memo indicates that the IRS does not agree with interpretations that the Internal Revenue Code (“Code”) or IRS guidance allow certain substantiation practices that have been become more common for reasons such as administrative convenience or cost reduction.

The IRS’ memo provides five examples of impermissible substantiation practices, but the IRS’s position is not limited to these five examples and likely extends to additional methods that do not adhere to IRS guidance:

1. Self-certification -The IRS memo notes that all claims must be substantiated under the Code and IRS guidance. Accordingly, self-certification of claims that are not otherwise substantiated does not fulfill the requirement that every FSA claim must be substantiated by information from a third-party party that is independent of the employee and their spouse and dependents (Notice 2006-69). The IRS memo notes that its prior guidance prohibits self-substantiation of medical expenses (Prop. Reg. § 1.125-6(b)(3)). As a result, the cafeteria plan is disqualified if it

only requires an employee to submit information describing the service or product, the date of sale or service, and the amount, but does not also require a statement from an independent third party to verify the expense.

2. Sampling – A cafeteria plan is disqualified if it reimburses all debit card charges but requires the employee to substantiate with thirdparty information a random sample of debit card charges that were not otherwise auto-substantiated under IRS rules. The IRS notes that its guidance requires substantiation of all claims (either manually or in accordance with IRS autoadjudication guidance) and prohibits the use of sampling techniques (Prop. Reg. § 1.125-6(b); Rev. Rul. 200343).

3. De minimis thresholds – A cafeteria plan is disqualified if it does not require substantiation of all debit card charges (either manually or in accordance with IRS auto-adjudication guidance) regardless of how small the expense is. Plans must limit reimbursement and claims payment to medical expenses substantiated with third-party information that describes the service or product and includes the date of the service or sale (which the IRS notes includes expenses that are autosubstantiated consistent with IRS guidance) (Prop. Reg. §

You want unparalleled customer service. Employers need the right stop loss coverage. At Swiss Re Corporate Solutions, we deliver both. We combine cutting-edge risk knowledge with tech-driven solutions and a commitment to put our customers first. We make it easy to do business with us and relentlessly go above and beyond to make stop loss simpler, smarter, faster and better. We’re addressing industry inefficiencies and customer pain points, moving the industry forward – rethinking employer stop loss coverage with you in mind.

corporatesolutions.swissre.com/esl

1.125-6(b); Notice 2006-69; Notice 2003-43).

4. Favored providers – A cafeteria plan is disqualified if it does not require employees to substantiate debit card charges (either manually or in accordance with IRS auto-adjudication guidance) even though they may be incurred at certain providers whose expenses almost always qualify (e.g., dentists, doctors, hospitals, or other health care providers). As in the other examples, the plan must require substantiation of all claims (including via IRS approved auto-adjudication methods) and plans cannot exclude claims incurred

at specific providers or facilities from their substantiation requirements. Note that real time adjudication or EOB rollover procedures for such providers are still allowable as long as they satisfy existing IRS guidance.

5. Advance Dependent Care Assistance Claims – A cafeteria plan is disqualified if it pays or reimburses an employee’s dependent care expenses by submitting a form before receiving the dependent care that attests to the amount of dependent care expenses they will incur in the upcoming year. A plan cannot cure this by requiring employees to provide an after-the fact notice if their dependent care situation changes and they will not incur the qualified dependent care expenses to which they attested. The IRS reiterates that dependent care expenses paid by debit card must be substantiated with a statement from the dependent care provider that includes the dates and amounts for dependent care services provided (Prop. Reg. § 1.125-6(g)). Additionally, the IRS reminds plans that dependent care expenses cannot be reimbursed before the expense is incurred (Prop. Reg. § 1.125-6(a)(4)). A dependent care expense is incurred when the care is provided and not when the employee is formally billed, charged, or pays for dependent care.

We deliver value other TPAs can’t match. Our three-year medical trend is beating the industry at 2.6%, our claims reviews are finding an extra 15% in savings before network discounts, and our Excellent NPS Score tells us we’re keeping our clients very happy. Our people deliver incredible value for our customers. They can do it for you too.

As for consequences, the IRS says that employers sponsoring health FSAs that use the methods described in the first four examples must include all reimbursements by the health FSA during the year in the gross income of employees, including claims that were substantiated consistent with IRS guidance.

The IRS adds that an employer providing the advance reimbursement of dependent care expenses must include all payments under the dependent care assistance plan in the gross income of employees and wages of employees for FICA and FUTA tax purposes.

Perhaps even more significantly for employers, the IRS adds that its flexible spending accounts’ failure to follow the substantiation requirements in Prop. Reg. § 1.125-6(b) is also a failure to operate in accordance with the written plan or a failure to operate in accordance with Code § 125 and § Prop. Reg. § 1.125-1(c)(7)(ii)(G).

This supports the IRS’ position that the entire cafeteria plan is disqualified by substantiation failures and the tax consequences are not limited to the flexible spending accounts. Thus, even employees who do not make an FSA election will lose the pre-tax advantages under the employer’s cafeteria plan.

In addition to the amounts that an employer must add to income and wages if its cafeteria plan is disqualified, the employer also becomes liable for applicable penalties and interest payable to the IRS for reporting and withholding errors and might need to amend its prior returns and reports, including employees’ W-2s.

In other words, the consequences are potentially far reaching and could reverberate across an employer and its workforce when a flexible spending account uses substantiation methods that the IRS has not adopted in its guidance.

AAs advancements in how individuals consume healthcare have drastically and rapidly improved (i.e., the prevalence of virtual patient care, online pharmacies where treatments can be received and delivered to the home, etc.) face-to-face communication between providers and patients has often been supplanted by virtual interactions that expedite processes. The result is faster and easier access to healthcare.

Improved access is certainly a step forward, but is it enough? For patients diagnosed with a rare or life-threatening condition where the only treatment is difficult to obtain, the answer is probably not.

Availability is a challenge for patients seeking gene and cell therapy as treatment can cost millions to obtain. Cost is a factor and has the potential to impact the availability of treatment for patients. Access and availability are not always in parity when it comes to patient care.

Research shows and common sense would suggest that providing healthcare services for patients to maintain or restore their physical, mental, or emotional well-being is best when the patient care is embedded with empathy and kindness; it greatly enhances the healing process. Compassion is important for healthcare providers, and for employers with self-funded healthcare benefit plans.

Gene and cell therapies are quickly evolving, and employers need to understand the potential impact. Employers face the tall order of exuding empathy while relating to employees contemplating the multimillion-dollar treatment that is gene and cell therapy.

Even the most compassionate of such professionals find it difficult to strike the delicate balance of weighing costs to their respective plans with the natural inclination to provide coverage for potentially lifesaving or life-altering therapy.